PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

for the year ended 30 June<br />

NOTES TO THE GROUP FINANCIAL STATEMENTS continued<br />

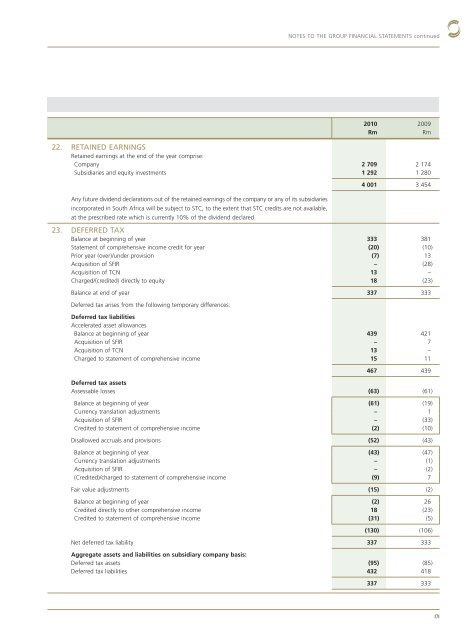

22. RETAINED EARNINGS<br />

Retained earnings at the end of the year comprise:<br />

Company 2 709 2 174<br />

Subsidiaries and equity investments 1 292 1 280<br />

Any future dividend declarations out of the retained earnings of the company or any of its subsidiaries<br />

incorporated in South Africa will be subject to STC, to the extent that STC credits are not available,<br />

at the prescribed rate which is currently 10% of the dividend declared.<br />

2010<br />

Rm<br />

2009<br />

Rm<br />

4 001 3 454<br />

23. DEFERRED TAX<br />

Balance at beginning of year 333 381<br />

Statement of comprehensive income credit for year (20) (10)<br />

Prior year (over)/under provision (7) 13<br />

Acquisition of SFIR – (28)<br />

Acquisition of TCN 13 –<br />

Charged/(credited) directly to equity 18 (23)<br />

Balance at end of year 337 333<br />

Deferred tax arises from the following temporary differences:<br />

Deferred tax liabilities<br />

Accelerated asset allowances<br />

Balance at beginning of year 439 421<br />

Acquisition of SFIR – 7<br />

Acquisition of TCN 13 –<br />

Charged to statement of comprehensive income 15 11<br />

467 439<br />

Deferred tax assets<br />

Assessable losses (63) (61)<br />

Balance at beginning of year (61) (19)<br />

Currency translation adjustments – 1<br />

Acquisition of SFIR – (33)<br />

Credited to statement of comprehensive income (2) (10)<br />

Disallowed accruals and provisions (52) (43)<br />

Balance at beginning of year (43) (47)<br />

Currency translation adjustments – (1)<br />

Acquisition of SFIR – (2)<br />

(Credited)/charged to statement of comprehensive income (9) 7<br />

Fair value adjustments (15) (2)<br />

Balance at beginning of year (2) 26<br />

Credited directly to other comprehensive income 18 (23)<br />

Credited to statement of comprehensive income (31) (5)<br />

(130) (106)<br />

Net deferred tax liability 337 333<br />

Aggregate assets and liabilities on subsidiary company basis:<br />

Deferred tax assets (95) (85)<br />

Deferred tax liabilities 432 418<br />

337 333<br />

171