PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SUN INTERNATIONAL ANNUAL REPORT ’10<br />

168<br />

NOTES TO THE GROUP FINANCIAL STATEMENTS CONTINUED<br />

for the year ended 30 June<br />

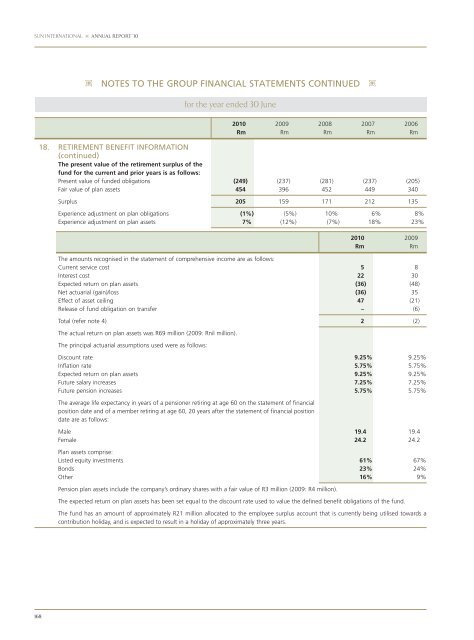

18. RETIREMENT BENEFIT INFORMATION<br />

(continued)<br />

The present value of the retirement surplus of the<br />

fund for the current and prior years is as follows:<br />

Present value of funded obligations (249) (237) (281) (237) (205)<br />

Fair value of plan assets 454 396 452 449 340<br />

2010<br />

Rm<br />

Surplus 205 159 171 212 135<br />

Experience adjustment on plan obligations (1%) (5%) 10% 6% 8%<br />

Experience adjustment on plan assets 7% (12%) (7%) 18% 23%<br />

The amounts recognised in the statement of comprehensive income are as follows:<br />

Current service cost 5 8<br />

Interest cost 22 30<br />

Expected return on plan assets (36) (48)<br />

Net actuarial (gain)/loss (36) 35<br />

Effect of asset ceiling 47 (21)<br />

Release of fund obligation on transfer – (6)<br />

Total (refer note 4) 2 (2)<br />

The actual return on plan assets was R69 million (2009: Rnil million).<br />

The principal actuarial assumptions used were as follows:<br />

Discount rate 9.<strong>25</strong>% 9.<strong>25</strong>%<br />

Inflation rate 5.75% 5.75%<br />

Expected return on plan assets 9.<strong>25</strong>% 9.<strong>25</strong>%<br />

Future salary increases 7.<strong>25</strong>% 7.<strong>25</strong>%<br />

Future pension increases 5.75% 5.75%<br />

2009<br />

Rm<br />

The average life expectancy in years of a pensioner retiring at age 60 on the statement of financial<br />

position date and of a member retiring at age 60, 20 years after the statement of financial position<br />

date are as follows:<br />

Male 19.4 19.4<br />

Female 24.2 24.2<br />

Plan assets comprise:<br />

Listed equity investments 61% 67%<br />

Bonds 23% 24%<br />

Other 16% 9%<br />

2008<br />

Rm<br />

Pension plan assets include the company’s ordinary shares with a fair value of R3 million (2009: R4 million).<br />

The expected return on plan assets has been set equal to the discount rate used to value the defined benefit obligations of the fund.<br />

The fund has an amount of approximately R21 million allocated to the employee surplus account that is currently being utilised towards a<br />

contribution holiday, and is expected to result in a holiday of approximately three years.<br />

2010<br />

Rm<br />

2007<br />

Rm<br />

2006<br />

Rm<br />

2009<br />

Rm