PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO THE GROUP FINANCIAL STATEMENTS continued<br />

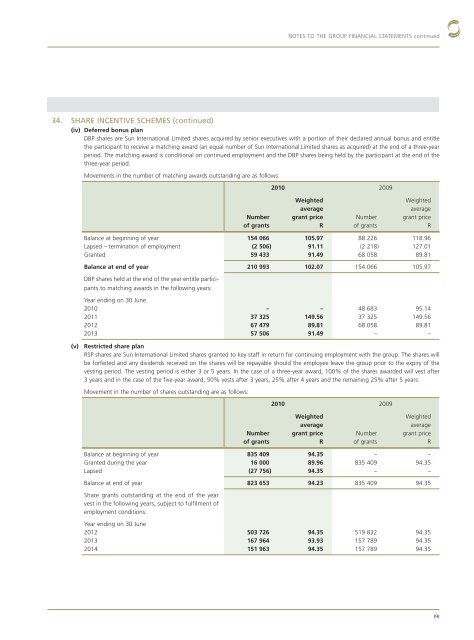

34. SHARE INCENTIVE SCHEMES (continued)<br />

(iv) Deferred bonus plan<br />

DBP shares are <strong>Sun</strong> <strong>International</strong> Limited shares acquired by senior executives with a portion of their declared annual bonus and entitle<br />

the participant to receive a matching award (an equal number of <strong>Sun</strong> <strong>International</strong> Limited shares as acquired) at the end of a three-year<br />

period. The matching award is conditional on continued employment and the DBP shares being held by the participant at the end of the<br />

three-year period.<br />

Movements in the number of matching awards outstanding are as follows:<br />

Number<br />

of grants<br />

2010 2009<br />

Weighted<br />

average<br />

grant price<br />

R<br />

Number<br />

of grants<br />

Weighted<br />

average<br />

grant price<br />

R<br />

Balance at beginning of year 154 066 105.97 88 226 118.96<br />

Lapsed – termination of employment (2 506) 91.11 (2 218) 127.01<br />

Granted 59 433 91.49 68 058 89.81<br />

Balance at end of year 210 993 102.07 154 066 105.97<br />

DBP shares held at the end of the year entitle participants<br />

to matching awards in the following years:<br />

Year ending on 30 June<br />

2010 – – 48 683 95.14<br />

2011 37 3<strong>25</strong> 149.56 37 3<strong>25</strong> 149.56<br />

2012 67 479 89.81 68 058 89.81<br />

2013 57 506 91.49 – –<br />

(v) Restricted share plan<br />

RSP shares are <strong>Sun</strong> <strong>International</strong> Limited shares granted to key staff in return for continuing employment with the group. The shares will<br />

be forfeited and any dividends received on the shares will be repayable should the employee leave the group prior to the expiry of the<br />

vesting period. The vesting period is either 3 or 5 years. In the case of a three-year award, 100% of the shares awarded will vest after<br />

3 years and in the case of the five-year award, 50% vests after 3 years, <strong>25</strong>% after 4 years and the remaining <strong>25</strong>% after 5 years.<br />

Movement in the number of shares outstanding are as follows:<br />

Number<br />

of grants<br />

2010 2009<br />

Weighted<br />

average<br />

grant price<br />

R<br />

Number<br />

of grants<br />

Weighted<br />

average<br />

grant price<br />

R<br />

Balance at beginning of year 835 409 94.35 – –<br />

Granted during the year 16 000 89.96 835 409 94.35<br />

Lapsed (27 756) 94.35 – –<br />

Balance at end of year 823 653 94.23 835 409 94.35<br />

Share grants outstanding at the end of the year<br />

vest in the following years, subject to fulfilment of<br />

employ ment conditions:<br />

Year ending on 30 June<br />

2012 503 726 94.35 519 832 94.35<br />

2013 167 964 93.93 157 789 94.35<br />

2014 151 963 94.35 157 789 94.35<br />

191