PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

for the year ended 30 June<br />

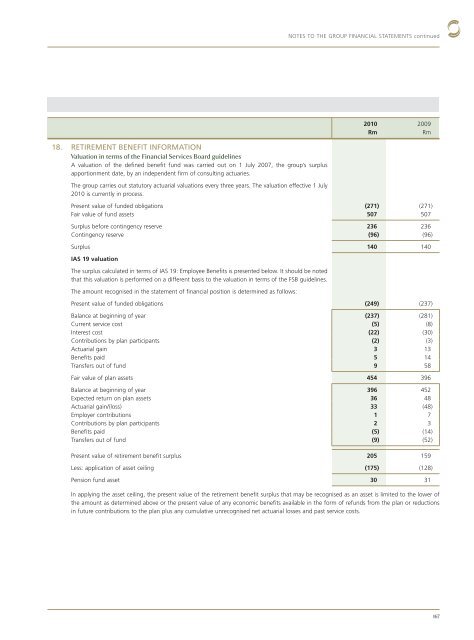

18. RETIREMENT BENEFIT INFORMATION<br />

Valuation in terms of the Financial Services Board guidelines<br />

A valuation of the defined benefit fund was carried out on 1 July 2007, the group’s surplus<br />

apportionment date, by an independent firm of consulting actuaries.<br />

The group carries out statutory actuarial valuations every three years. The valuation effective 1 July<br />

2010 is currently in process.<br />

NOTES TO THE GROUP FINANCIAL STATEMENTS continued<br />

Present value of funded obligations (271) (271)<br />

Fair value of fund assets 507 507<br />

Surplus before contingency reserve 236 236<br />

Contingency reserve (96) (96)<br />

Surplus 140 140<br />

IAS 19 valuation<br />

The surplus calculated in terms of IAS 19: Employee Benefits is presented below. It should be noted<br />

that this valuation is performed on a different basis to the valuation in terms of the FSB guidelines.<br />

The amount recognised in the statement of financial position is determined as follows:<br />

Present value of funded obligations (249) (237)<br />

Balance at beginning of year (237) (281)<br />

Current service cost (5) (8)<br />

Interest cost (22) (30)<br />

Contributions by plan participants (2) (3)<br />

Actuarial gain 3 13<br />

Benefits paid 5 14<br />

Transfers out of fund 9 58<br />

Fair value of plan assets 454 396<br />

Balance at beginning of year 396 452<br />

Expected return on plan assets 36 48<br />

Actuarial gain/(loss) 33 (48)<br />

Employer contributions 1 7<br />

Contributions by plan participants 2 3<br />

Benefits paid (5) (14)<br />

Transfers out of fund (9) (52)<br />

Present value of retirement benefit surplus 205 159<br />

Less: application of asset ceiling (175) (128)<br />

Pension fund asset 30 31<br />

In applying the asset ceiling, the present value of the retirement benefit surplus that may be recognised as an asset is limited to the lower of<br />

the amount as determined above or the present value of any economic benefits available in the form of refunds from the plan or reductions<br />

in future contributions to the plan plus any cumulative unrecognised net actuarial losses and past service costs.<br />

2010<br />

Rm<br />

2009<br />

Rm<br />

167