PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SUN INTERNATIONAL ANNUAL REPORT ’10<br />

<strong>Sun</strong> <strong>International</strong> Employee Share Trust (SIEST)<br />

The SIEST gives employees the opportunity to benefit from equity<br />

ownership in <strong>Sun</strong> <strong>International</strong> Limited. The Trust, set up in 2003, owns an<br />

effective 5.6% (for BEE measurement purposes, excluding 40% mandated<br />

investments, equates to 9.3%) of the group’s shares and up to 3.5% in a<br />

number of the group’s operating subsidiaries. The Trust has the benefit<br />

of an interest free loan from the group of which to date it has repaid<br />

R41 million leaving it with a balance of R103 million at 30 June 2010.<br />

During the current year eligible, employees benefited from the SIEST via the<br />

bi-annual distributions in October 2009 and April 2010 of R17.4 million in<br />

aggregate, or R2 141 per employee. Since inception the Trust has distributed<br />

R144 million in total or an aggregate amount of R20 000 per employee.<br />

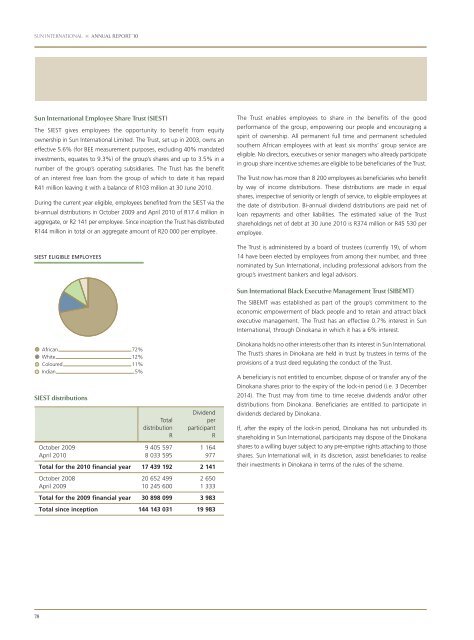

SIEST ELIGIBLE EMPLOYEES<br />

SIEST distributions<br />

78<br />

Total<br />

distribution<br />

R<br />

Dividend<br />

per<br />

participant<br />

R<br />

October 2009 9 405 597 1 164<br />

April 2010 8 033 595 977<br />

Total for the 2010 financial year 17 439 192 2 141<br />

October 2008 20 652 499 2 650<br />

April 2009 10 245 600 1 333<br />

Total for the 2009 financial year 30 898 099 3 983<br />

Total since inception 144 143 031 19 983<br />

The Trust enables employees to share in the benefits of the good<br />

performance of the group, empowering our people and encouraging a<br />

spirit of ownership. All permanent full time and permanent scheduled<br />

southern African employees with at least six months’ group service are<br />

eligible. No directors, executives or senior managers who already participate<br />

in group share incentive schemes are eligible to be beneficiaries of the Trust.<br />

The Trust now has more than 8 200 employees as beneficiaries who benefit<br />

by way of income distributions. These distributions are made in equal<br />

shares, irrespective of seniority or length of service, to eligible employees at<br />

the date of distribution. Bi-annual dividend distributions are paid net of<br />

loan repayments and other liabilities. The estimated value of the Trust<br />

shareholdings net of debt at 30 June 2010 is R374 million or R45 530 per<br />

employee.<br />

The Trust is administered by a board of trustees (currently 19), of whom<br />

14 have been elected by employees from among their number, and three<br />

nominated by <strong>Sun</strong> <strong>International</strong>, including professional advisors from the<br />

group’s investment bankers and legal advisors.<br />

<strong>Sun</strong> <strong>International</strong> Black Executive Management Trust (SIBEMT)<br />

The SIBEMT was established as part of the group’s commitment to the<br />

economic empowerment of black people and to retain and attract black<br />

executive management. The Trust has an effective 0.7% interest in <strong>Sun</strong><br />

<strong>International</strong>, through Dinokana in which it has a 6% interest.<br />

Dinokana holds no other interests other than its interest in <strong>Sun</strong> <strong>International</strong>.<br />

The Trust’s shares in Dinokana are held in trust by trustees in terms of the<br />

provisions of a trust deed regulating the conduct of the Trust.<br />

A beneficiary is not entitled to encumber, dispose of or transfer any of the<br />

Dinokana shares prior to the expiry of the lock-in period (i.e. 3 December<br />

2014). The Trust may from time to time receive dividends and/or other<br />

distributions from Dinokana. Beneficiaries are entitled to participate in<br />

dividends declared by Dinokana.<br />

If, after the expiry of the lock-in period, Dinokana has not unbundled its<br />

shareholding in <strong>Sun</strong> <strong>International</strong>, participants may dispose of the Dinokana<br />

shares to a willing buyer subject to any pre-emptive rights attaching to those<br />

shares. <strong>Sun</strong> <strong>International</strong> will, in its discretion, assist beneficiaries to realise<br />

their investments in Dinokana in terms of the rules of the scheme.