PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SUN INTERNATIONAL ANNUAL REPORT ’10<br />

180<br />

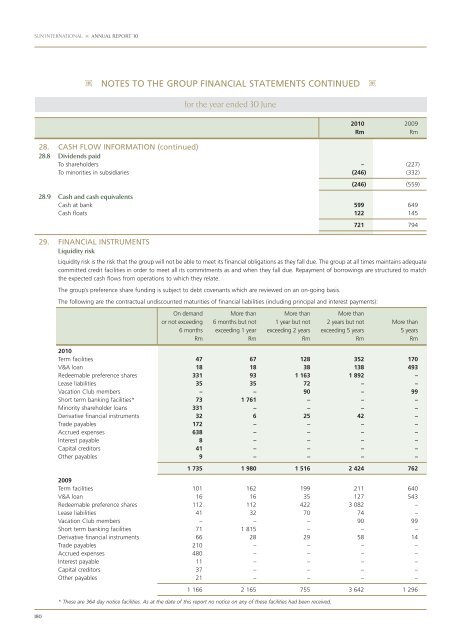

NOTES TO THE GROUP FINANCIAL STATEMENTS CONTINUED<br />

for the year ended 30 June<br />

28. CASH FLOW INFORMATION (continued)<br />

28.8 Dividends paid<br />

To shareholders – (227)<br />

To minorities in subsidiaries (246) (332)<br />

2010<br />

Rm<br />

2009<br />

Rm<br />

(246) (559)<br />

28.9 Cash and cash equivalents<br />

Cash at bank 599 649<br />

Cash floats 122 145<br />

29. FINANCIAL INSTRUMENTS<br />

Liquidity risk<br />

721 794<br />

Liquidity risk is the risk that the group will not be able to meet its financial obligations as they fall due. The group at all times maintains adequate<br />

committed credit facilities in order to meet all its commitments as and when they fall due. Repayment of borrowings are structured to match<br />

the expected cash flows from operations to which they relate.<br />

The group’s preference share funding is subject to debt covenants which are reviewed on an on-going basis.<br />

The following are the contractual undiscounted maturities of financial liabilities (including principal and interest payments):<br />

On demand<br />

or not exceeding<br />

6 months<br />

Rm<br />

More than<br />

6 months but not<br />

exceeding 1 year<br />

Rm<br />

More than<br />

1 year but not<br />

exceeding 2 years<br />

Rm<br />

More than<br />

2 years but not<br />

exceeding 5 years<br />

Rm<br />

More than<br />

5 years<br />

Rm<br />

2010<br />

Term facilities 47 67 128 352 170<br />

V&A loan 18 18 38 138 493<br />

Redeemable preference shares 331 93 1 163 1 892 –<br />

Lease liabilities 35 35 72 – –<br />

Vacation Club members – – 90 – 99<br />

Short term banking facilities* 73 1 761 – – –<br />

Minority shareholder loans 331 – – – –<br />

Derivative financial instruments 32 6 <strong>25</strong> 42 –<br />

Trade payables 172 – – – –<br />

Accrued expenses 638 – – – –<br />

Interest payable 8 – – – –<br />

Capital creditors 41 – – – –<br />

Other payables 9 – – – –<br />

1 735 1 980 1 516 2 424 762<br />

2009<br />

Term facilities 101 162 199 211 640<br />

V&A loan 16 16 35 127 543<br />

Redeemable preference shares 112 112 422 3 082 –<br />

Lease liabilities 41 32 70 74 –<br />

Vacation Club members – – – 90 99<br />

Short term banking facilities 71 1 815 – – –<br />

Derivative financial instruments 66 28 29 58 14<br />

Trade payables 210 – – – –<br />

Accrued expenses 480 – – – –<br />

Interest payable 11 – – – –<br />

Capital creditors 37 – – – –<br />

Other payables 21 – – – –<br />

1 166 2 165 755 3 642 1 296<br />

* These are 364 day notice facilities. As at the date of this report no notice on any of these facilities had been received.