PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

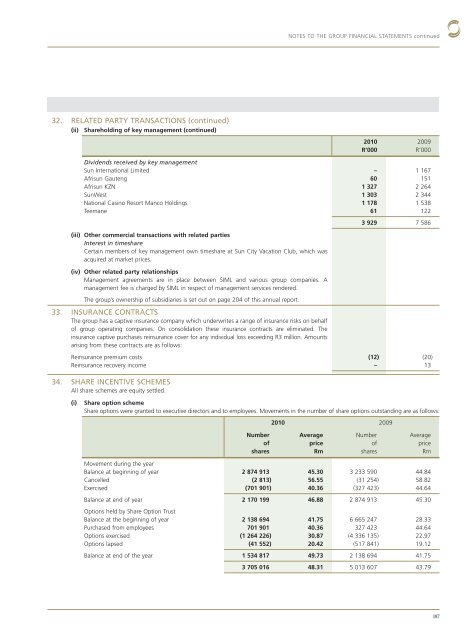

32. RELATED PARTY TRANSACTIONS (continued)<br />

(ii) Shareholding of key management (continued)<br />

NOTES TO THE GROUP FINANCIAL STATEMENTS continued<br />

2010<br />

R’000<br />

2009<br />

R’000<br />

Dividends received by key management<br />

<strong>Sun</strong> <strong>International</strong> Limited – 1 167<br />

Afrisun Gauteng 60 151<br />

Afrisun KZN 1 327 2 264<br />

<strong>Sun</strong>West 1 303 2 344<br />

National Casino Resort Manco Holdings 1 178 1 538<br />

Teemane 61 122<br />

(iii) Other commercial transactions with related parties<br />

Interest in timeshare<br />

Certain members of key management own timeshare at <strong>Sun</strong> City Vacation Club, which was<br />

acquired at market prices.<br />

(iv) Other related party relationships<br />

Management agreements are in place between SIML and various group companies. A<br />

manage ment fee is charged by SIML in respect of management services rendered.<br />

The group’s ownership of subsidiaries is set out on page 204 of this annual report.<br />

33. INSURANCE CONTRACTS<br />

The group has a captive insurance company which underwrites a range of insurance risks on behalf<br />

of group operating companies. On consolidation these insurance contracts are eliminated. The<br />

insurance captive purchases reinsurance cover for any individual loss exceeding R3 million. Amounts<br />

arising from these contracts are as follows:<br />

3 929 7 586<br />

Reinsurance premium costs (12) (20)<br />

Reinsurance recovery income – 13<br />

34. SHARE INCENTIVE SCHEMES<br />

All share schemes are equity settled.<br />

(i) Share option scheme<br />

Share options were granted to executive directors and to employees. Movements in the number of share options outstanding are as follows:<br />

2010 2009<br />

Number<br />

of<br />

shares<br />

Average<br />

price<br />

Rm<br />

Number<br />

of<br />

shares<br />

Average<br />

price<br />

Rm<br />

Movement during the year<br />

Balance at beginning of year 2 874 913 45.30 3 233 590 44.84<br />

Cancelled (2 813) 56.55 (31 <strong>25</strong>4) 58.82<br />

Exercised (701 901) 40.36 (327 423) 44.64<br />

Balance at end of year 2 170 199 46.88 2 874 913 45.30<br />

Options held by Share Option Trust<br />

Balance at the beginning of year 2 138 694 41.75 6 665 247 28.33<br />

Purchased from employees 701 901 40.36 327 423 44.64<br />

Options exercised (1 264 226) 30.87 (4 336 135) 22.97<br />

Options lapsed (41 552) 20.42 (517 841) 19.12<br />

Balance at end of the year 1 534 817 49.73 2 138 694 41.75<br />

3 705 016 48.31 5 013 607 43.79<br />

187