PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SUN INTERNATIONAL ANNUAL REPORT ’10<br />

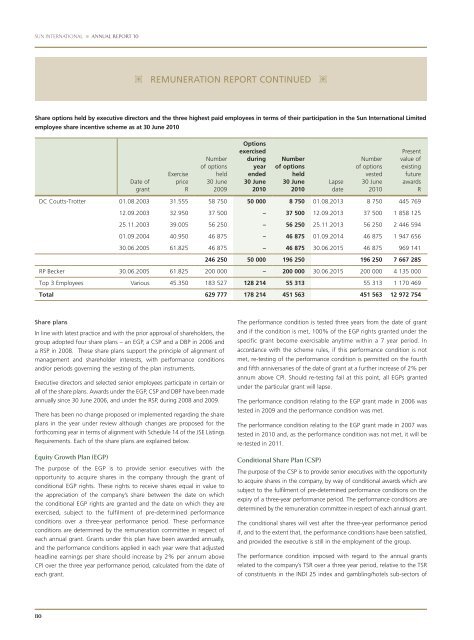

Share options held by executive directors and the three highest paid employees in terms of their participation in the <strong>Sun</strong> <strong>International</strong> Limited<br />

employee share incentive scheme as at 30 June 2010<br />

130<br />

Date of<br />

grant<br />

remuneration report continued<br />

Exercise<br />

price<br />

R<br />

Number<br />

of options<br />

held<br />

30 June<br />

2009<br />

Options<br />

exercised<br />

during<br />

year<br />

ended<br />

30 June<br />

2010<br />

Number<br />

of options<br />

held<br />

30 June<br />

2010<br />

Lapse<br />

date<br />

Number<br />

of options<br />

vested<br />

30 June<br />

2010<br />

Present<br />

value of<br />

existing<br />

future<br />

awards<br />

R<br />

DC Coutts-Trotter 01.08.2003 31.555 58 750 50 000 8 750 01.08.2013 8 750 445 769<br />

12.09.2003 32.950 37 500 – 37 500 12.09.2013 37 500 1 858 1<strong>25</strong><br />

<strong>25</strong>.11.2003 39.005 56 <strong>25</strong>0 – 56 <strong>25</strong>0 <strong>25</strong>.11.2013 56 <strong>25</strong>0 2 446 594<br />

01.09.2004 40.950 46 875 – 46 875 01.09.2014 46 875 1 947 656<br />

30.06.2005 61.8<strong>25</strong> 46 875 – 46 875 30.06.2015 46 875 969 141<br />

246 <strong>25</strong>0 50 000 196 <strong>25</strong>0 196 <strong>25</strong>0 7 667 285<br />

RP Becker 30.06.2005 61.8<strong>25</strong> 200 000 – 200 000 30.06.2015 200 000 4 135 000<br />

Top 3 Employees Various 45.350 183 527 128 214 55 313 55 313 1 170 469<br />

Total 629 777 178 214 451 563 451 563 12 972 754<br />

Share plans<br />

In line with latest practice and with the prior approval of shareholders, the<br />

group adopted four share plans – an EGP, a CSP and a DBP in 2006 and<br />

a RSP in 2008. These share plans support the principle of alignment of<br />

management and shareholder interests, with performance conditions<br />

and/or periods governing the vesting of the plan instruments.<br />

Executive directors and selected senior employees participate in certain or<br />

all of the share plans. Awards under the EGP, CSP and DBP have been made<br />

annually since 30 June 2006, and under the RSP, during 2008 and 2009.<br />

There has been no change proposed or implemented regarding the share<br />

plans in the year under review although changes are proposed for the<br />

forthcoming year in terms of alignment with Schedule 14 of the JSE Listings<br />

Requirements. Each of the share plans are explained below.<br />

Equity Growth Plan (EGP)<br />

The purpose of the EGP is to provide senior executives with the<br />

opportunity to acquire shares in the company through the grant of<br />

conditional EGP rights. These rights to receive shares equal in value to<br />

the appreciation of the company’s share between the date on which<br />

the conditional EGP rights are granted and the date on which they are<br />

exercised, subject to the fulfilment of pre-determined performance<br />

conditions over a three-year performance period. These performance<br />

conditions are determined by the remuneration committee in respect of<br />

each annual grant. Grants under this plan have been awarded annually,<br />

and the performance conditions applied in each year were that adjusted<br />

headline earnings per share should increase by 2% per annum above<br />

CPI over the three year performance period, calculated from the date of<br />

each grant.<br />

The performance condition is tested three years from the date of grant<br />

and if the condition is met, 100% of the EGP rights granted under the<br />

specific grant become exercisable anytime within a 7 year period. In<br />

accordance with the scheme rules, if this performance condition is not<br />

met, re-testing of the performance condition is permitted on the fourth<br />

and fifth anniversaries of the date of grant at a further increase of 2% per<br />

annum above CPI. Should re-testing fail at this point, all EGPs granted<br />

under the particular grant will lapse.<br />

The performance condition relating to the EGP grant made in 2006 was<br />

tested in 2009 and the performance condition was met.<br />

The performance condition relating to the EGP grant made in 2007 was<br />

tested in 2010 and, as the performance condition was not met, it will be<br />

re-tested in 2011.<br />

Conditional Share Plan (CSP)<br />

The purpose of the CSP is to provide senior executives with the opportunity<br />

to acquire shares in the company, by way of conditional awards which are<br />

subject to the fulfilment of pre-determined performance conditions on the<br />

expiry of a three-year performance period. The performance conditions are<br />

determined by the remuneration committee in respect of each annual grant.<br />

The conditional shares will vest after the three-year performance period<br />

if, and to the extent that, the performance conditions have been satisfied,<br />

and provided the executive is still in the employment of the group.<br />

The performance condition imposed with regard to the annual grants<br />

related to the company’s TSR over a three year period, relative to the TSR<br />

of constituents in the INDI <strong>25</strong> index and gambling/hotels sub-sectors of