PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

15. INTANGIBLE ASSETS (continued)<br />

<strong>Sun</strong> <strong>International</strong> name<br />

for the year ended 30 June<br />

NOTES TO THE GROUP FINANCIAL STATEMENTS continued<br />

The <strong>Sun</strong> <strong>International</strong> name is classified as an indefinite life intangible asset as the group believes that it will benefit from the name for an<br />

indefinite period. The name was tested for impairment by discounting five years of projected cash flows on relevant operations and<br />

management contracts. Discount rates were based on the risk free rate of the appropriate country, a standard risk premium and a country risk<br />

premium and ranged from 7% to 13%. In determining the growth rates applied in the impairment calculations, consideration was given to<br />

the location of the business, including economic and political facts and circumstances. Based on these calculations, there is no indication of<br />

impairment.<br />

Goodwill<br />

The goodwill relates to the acquisition of SFIR on 20 August 2008. Goodwill comprises intellectual property and the casino licence. Goodwill<br />

was tested for impairment by performing a ‘value in use’ valuation and applying a discount rate of 9.73% (2009: 12.47%) to the directors’<br />

estimated future operating cash flows. Local territory tax rates were applied and a terminal growth rate based on local inflation plus a margin<br />

premium was used.<br />

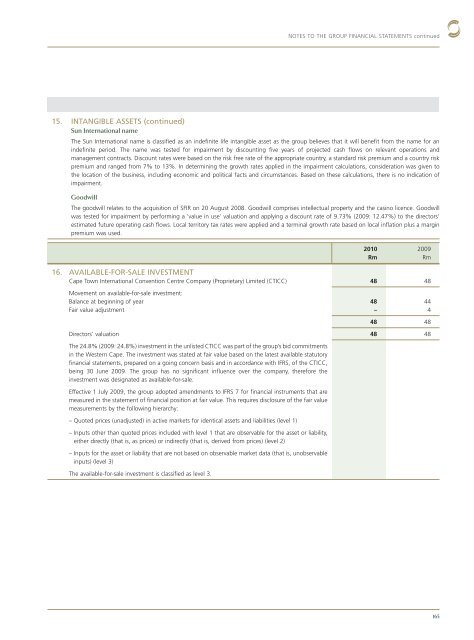

16. AVAILABLE-FOR-SALE INVESTMENT<br />

Cape Town <strong>International</strong> Convention <strong>Centre</strong> Company (Proprietary) Limited (CTICC) 48 48<br />

Movement on available-for-sale investment:<br />

Balance at beginning of year 48 44<br />

Fair value adjustment – 4<br />

2010<br />

Rm<br />

2009<br />

Rm<br />

48 48<br />

Directors’ valuation 48 48<br />

The 24.8% (2009: 24.8%) investment in the unlisted CTICC was part of the group’s bid commitments<br />

in the Western Cape. The investment was stated at fair value based on the latest available statutory<br />

financial statements, prepared on a going concern basis and in accordance with IFRS, of the CTICC,<br />

being 30 June 2009. The group has no significant influence over the company, therefore the<br />

investment was designated as available-for-sale.<br />

Effective 1 July 2009, the group adopted amendments to IFRS 7 for financial instruments that are<br />

measured in the statement of financial position at fair value. This requires disclosure of the fair value<br />

measurements by the following hierarchy:<br />

– Quoted prices (unadjusted) in active markets for identical assets and liabilities (level 1)<br />

– Inputs other than quoted prices included with level 1 that are observable for the asset or liability,<br />

either directly (that is, as prices) or indirectly (that is, derived from prices) (level 2)<br />

– Inputs for the asset or liability that are not based on observable market data (that is, unobservable<br />

inputs) (level 3)<br />

The available-for-sale investment is classified as level 3.<br />

165