PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SUN INTERNATIONAL ANNUAL REPORT ’10<br />

192<br />

NOTES TO THE GROUP FINANCIAL STATEMENTS CONTINUED<br />

for the year ended 30 June<br />

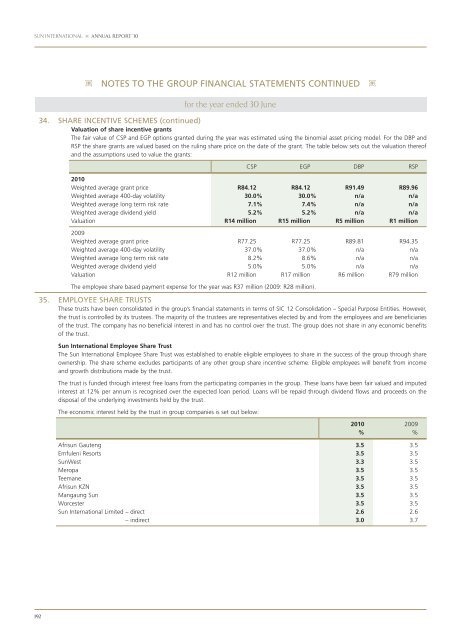

34. SHARE INCENTIVE SCHEMES (continued)<br />

Valuation of share incentive grants<br />

The fair value of CSP and EGP options granted during the year was estimated using the binomial asset pricing model. For the DBP and<br />

RSP the share grants are valued based on the ruling share price on the date of the grant. The table below sets out the valuation thereof<br />

and the assumptions used to value the grants:<br />

CSP EGP DBP RSP<br />

2010<br />

Weighted average grant price R84.12 R84.12 R91.49 R89.96<br />

Weighted average 400-day volatility 30.0% 30.0% n/a n/a<br />

Weighted average long term risk rate 7.1% 7.4% n/a n/a<br />

Weighted average dividend yield 5.2% 5.2% n/a n/a<br />

Valuation R14 million R15 million R5 million R1 million<br />

2009<br />

Weighted average grant price R77.<strong>25</strong> R77.<strong>25</strong> R89.81 R94.35<br />

Weighted average 400-day volatility 37.0% 37.0% n/a n/a<br />

Weighted average long term risk rate 8.2% 8.6% n/a n/a<br />

Weighted average dividend yield 5.0% 5.0% n/a n/a<br />

Valuation R12 million R17 million R6 million R79 million<br />

The employee share based payment expense for the year was R37 million (2009: R28 million).<br />

35. EMPLOYEE SHARE TRUSTS<br />

These trusts have been consolidated in the group’s financial statements in terms of SIC 12 Consolidation – Special Purpose Entities. However,<br />

the trust is controlled by its trustees. The majority of the trustees are representatives elected by and from the employees and are beneficiaries<br />

of the trust. The company has no beneficial interest in and has no control over the trust. The group does not share in any economic benefits<br />

of the trust.<br />

<strong>Sun</strong> <strong>International</strong> Employee Share Trust<br />

The <strong>Sun</strong> <strong>International</strong> Employee Share Trust was established to enable eligible employees to share in the success of the group through share<br />

ownership. The share scheme excludes participants of any other group share incentive scheme. Eligible employees will benefit from income<br />

and growth distributions made by the trust.<br />

The trust is funded through interest free loans from the participating companies in the group. These loans have been fair valued and imputed<br />

interest at 12% per annum is recognised over the expected loan period. Loans will be repaid through dividend flows and proceeds on the<br />

disposal of the underlying investments held by the trust.<br />

The economic interest held by the trust in group companies is set out below:<br />

Afrisun Gauteng 3.5 3.5<br />

Emfuleni Resorts 3.5 3.5<br />

<strong>Sun</strong>West 3.3 3.5<br />

Meropa 3.5 3.5<br />

Teemane 3.5 3.5<br />

Afrisun KZN 3.5 3.5<br />

Mangaung <strong>Sun</strong> 3.5 3.5<br />

Worcester 3.5 3.5<br />

<strong>Sun</strong> <strong>International</strong> Limited – direct 2.6 2.6<br />

– indirect 3.0 3.7<br />

2010<br />

%<br />

2009<br />

%