PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

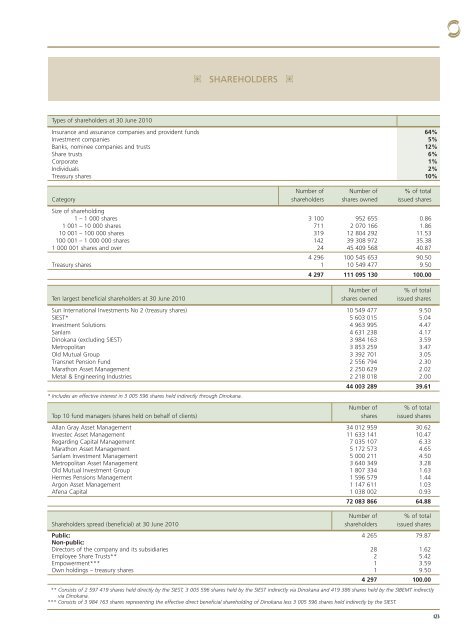

Types of shareholders at 30 June 2010<br />

Insurance and assurance companies and provident funds 64%<br />

Investment companies 5%<br />

Banks, nominee companies and trusts 12%<br />

Share trusts 6%<br />

Corporate 1%<br />

Individuals 2%<br />

Treasury shares 10%<br />

Category<br />

Number of<br />

shareholders<br />

Number of<br />

shares owned<br />

% of total<br />

issued shares<br />

Size of shareholding<br />

1 – 1 000 shares 3 100 952 655 0.86<br />

1 001 – 10 000 shares 711 2 070 166 1.86<br />

10 001 – 100 000 shares 319 12 804 292 11.53<br />

100 001 – 1 000 000 shares 142 39 308 972 35.38<br />

1 000 001 shares and over 24 45 409 568 40.87<br />

4 296 100 545 653 90.50<br />

Treasury shares 1 10 549 477 9.50<br />

4 297 111 095 130 100.00<br />

Ten largest beneficial shareholders at 30 June 2010<br />

Number of<br />

shares owned<br />

% of total<br />

issued shares<br />

<strong>Sun</strong> <strong>International</strong> Investments No 2 (treasury shares) 10 549 477 9.50<br />

SIEST* 5 603 015 5.04<br />

Investment Solutions 4 963 995 4.47<br />

Sanlam 4 631 238 4.17<br />

Dinokana (excluding SIEST) 3 984 163 3.59<br />

Metropolitan 3 853 <strong>25</strong>9 3.47<br />

Old Mutual Group 3 392 701 3.05<br />

Transnet Pension Fund 2 556 794 2.30<br />

Marathon Asset Management 2 <strong>25</strong>0 629 2.02<br />

Metal & Engineering Industries 2 218 018 2.00<br />

* Includes an effective interest in 3 005 596 shares held indirectly through Dinokana.<br />

44 003 289 39.61<br />

Top 10 fund managers (shares held on behalf of clients)<br />

Number of<br />

shares<br />

% of total<br />

issued shares<br />

Allan Gray Asset Management 34 012 959 30.62<br />

Investec Asset Management 11 633 141 10.47<br />

Regarding Capital Management 7 035 107 6.33<br />

Marathon Asset Management 5 172 573 4.65<br />

Sanlam Investment Management 5 000 211 4.50<br />

Metropolitan Asset Management 3 640 349 3.28<br />

Old Mutual Investment Group 1 807 334 1.63<br />

Hermes Pensions Management 1 596 579 1.44<br />

Argon Asset Management 1 147 611 1.03<br />

Afena Capital 1 038 002 0.93<br />

72 083 866 64.88<br />

Shareholders spread (beneficial) at 30 June 2010<br />

SHAREHOLDERS<br />

Number of<br />

shareholders<br />

% of total<br />

issued shares<br />

Public:<br />

Non-public:<br />

4 265 79.87<br />

Directors of the company and its subsidiaries 28 1.62<br />

Employee Share Trusts** 2 5.42<br />

Empowerment*** 1 3.59<br />

Own holdings – treasury shares 1 9.50<br />

4 297 100.00<br />

** Consists of 2 597 419 shares held directly by the SIEST, 3 005 596 shares held by the SIEST indirectly via Dinokana and 419 386 shares held by the SIBEMT indirectly<br />

via Dinokana.<br />

*** Consists of 3 984 163 shares representing the effective direct beneficial shareholding of Dinokana less 3 005 596 shares held indirectly by the SIEST.<br />

123