Guide to COST-BENEFIT ANALYSIS of investment projects - Ramiri

Guide to COST-BENEFIT ANALYSIS of investment projects - Ramiri

Guide to COST-BENEFIT ANALYSIS of investment projects - Ramiri

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

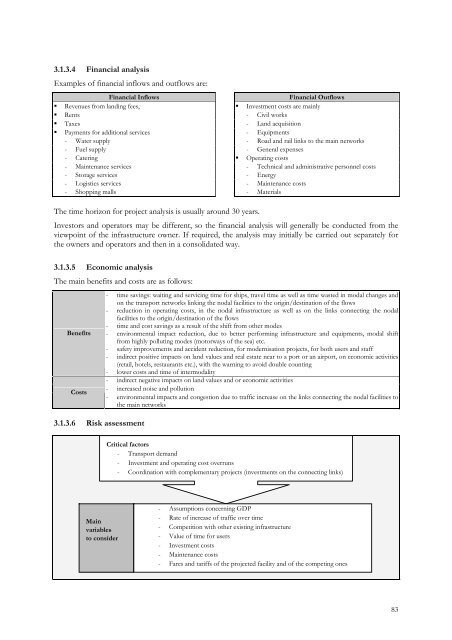

3.1.3.4 Financial analysisExamples <strong>of</strong> financial inflows and outflows are:Financial InflowsFinancial Outflows• Revenues from landing fees, • Investment costs are mainly• Rents - Civil works• Taxes - Land acquisition• Payments for additional services - Equipments- Water supply - Road and rail links <strong>to</strong> the main networks- Fuel supply - General expenses- Catering • Operating costs- Maintenance services - Technical and administrative personnel costs- S<strong>to</strong>rage services - Energy- Logistics services - Maintenance costs- Shopping malls - MaterialsThe time horizon for project analysis is usually around 30 years.Inves<strong>to</strong>rs and opera<strong>to</strong>rs may be different, so the financial analysis will generally be conducted from theviewpoint <strong>of</strong> the infrastructure owner. If required, the analysis may initially be carried out separately forthe owners and opera<strong>to</strong>rs and then in a consolidated way.3.1.3.5 Economic analysisThe main benefits and costs are as follows:BenefitsCosts3.1.3.6 Risk assessment- time savings: waiting and servicing time for ships, travel time as well as time wasted in modal changes andon the transport networks linking the nodal facilities <strong>to</strong> the origin/destination <strong>of</strong> the flows- reduction in operating costs, in the nodal infrastructure as well as on the links connecting the nodalfacilities <strong>to</strong> the origin/destination <strong>of</strong> the flows- time and cost savings as a result <strong>of</strong> the shift from other modes- environmental impact reduction, due <strong>to</strong> better performing infrastructure and equipments, modal shiftfrom highly polluting modes (mo<strong>to</strong>rways <strong>of</strong> the sea) etc.- safety improvements and accident reduction, for modernisation <strong>projects</strong>, for both users and staff- indirect positive impacts on land values and real estate near <strong>to</strong> a port or an airport, on economic activities(retail, hotels, restaurants etc.), with the warning <strong>to</strong> avoid double counting- lower costs and time <strong>of</strong> intermodality- indirect negative impacts on land values and or economic activities- increased noise and pollution- environmental impacts and congestion due <strong>to</strong> traffic increase on the links connecting the nodal facilities <strong>to</strong>the main networksCritical fac<strong>to</strong>rs- Transport demand- Investment and operating cost overruns- Coordination with complementary <strong>projects</strong> (<strong>investment</strong>s on the connecting links)Mainvariables<strong>to</strong> consider- Assumptions concerning GDP- Rate <strong>of</strong> increase <strong>of</strong> traffic over time- Competition with other existing infrastructure- Value <strong>of</strong> time for users- Investment costs- Maintenance costs- Fares and tariffs <strong>of</strong> the projected facility and <strong>of</strong> the competing ones83