PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SUN INTERNATIONAL ANNUAL REPORT ’10<br />

As the forfeitable shares are held for the benefit of the employee, in a<br />

controlled account, he will be entitled to all shareholder rights applicable<br />

to those shares, namely the right to dividends and to voting at general<br />

meetings of the company. In the event that the shares are forfeited due<br />

to resignation or dismissal, any dividends received prior to the forfeiture<br />

are to be repaid.<br />

Proposed amendments to share plans<br />

Recommendation will be made to members at the forthcoming annual<br />

general meeting to amend the CSP, EGP and DBP in compliance with<br />

Schedule 14 of the JSE Listings Requirements (‘the rules’). The key<br />

amendments are:<br />

� although the maximum number of shares that may be issued under<br />

the plans is retained at 10 780 000 shares, this limit is permitted to<br />

be increased proportionately to reflect changes in capital structure, as<br />

specified in the rules. The proviso to the number of the shares that<br />

may be issued under the plans namely that no more than 5 390 000<br />

shares (which represents approximately 5% of the ordinary issued<br />

share capital will be allocated under the plans in the first 3 years of<br />

the operation of the plans), has been deleted;<br />

� although the maximum number of unvested shares, namely 1 078 026<br />

shares, that can be allocated to any participant under any of the plans<br />

has been retained, the proviso to the number of shares that may be<br />

issued to any participant under the plans which represents approximately<br />

1% of the issued ordinary share capital of the company at the date of<br />

approval of the plans has been deleted;<br />

� the plans have been amended to confirm that employees’ TCOE,<br />

grade, performance, retention requirements and market benchmarks<br />

form the primary basis upon which awards under the plans are made;<br />

132<br />

REMUNERATION REPORT CONTINUED<br />

� the EGP and CSP have been amended to provide that the discretion<br />

of the committee to change the performance conditions specified in<br />

a letter of grant if events happen which cause the committee<br />

reasonably to consider that a changed performance condition would<br />

be a fairer measure of performance will not apply in respect of grants<br />

made on or after 1 July 2010;<br />

� a provision has been inserted into the rules of the plans to provide<br />

that in the event that the company is placed into liquidation<br />

otherwise than for the purposes of internal reorganisation, any<br />

unvested awards shall be deemed to have vested; and<br />

� certain points of clarity and administrative changes to the plans as<br />

required by the rules are proposed.<br />

Details of these amendments also appear in the notice of annual general<br />

meeting forming part of this annual report and will be available for<br />

inspection at the company’s offices 21 days before the annual general<br />

meeting.<br />

Capacity of share plans and dilution<br />

Details of the number of shares issued in satisfaction of the LTI plans<br />

approved by shareholders are noted on pages 187 to 192 of the<br />

annual report.<br />

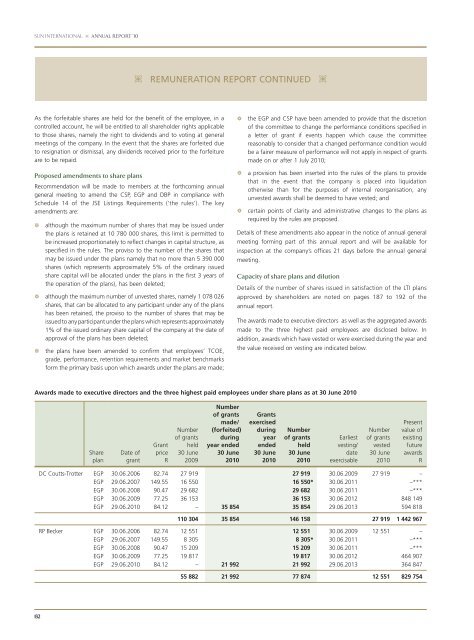

The awards made to executive directors as well as the aggregated awards<br />

made to the three highest paid employees are disclosed below. In<br />

addition, awards which have vested or were exercised during the year and<br />

the value received on vesting are indicated below.<br />

Awards made to executive directors and the three highest paid employees under share plans as at 30 June 2010<br />

Share<br />

plan<br />

Date of<br />

grant<br />

Grant<br />

price<br />

R<br />

Number<br />

of grants<br />

held<br />

30 June<br />

2009<br />

Number<br />

of grants<br />

made/<br />

(forfeited)<br />

during<br />

year ended<br />

30 June<br />

2010<br />

Grants<br />

exercised<br />

during<br />

year<br />

ended<br />

30 June<br />

2010<br />

Number<br />

of grants<br />

held<br />

30 June<br />

2010<br />

Earliest<br />

vesting/<br />

date<br />

exercisable<br />

Number<br />

of grants<br />

vested<br />

30 June<br />

2010<br />

Present<br />

value of<br />

existing<br />

future<br />

awards<br />

R<br />

DC Coutts-Trotter EGP 30.06.2006 82.74 27 919 27 919 30.06.2009 27 919 –<br />

EGP 29.06.2007 149.55 16 550 16 550* 30.06.2011 –***<br />

EGP 30.06.2008 90.47 29 682 29 682 30.06.2011 –***<br />

EGP 30.06.2009 77.<strong>25</strong> 36 153 36 153 30.06.2012 848 149<br />

EGP 29.06.2010 84.12 – 35 854 35 854 29.06.2013 594 818<br />

110 304 35 854 146 158 27 919 1 442 967<br />

RP Becker EGP 30.06.2006 82.74 12 551 12 551 30.06.2009 12 551 –<br />

EGP 29.06.2007 149.55 8 305 8 305* 30.06.2011 –***<br />

EGP 30.06.2008 90.47 15 209 15 209 30.06.2011 –***<br />

EGP 30.06.2009 77.<strong>25</strong> 19 817 19 817 30.06.2012 464 907<br />

EGP 29.06.2010 84.12 – 21 992 21 992 29.06.2013 364 847<br />

55 882 21 992 77 874 12 551 829 754