PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SUN INTERNATIONAL ANNUAL REPORT ’10<br />

174<br />

NOTES TO THE GROUP FINANCIAL STATEMENTS CONTINUED<br />

for the year ended 30 June<br />

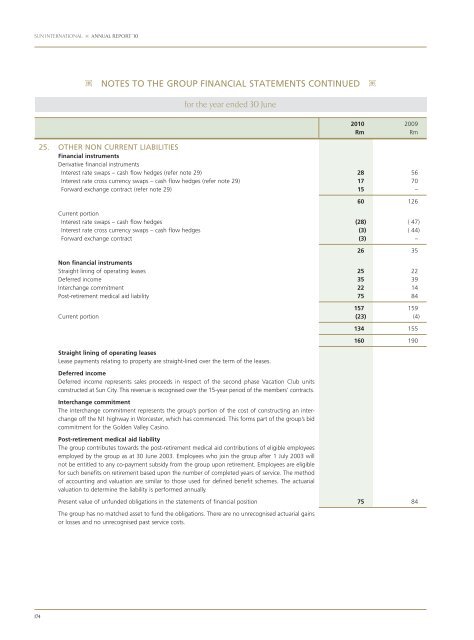

<strong>25</strong>. OTHER NON CURRENT LIABILITIES<br />

Financial instruments<br />

Derivative financial instruments<br />

Interest rate swaps – cash flow hedges (refer note 29) 28 56<br />

Interest rate cross currency swaps – cash flow hedges (refer note 29) 17 70<br />

Forward exchange contract (refer note 29) 15 –<br />

2010<br />

Rm<br />

2009<br />

Rm<br />

60 126<br />

Current portion<br />

Interest rate swaps – cash flow hedges (28) ( 47)<br />

Interest rate cross currency swaps – cash flow hedges (3) ( 44)<br />

Forward exchange contract (3) –<br />

26 35<br />

Non financial instruments<br />

Straight lining of operating leases <strong>25</strong> 22<br />

Deferred income 35 39<br />

Interchange commitment 22 14<br />

Post-retirement medical aid liability 75 84<br />

157 159<br />

Current portion (23) (4)<br />

Straight lining of operating leases<br />

Lease payments relating to property are straight-lined over the term of the leases.<br />

Deferred income<br />

Deferred income represents sales proceeds in respect of the second phase Vacation Club units<br />

constructed at <strong>Sun</strong> City. This revenue is recognised over the 15-year period of the members’ contracts.<br />

Interchange commitment<br />

The interchange commitment represents the group’s portion of the cost of constructing an interchange<br />

off the N1 highway in Worcester, which has commenced. This forms part of the group’s bid<br />

commitment for the Golden Valley Casino.<br />

Post-retirement medical aid liability<br />

The group contributes towards the post-retirement medical aid contributions of eligible employees<br />

employed by the group as at 30 June 2003. Employees who join the group after 1 July 2003 will<br />

not be entitled to any co-payment subsidy from the group upon retirement. Employees are eligible<br />

for such benefits on retirement based upon the number of completed years of service. The method<br />

of accounting and valuation are similar to those used for defined benefit schemes. The actuarial<br />

valuation to determine the liability is performed annually.<br />

134 155<br />

160 190<br />

Present value of unfunded obligations in the statements of financial position 75 84<br />

The group has no matched asset to fund the obligations. There are no unrecognised actuarial gains<br />

or losses and no unrecognised past service costs.