PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

29. FINANCIAL INSTRUMENTS (continued)<br />

for the year ended 30 June<br />

NOTES TO THE GROUP FINANCIAL STATEMENTS continued<br />

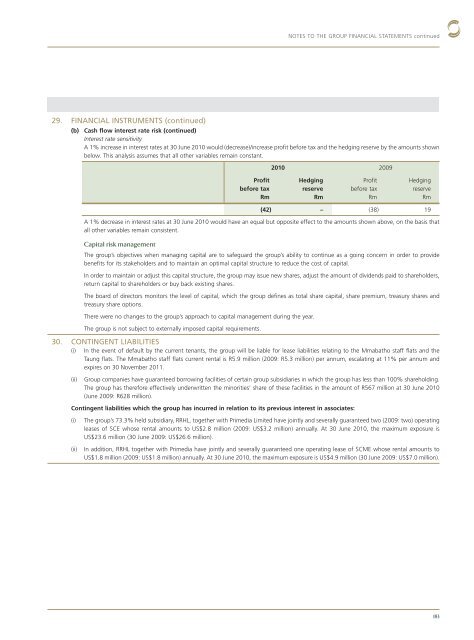

(b) Cash flow interest rate risk (continued)<br />

Interest rate sensitivity<br />

A 1% increase in interest rates at 30 June 2010 would (decrease)/increase profit before tax and the hedging reserve by the amounts shown<br />

below. This analysis assumes that all other variables remain constant.<br />

Profit<br />

before tax<br />

Rm<br />

2010 2009<br />

Hedging<br />

reserve<br />

Rm<br />

Profit<br />

before tax<br />

Rm<br />

Hedging<br />

reserve<br />

Rm<br />

(42) – (38) 19<br />

A 1% decrease in interest rates at 30 June 2010 would have an equal but opposite effect to the amounts shown above, on the basis that<br />

all other variables remain consistent.<br />

Capital risk management<br />

The group’s objectives when managing capital are to safeguard the group’s ability to continue as a going concern in order to provide<br />

benefits for its stakeholders and to maintain an optimal capital structure to reduce the cost of capital.<br />

In order to maintain or adjust this capital structure, the group may issue new shares, adjust the amount of dividends paid to shareholders,<br />

return capital to shareholders or buy back existing shares.<br />

The board of directors monitors the level of capital, which the group defines as total share capital, share premium, treasury shares and<br />

treasury share options.<br />

There were no changes to the group’s approach to capital management during the year.<br />

The group is not subject to externally imposed capital requirements.<br />

30. CONTINGENT LIABILITIES<br />

(i) In the event of default by the current tenants, the group will be liable for lease liabilities relating to the Mmabatho staff flats and the<br />

Taung flats. The Mmabatho staff flats current rental is R5.9 million (2009: R5.3 million) per annum, escalating at 11% per annum and<br />

expires on 30 November 2011.<br />

(ii) Group companies have guaranteed borrowing facilities of certain group subsidiaries in which the group has less than 100% shareholding.<br />

The group has therefore effectively underwritten the minorities’ share of these facilities in the amount of R567 million at 30 June 2010<br />

(June 2009: R628 million).<br />

Contingent liabilities which the group has incurred in relation to its previous interest in associates:<br />

(i) The group’s 73.3% held subsidiary, RRHL, together with Primedia Limited have jointly and severally guaranteed two (2009: two) operating<br />

leases of SCE whose rental amounts to US$2.8 million (2009: US$3.2 million) annually. At 30 June 2010, the maximum exposure is<br />

US$23.6 million (30 June 2009: US$26.6 million).<br />

(ii) In addition, RRHL together with Primedia have jointly and severally guaranteed one operating lease of SCME whose rental amounts to<br />

US$1.8 million (2009: US$1.8 million) annually. At 30 June 2010, the maximum exposure is US$4.9 million (30 June 2009: US$7.0 million).<br />

183