PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

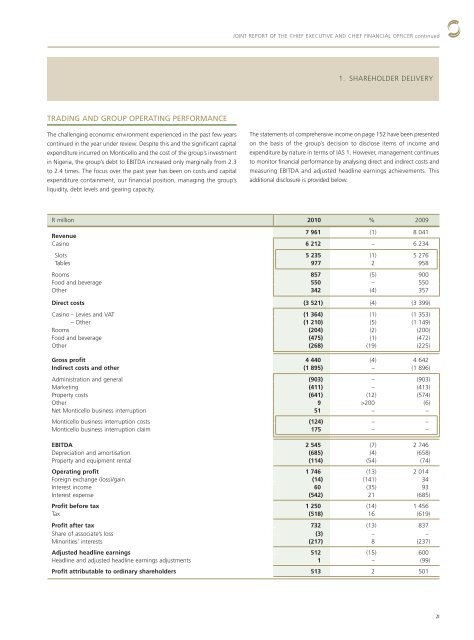

TRADING AND GROUP OPERATING PERFORMANCE<br />

The challenging economic environment experienced in the past few years<br />

continued in the year under review. Despite this and the significant capital<br />

expenditure incurred on Monticello and the cost of the group’s investment<br />

in Nigeria, the group’s debt to EBITDA increased only marginally from 2.3<br />

to 2.4 times. The focus over the past year has been on costs and capital<br />

expenditure containment, our financial position, managing the group’s<br />

liquidity, debt levels and gearing capacity.<br />

JOINT REPORT OF THE CHIEF EXECUTIVE AND CHIEF FINANCIAL OFFICER continued<br />

1. SHAREHOLDER DELIVERY<br />

The statements of comprehensive income on page 152 have been presented<br />

on the basis of the group’s decision to disclose items of income and<br />

expenditure by nature in terms of IAS 1. However, management continues<br />

to monitor financial performance by analysing direct and indirect costs and<br />

measuring EBITDA and adjusted headline earnings achievements. This<br />

additional disclosure is provided below.<br />

R million 2010 % 2009<br />

Revenue<br />

7 961 (1) 8 041<br />

Casino 6 212 – 6 234<br />

Slots 5 235 (1) 5 276<br />

Tables 977 2 958<br />

Rooms 857 (5) 900<br />

Food and beverage 550 – 550<br />

Other 342 (4) 357<br />

Direct costs (3 521) (4) (3 399)<br />

Casino – Levies and VAT (1 364) (1) (1 353)<br />

– Other (1 210) (5) (1 149)<br />

Rooms (204) (2) (200)<br />

Food and beverage (475) (1) (472)<br />

Other (268) (19) (2<strong>25</strong>)<br />

Gross profit 4 440 (4) 4 642<br />

Indirect costs and other (1 895) – (1 896)<br />

Administration and general (903) – (903)<br />

Marketing (411) – (413)<br />

Property costs (641) (12) (574)<br />

Other 9 >200 (6)<br />

Net Monticello business interruption 51 – –<br />

Monticello business interruption costs (124) – –<br />

Monticello business interruption claim 175 – –<br />

EBITDA 2 545 (7) 2 746<br />

Depreciation and amortisation (685) (4) (658)<br />

Property and equipment rental (114) (54) (74)<br />

Operating profit 1 746 (13) 2 014<br />

Foreign exchange (loss)/gain (14) (141) 34<br />

Interest income 60 (35) 93<br />

Interest expense (542) 21 (685)<br />

Profit before tax 1 <strong>25</strong>0 (14) 1 456<br />

Tax (518) 16 (619)<br />

Profit after tax 732 (13) 837<br />

Share of associate’s loss (3) – –<br />

Minorities’ interests (217) 8 (237)<br />

Adjusted headline earnings 512 (15) 600<br />

Headline and adjusted headline earnings adjustments 1 – (99)<br />

Profit attributable to ordinary shareholders 513 2 501<br />

21