PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

for the year ended 30 June<br />

NOTES TO THE GROUP FINANCIAL STATEMENTS continued<br />

29. FINANCIAL INSTRUMENTS (continued)<br />

Effective 1 July 2009, the group adopted amendments to IFRS 7 for financial instruments that are measured in the statement of financial<br />

position at fair value. This requires disclosure of the fair value measurements by level of the fair value measurements hierarchy.<br />

All derivative financial instruments are classified as level 2 financial instruments.<br />

Credit risk<br />

Credit risk arises from loans and receivables, accounts receivable (excluding prepayments and VAT), and cash and cash equivalents. Trade<br />

debtors consist mainly of large tour operators. The granting of credit is controlled by application and account limits. Cash investments are only<br />

placed with high quality financial institutions.<br />

The maximum exposure to credit risk is represented by the carrying amount of all financial assets determined to be exposed to credit risk, with<br />

the exception of financial guarantees granted by the group for which the maximum exposure to credit risk is the maximum amount the group<br />

could have to pay if the guarantees are called on (refer note 30).<br />

The group has no significant concentrations of credit risk with respect to trade receivables due to a widely dispersed customer base. Credit risk<br />

with respect to loans and receivables is disclosed in note 17.<br />

Market risk<br />

Market risk includes foreign currency risk, interest rate risk and other price risk. The group’s exposure to other price risk is limited as the group<br />

does not have material investments which are subject to changes in equity prices.<br />

(a) Foreign currency risk<br />

The group operates internationally and is exposed to foreign exchange risk arising from various currency exposures primarily with respect<br />

to US Dollar, Sterling, Botswana Pula, Chilean Peso and Nigerian Naira.<br />

The group manages its foreign currency risk by ensuring that the net foreign currency exposure remains within acceptable levels.<br />

Companies in the group use foreign exchange contracts (FECs) and interest rate cross currency swaps to hedge certain of their exposures<br />

to foreign currency risk. The group had three material FECs outstanding at 30 June 2010 (2009: one) with a fair value of R8 million<br />

(2009: R9 million). The notional amount of the outstanding FECs at 30 June 2010 was R475 million (2009: R37 million). Refer to paragraph<br />

(b) for the interest rate cross currency swaps.<br />

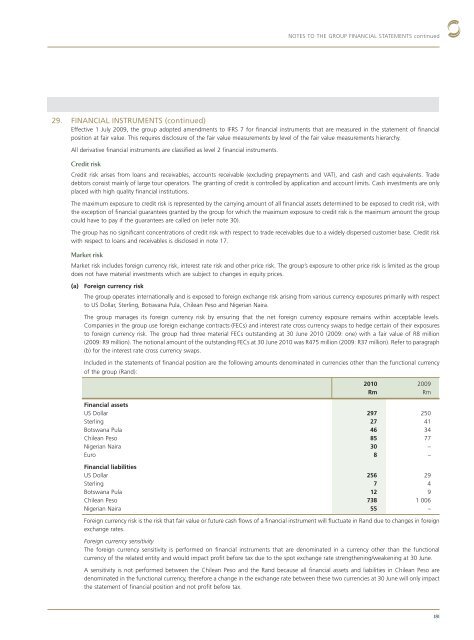

Included in the statements of financial position are the following amounts denominated in currencies other than the functional currency<br />

of the group (Rand):<br />

Financial assets<br />

US Dollar 297 <strong>25</strong>0<br />

Sterling 27 41<br />

Botswana Pula 46 34<br />

Chilean Peso 85 77<br />

Nigerian Naira 30 –<br />

Euro 8 –<br />

Financial liabilities<br />

US Dollar <strong>25</strong>6 29<br />

Sterling 7 4<br />

Botswana Pula 12 9<br />

Chilean Peso 738 1 006<br />

Nigerian Naira 55 –<br />

Foreign currency risk is the risk that fair value or future cash flows of a financial instrument will fluctuate in Rand due to changes in foreign<br />

exchange rates.<br />

Foreign currency sensitivity<br />

The foreign currency sensitivity is performed on financial instruments that are denominated in a currency other than the functional<br />

currency of the related entity and would impact profit before tax due to the spot exchange rate strengthening/weakening at 30 June.<br />

A sensitivity is not performed between the Chilean Peso and the Rand because all financial assets and liabilities in Chilean Peso are<br />

denominated in the functional currency, therefore a change in the exchange rate between these two currencies at 30 June will only impact<br />

the statement of financial position and not profit before tax.<br />

2010<br />

Rm<br />

2009<br />

Rm<br />

181