PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SUN INTERNATIONAL ANNUAL REPORT ’10<br />

NATURE OF BUSINESS<br />

The <strong>Sun</strong> <strong>International</strong> group has interests in, and provides management<br />

services to businesses in the hotel, resort and casino industry.<br />

EARNINGS<br />

The results of the company and the group are set out in the statements<br />

of comprehensive income on page 152.<br />

Segmental information is set out on pages 156 to 157.<br />

DIVIDENDS<br />

Dividends totalling 100 cents per share (2009: Nil) have been declared by<br />

the directors in respect of the year under review, as follows:<br />

Declared 27 August 2010; and<br />

Paid, 20 September 2010.<br />

The dividend referred to above will be accounted for in the 2011 annual<br />

financial statements as it was declared subsequent to the year end.<br />

REVIEW OF OPERATIONS AND FUTURE<br />

DEVELOPMENTS<br />

Detailed commentary on the nature of business of the company and its<br />

subsidiaries, acquisitions, disposals, future developments and prospects<br />

of the group are given in the chairman’s report, and the joint chief<br />

executive’s and chief financial officer’s report commencing on page 18.<br />

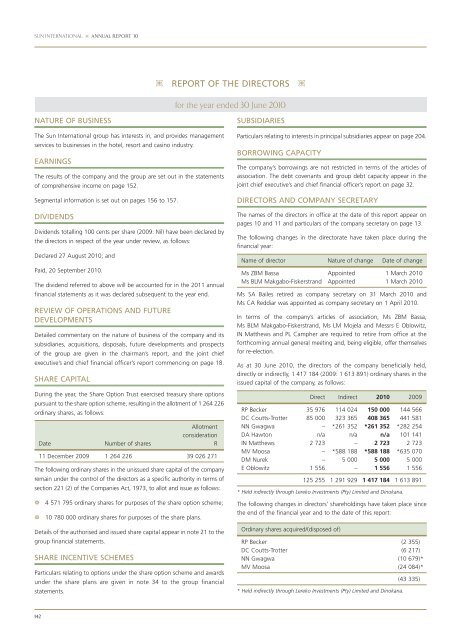

SHARE CAPITAL<br />

During the year, the Share Option Trust exercised treasury share options<br />

pursuant to the share option scheme, resulting in the allotment of 1 264 226<br />

ordinary shares, as follows:<br />

142<br />

Date Number of shares<br />

for the year ended 30 June 2010<br />

Allotment<br />

consideration<br />

R<br />

11 December 2009 1 264 226 39 026 271<br />

The following ordinary shares in the unissued share capital of the company<br />

remain under the control of the directors as a specific authority in terms of<br />

section 221 (2) of the Companies Act, 1973, to allot and issue as follows:<br />

� 4 571 795 ordinary shares for purposes of the share option scheme;<br />

� 10 780 000 ordinary shares for purposes of the share plans.<br />

Details of the authorised and issued share capital appear in note 21 to the<br />

group financial statements.<br />

SHARE INCENTIVE SCHEMES<br />

Particulars relating to options under the share option scheme and awards<br />

under the share plans are given in note 34 to the group financial<br />

statements.<br />

REPORT OF THE DIRECTORS<br />

SUBSIDIARIES<br />

Particulars relating to interests in principal subsidiaries appear on page 204.<br />

BORROWING CAPACITY<br />

The company’s borrowings are not restricted in terms of the articles of<br />

association. The debt covenants and group debt capacity appear in the<br />

joint chief executive’s and chief financial officer’s report on page 32.<br />

DIRECTORS AND COMPANY SECRETARY<br />

The names of the directors in office at the date of this report appear on<br />

pages 10 and 11 and particulars of the company secretary on page 13.<br />

The following changes in the directorate have taken place during the<br />

financial year:<br />

Name of director Nature of change Date of change<br />

Ms ZBM Bassa Appointed 1 March 2010<br />

Ms BLM Makgabo-Fiskerstrand Appointed 1 March 2010<br />

Ms SA Bailes retired as company secretary on 31 March 2010 and<br />

Ms CA Reddiar was appointed as company secretary on 1 April 2010.<br />

In terms of the company’s articles of association, Ms ZBM Bassa,<br />

Ms BLM Makgabo-Fiskerstrand, Ms LM Mojela and Messrs E Oblowitz,<br />

IN Matthews and PL Campher are required to retire from office at the<br />

forthcoming annual general meeting and, being eligible, offer themselves<br />

for re-election.<br />

As at 30 June 2010, the directors of the company beneficially held,<br />

directly or indirectly, 1 417 184 (2009: 1 613 891) ordinary shares in the<br />

issued capital of the company, as follows:<br />

Direct Indirect 2010 2009<br />

RP Becker 35 976 114 024 150 000 144 566<br />

DC Coutts-Trotter 85 000 323 365 408 365 441 581<br />

NN Gwagwa – *261 352 *261 352 *282 <strong>25</strong>4<br />

DA Hawton n/a n/a n/a 101 141<br />

IN Matthews 2 723 – 2 723 2 723<br />

MV Moosa – *588 188 *588 188 *635 070<br />

DM Nurek – 5 000 5 000 5 000<br />

E Oblowitz 1 556 – 1 556 1 556<br />

1<strong>25</strong> <strong>25</strong>5 1 291 929 1 417 184 1 613 891<br />

* Held indirectly through Lereko Investments (Pty) Limited and Dinokana.<br />

The following changes in directors’ shareholdings have taken place since<br />

the end of the financial year and to the date of this report:<br />

Ordinary shares acquired/(disposed of)<br />

RP Becker (2 355)<br />

DC Coutts-Trotter (6 217)<br />

NN Gwagwa (10 679)*<br />

MV Moosa (24 084)*<br />

* Held indirectly through Lereko Investments (Pty) Limited and Dinokana.<br />

(43 335)