PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

for the year ended 30 June<br />

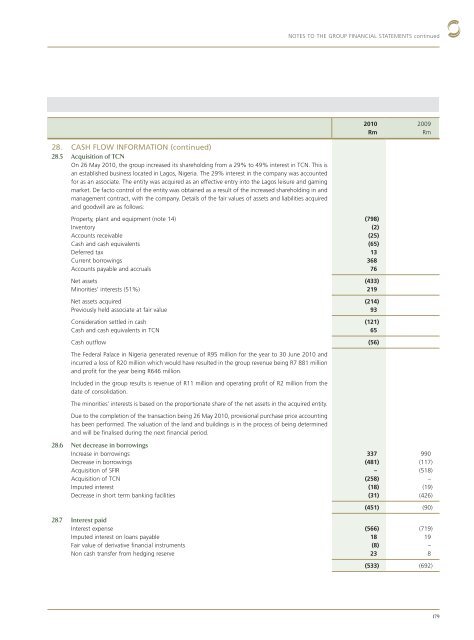

28. CASH FLOW INFORMATION (continued)<br />

28.5 Acquisition of TCN<br />

On 26 May 2010, the group increased its shareholding from a 29% to 49% interest in TCN. This is<br />

an established business located in Lagos, Nigeria. The 29% interest in the company was accounted<br />

for as an associate. The entity was acquired as an effective entry into the Lagos leisure and gaming<br />

market. De facto control of the entity was obtained as a result of the increased shareholding in and<br />

management contract, with the company. Details of the fair values of assets and liabilities acquired<br />

and goodwill are as follows:<br />

NOTES TO THE GROUP FINANCIAL STATEMENTS continued<br />

Property, plant and equipment (note 14) (798)<br />

Inventory (2)<br />

Accounts receivable (<strong>25</strong>)<br />

Cash and cash equivalents (65)<br />

Deferred tax 13<br />

Current borrowings 368<br />

Accounts payable and accruals 76<br />

Net assets (433)<br />

Minorities’ interests (51%) 219<br />

Net assets acquired (214)<br />

Previously held associate at fair value 93<br />

Consideration settled in cash (121)<br />

Cash and cash equivalents in TCN 65<br />

Cash outflow (56)<br />

The Federal Palace in Nigeria generated revenue of R95 million for the year to 30 June 2010 and<br />

incurred a loss of R20 million which would have resulted in the group revenue being R7 881 million<br />

and profit for the year being R646 million.<br />

Included in the group results is revenue of R11 million and operating profit of R2 million from the<br />

date of consolidation.<br />

The minorities’ interests is based on the proportionate share of the net assets in the acquired entity.<br />

Due to the completion of the transaction being 26 May 2010, provisional purchase price accounting<br />

has been performed. The valuation of the land and buildings is in the process of being determined<br />

and will be finalised during the next financial period.<br />

28.6 Net decrease in borrowings<br />

Increase in borrowings 337 990<br />

Decrease in borrowings (481) (117)<br />

Acquisition of SFIR – (518)<br />

Acquisition of TCN (<strong>25</strong>8) –<br />

Imputed interest (18) (19)<br />

Decrease in short term banking facilities (31) (426)<br />

2010<br />

Rm<br />

2009<br />

Rm<br />

(451) (90)<br />

28.7 Interest paid<br />

Interest expense (566) (719)<br />

Imputed interest on loans payable 18 19<br />

Fair value of derivative financial instruments (8) –<br />

Non cash transfer from hedging reserve 23 8<br />

(533) (692)<br />

179