PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

for the year ended 30 June<br />

NOTES TO THE GROUP FINANCIAL STATEMENTS continued<br />

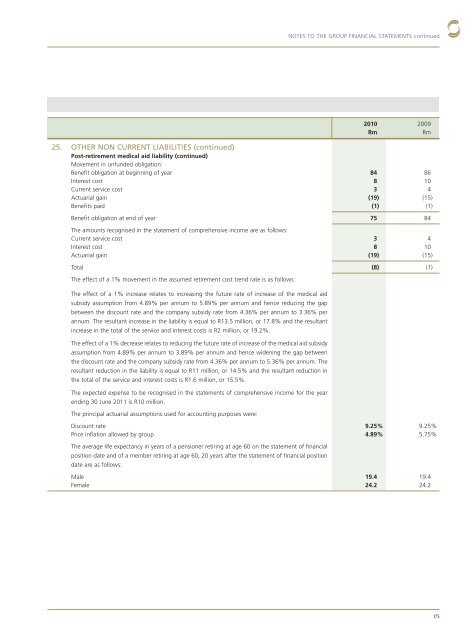

<strong>25</strong>. OTHER NON CURRENT LIABILITIES (continued)<br />

Post-retirement medical aid liability (continued)<br />

Movement in unfunded obligation:<br />

Benefit obligation at beginning of year 84 86<br />

Interest cost 8 10<br />

Current service cost 3 4<br />

Actuarial gain (19) (15)<br />

Benefits paid (1) (1)<br />

Benefit obligation at end of year 75 84<br />

The amounts recognised in the statement of comprehensive income are as follows:<br />

Current service cost 3 4<br />

Interest cost 8 10<br />

Actuarial gain (19) (15)<br />

Total (8) (1)<br />

The effect of a 1% movement in the assumed retirement cost trend rate is as follows:<br />

The effect of a 1% increase relates to increasing the future rate of increase of the medical aid<br />

subsidy assumption from 4.89% per annum to 5.89% per annum and hence reducing the gap<br />

between the discount rate and the company subsidy rate from 4.36% per annum to 3.36% per<br />

annum. The resultant increase in the liability is equal to R13.5 million, or 17.8% and the resultant<br />

increase in the total of the service and interest costs is R2 million, or 19.2%.<br />

The effect of a 1% decrease relates to reducing the future rate of increase of the medical aid subsidy<br />

assumption from 4.89% per annum to 3.89% per annum and hence widening the gap between<br />

the discount rate and the company subsidy rate from 4.36% per annum to 5.36% per annum. The<br />

resultant reduction in the liability is equal to R11 million, or 14.5% and the resultant reduction in<br />

the total of the service and interest costs is R1.6 million, or 15.5%.<br />

The expected expense to be recognised in the statements of comprehensive income for the year<br />

ending 30 June 2011 is R10 million.<br />

The principal actuarial assumptions used for accounting purposes were:<br />

Discount rate 9.<strong>25</strong>% 9.<strong>25</strong>%<br />

Price inflation allowed by group 4.89% 5.75%<br />

The average life expectancy in years of a pensioner retiring at age 60 on the statement of financial<br />

position date and of a member retiring at age 60, 20 years after the statement of financial position<br />

date are as follows:<br />

Male 19.4 19.4<br />

Female 24.2 24.2<br />

2010<br />

Rm<br />

2009<br />

Rm<br />

175