- Page 1 and 2:

ANNUAL REPORT 2010

- Page 3 and 4:

ABOUT THE INTEGRATED REPORT This re

- Page 5 and 6:

Carnival City AFRISUN GAUTENG 85% 8

- Page 7 and 8:

Monticello

- Page 9 and 10:

KEY STRATEGIC IMPERATIVES 3. OUR CU

- Page 11 and 12:

Energy management Communities Publi

- Page 13 and 14:

Non-Executive Directors MP (MIKE) E

- Page 15 and 16:

KH (Kele) Mazwai (41) / GROUP HUMAN

- Page 17 and 18:

INTRODUCTION This past year has onc

- Page 19 and 20:

Morula APPRECIATION On behalf of th

- Page 21 and 22:

AT A GLANCE FINANCIAL HIGHLIGHTS Wi

- Page 23 and 24:

TRADING AND GROUP OPERATING PERFORM

- Page 25 and 26:

Operational overview - Casinos and

- Page 27 and 28:

GrandWest JOINT REPORT OF THE CHIEF

- Page 29 and 30:

Gaming taxes by province and countr

- Page 31 and 32:

DIVIDENDS 1. SHAREHOLDER DELIVERY T

- Page 33 and 34:

JOINT REPORT OF THE CHIEF EXECUTIVE

- Page 35 and 36:

The Royal Livingstone 33

- Page 37 and 38:

AT A GLANCE 2. PROTECT OUR BUSINESS

- Page 39 and 40:

By the end of February, the number

- Page 41 and 42:

WILD COAST SUN The local community

- Page 43 and 44:

Our market share South Africa Gamin

- Page 45 and 46:

We estimate that the group’s shar

- Page 47 and 48:

Carnival City 45

- Page 49 and 50:

OUR OBJECTIVES IN THIS SECTION: JOI

- Page 51 and 52:

FEEDBACK ON THE CM INITIATIVES/PROJ

- Page 53 and 54:

51 51

- Page 55 and 56:

AT A GLANCE WHAT WE ACHIEVED Final

- Page 57 and 58:

CAPITAL COMMITMENTS Capital commitm

- Page 59 and 60:

AT A GLANCE JOINT REPORT OF THE CHI

- Page 61 and 62:

CONCESSIONAIRES Our concessionaires

- Page 63 and 64:

AT A GLANCE IN THIS SECTION: JOINT

- Page 65 and 66:

In line with global trends for lead

- Page 67 and 68:

JOINT REPORT OF THE CHIEF EXECUTIVE

- Page 69 and 70:

Beneficiaries of training 2010 Bene

- Page 71 and 72:

Training investment model JOINT REP

- Page 73 and 74:

JOB PROFILING Also forming part of

- Page 75 and 76:

Occupational hygiene and legionella

- Page 77 and 78:

OUR OBJECTIVES JOINT REPORT OF THE

- Page 79 and 80:

The table below sets out the direct

- Page 81 and 82:

MANAGEMENT JOINT REPORT OF THE CHIE

- Page 83 and 84:

JOINT REPORT OF THE CHIEF EXECUTIVE

- Page 85 and 86:

GOLDEN VALLEY CASINO & LODGE’S EN

- Page 87 and 88:

INCIDENTS JOINT REPORT OF THE CHIEF

- Page 89 and 90:

Efforts to establish the Nedbank Go

- Page 91 and 92:

Our property ratings Rm 2010 2009 2

- Page 93 and 94:

JOINT REPORT OF THE CHIEF EXECUTIVE

- Page 95 and 96:

AT A GLANCE JOINT REPORT OF THE CHI

- Page 97 and 98:

SHAWCO - This student-run NGO at th

- Page 99 and 100:

REGULATORY COMPLIANCE The South Afr

- Page 101 and 102:

OUR COMMITMENT CORPORATE GOVERNANCE

- Page 103 and 104:

Principle Action Outcome Independen

- Page 105 and 106:

The group’s governance is facilit

- Page 107 and 108:

The chief executive is mandated and

- Page 109 and 110:

Board meetings A minimum of four bo

- Page 111 and 112:

The audit committee is primarily re

- Page 113 and 114:

The committee has adopted a written

- Page 115 and 116:

The key risks that are identified,

- Page 117 and 118:

Internal control The board of direc

- Page 119 and 120:

The group has continued to actively

- Page 121 and 122:

Group 2010 2009 2008 2007 2006 2005

- Page 123 and 124:

Group statistics 2010 2009 2008 200

- Page 125 and 126:

Types of shareholders at 30 June 20

- Page 127 and 128:

principles of inclusivity, material

- Page 129 and 130:

The board and the remuneration comm

- Page 131 and 132:

Prior to the commencement of the re

- Page 133 and 134:

the travel and leisure sector that

- Page 135 and 136:

Share plan Date of grant Grant pric

- Page 137 and 138:

Emoluments Executive directors’ r

- Page 139 and 140:

for the year ended 30 June NOTES TO

- Page 141 and 142:

The annual financial statements whi

- Page 143 and 144:

TO THE MEMBERS OF SUN INTERNATIONAL

- Page 145 and 146:

HOLDING COMPANY The company has no

- Page 147 and 148:

which the entity operates (the func

- Page 149 and 150:

elating to certain firm commitments

- Page 151 and 152:

expenditure represents the total co

- Page 153 and 154: government and other government rel

- Page 155 and 156: GROUP STATEMENTS OF FINANCIAL POSIT

- Page 157 and 158: Notes GROUP STATEMENTS OF CHANGES I

- Page 159 and 160: for the year ended 30 June Operatin

- Page 161 and 162: for the year ended 30 June NOTES TO

- Page 163 and 164: for the year ended 30 June NOTES TO

- Page 165 and 166: 14. PROPERTY, PLANT AND EQUIPMENT (

- Page 167 and 168: 15. INTANGIBLE ASSETS (continued) S

- Page 169 and 170: for the year ended 30 June 18. RETI

- Page 171 and 172: for the year ended 30 June NOTES TO

- Page 173 and 174: for the year ended 30 June NOTES TO

- Page 175 and 176: for the year ended 30 June NOTES TO

- Page 177 and 178: for the year ended 30 June NOTES TO

- Page 179 and 180: for the year ended 30 June 27. PROV

- Page 181 and 182: for the year ended 30 June 28. CASH

- Page 183 and 184: for the year ended 30 June NOTES TO

- Page 185 and 186: 29. FINANCIAL INSTRUMENTS (continue

- Page 187 and 188: 32. RELATED PARTY TRANSACTIONS Key

- Page 189 and 190: 32. RELATED PARTY TRANSACTIONS (con

- Page 191 and 192: NOTES TO THE GROUP FINANCIAL STATEM

- Page 193 and 194: NOTES TO THE GROUP FINANCIAL STATEM

- Page 195 and 196: NOTES TO THE GROUP FINANCIAL STATEM

- Page 197 and 198: COMPANY STATEMENTS OF FINANCIAL POS

- Page 199 and 200: COMPANY STATEMENTS OF CHANGES IN EQ

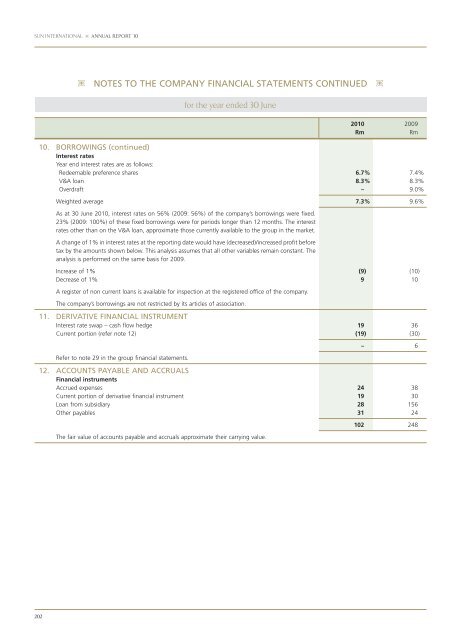

- Page 201 and 202: NOTES TO THE COMPANY FINANCIAL STAT

- Page 203: NOTES TO THE COMPANY FINANCIAL STAT

- Page 207 and 208: Notice is hereby given that the twe

- Page 209 and 210: Litigation statement The directors

- Page 211 and 212: SUN INTERNATIONAL LIMITED (Incorpor

- Page 213 and 214: SUN INTERNATIONAL LIMITED Incorpora