Guide to COST-BENEFIT ANALYSIS of investment projects - Ramiri

Guide to COST-BENEFIT ANALYSIS of investment projects - Ramiri

Guide to COST-BENEFIT ANALYSIS of investment projects - Ramiri

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

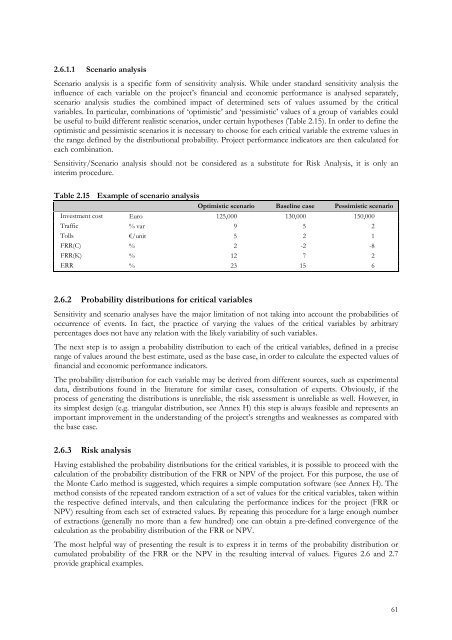

2.6.1.1 Scenario analysisScenario analysis is a specific form <strong>of</strong> sensitivity analysis. While under standard sensitivity analysis theinfluence <strong>of</strong> each variable on the project’s financial and economic performance is analysed separately,scenario analysis studies the combined impact <strong>of</strong> determined sets <strong>of</strong> values assumed by the criticalvariables. In particular, combinations <strong>of</strong> ‘optimistic’ and ‘pessimistic’ values <strong>of</strong> a group <strong>of</strong> variables couldbe useful <strong>to</strong> build different realistic scenarios, under certain hypotheses (Table 2.15). In order <strong>to</strong> define theoptimistic and pessimistic scenarios it is necessary <strong>to</strong> choose for each critical variable the extreme values inthe range defined by the distributional probability. Project performance indica<strong>to</strong>rs are then calculated foreach combination.Sensitivity/Scenario analysis should not be considered as a substitute for Risk Analysis, it is only aninterim procedure.Table 2.15 Example <strong>of</strong> scenario analysisOptimistic scenario Baseline case Pessimistic scenarioInvestment cost Euro 125,000 130,000 150,000Traffic % var 9 5 2Tolls €/unit 5 2 1FRR(C) % 2 -2 -8FRR(K) % 12 7 2ERR % 23 15 62.6.2 Probability distributions for critical variablesSensitivity and scenario analyses have the major limitation <strong>of</strong> not taking in<strong>to</strong> account the probabilities <strong>of</strong>occurrence <strong>of</strong> events. In fact, the practice <strong>of</strong> varying the values <strong>of</strong> the critical variables by arbitrarypercentages does not have any relation with the likely variability <strong>of</strong> such variables.The next step is <strong>to</strong> assign a probability distribution <strong>to</strong> each <strong>of</strong> the critical variables, defined in a preciserange <strong>of</strong> values around the best estimate, used as the base case, in order <strong>to</strong> calculate the expected values <strong>of</strong>financial and economic performance indica<strong>to</strong>rs.The probability distribution for each variable may be derived from different sources, such as experimentaldata, distributions found in the literature for similar cases, consultation <strong>of</strong> experts. Obviously, if theprocess <strong>of</strong> generating the distributions is unreliable, the risk assessment is unreliable as well. However, inits simplest design (e.g. triangular distribution, see Annex H) this step is always feasible and represents animportant improvement in the understanding <strong>of</strong> the project’s strengths and weaknesses as compared withthe base case.2.6.3 Risk analysisHaving established the probability distributions for the critical variables, it is possible <strong>to</strong> proceed with thecalculation <strong>of</strong> the probability distribution <strong>of</strong> the FRR or NPV <strong>of</strong> the project. For this purpose, the use <strong>of</strong>the Monte Carlo method is suggested, which requires a simple computation s<strong>of</strong>tware (see Annex H). Themethod consists <strong>of</strong> the repeated random extraction <strong>of</strong> a set <strong>of</strong> values for the critical variables, taken withinthe respective defined intervals, and then calculating the performance indices for the project (FRR orNPV) resulting from each set <strong>of</strong> extracted values. By repeating this procedure for a large enough number<strong>of</strong> extractions (generally no more than a few hundred) one can obtain a pre-defined convergence <strong>of</strong> thecalculation as the probability distribution <strong>of</strong> the FRR or NPV.The most helpful way <strong>of</strong> presenting the result is <strong>to</strong> express it in terms <strong>of</strong> the probability distribution orcumulated probability <strong>of</strong> the FRR or the NPV in the resulting interval <strong>of</strong> values. Figures 2.6 and 2.7provide graphical examples.61