PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

PDF 25 MB - Sun International | Investor Centre

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

SUN INTERNATIONAL ANNUAL REPORT ’10<br />

182<br />

NOTES TO THE GROUP FINANCIAL STATEMENTS CONTINUED<br />

for the year ended 30 June<br />

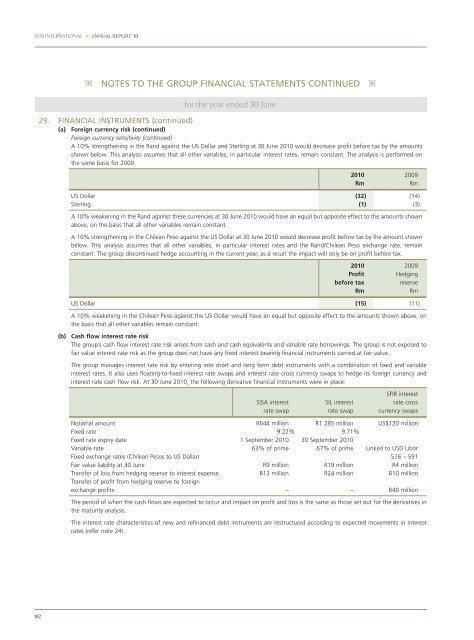

29. FINANCIAL INSTRUMENTS (continued)<br />

(a) Foreign currency risk (continued)<br />

Foreign currency sensitivity (continued)<br />

A 10% strengthening in the Rand against the US Dollar and Sterling at 30 June 2010 would decrease profit before tax by the amounts<br />

shown below. This analysis assumes that all other variables, in particular interest rates, remain constant. The analysis is performed on<br />

the same basis for 2009.<br />

US Dollar (32) (14)<br />

Sterling (1) (3)<br />

A 10% weakening in the Rand against these currencies at 30 June 2010 would have an equal but opposite effect to the amounts shown<br />

above, on the basis that all other variables remain constant.<br />

A 10% strengthening in the Chilean Peso against the US Dollar at 30 June 2010 would decrease profit before tax by the amount shown<br />

below. This analysis assumes that all other variables, in particular interest rates and the Rand/Chilean Peso exchange rate, remain<br />

constant. The group discontinued hedge accounting in the current year, as a result the impact will only be on profit before tax.<br />

2010<br />

Rm<br />

2010<br />

Profit<br />

before tax<br />

Rm<br />

2009<br />

Rm<br />

2009<br />

Hedging<br />

reserve<br />

Rm<br />

US Dollar (15) (11)<br />

A 10% weakening in the Chilean Peso against the US Dollar would have an equal but opposite effect to the amounts shown above, on<br />

the basis that all other variables remain constant.<br />

(b) Cash flow interest rate risk<br />

The group’s cash flow interest rate risk arises from cash and cash equivalents and variable rate borrowings. The group is not exposed to<br />

fair value interest rate risk as the group does not have any fixed interest bearing financial instruments carried at fair value.<br />

The group manages interest rate risk by entering into short and long term debt instruments with a combination of fixed and variable<br />

interest rates. It also uses floating-to-fixed interest rate swaps and interest rate cross currency swaps to hedge its foreign currency and<br />

interest rate cash flow risk. At 30 June 2010, the following derivative financial instruments were in place:<br />

SISA interest<br />

rate swap<br />

SIL interest<br />

rate swap<br />

SFIR interest<br />

rate cross<br />

currency swaps<br />

Notional amount R644 million R1 285 million US$120 million<br />

Fixed rate 9.22% 9.71%<br />

Fixed rate expiry date 1 September 2010 30 September 2010<br />

Variable rate 63% of prime 67% of prime Linked to USD Libor<br />

Fixed exchange rates (Chilean Pesos to US Dollar) 526 – 591<br />

Fair value liability at 30 June R9 million R19 million R4 million<br />

Transfer of loss from hedging reserve to interest expense R13 million R24 million R10 million<br />

Transfer of profit from hedging reserve to foreign<br />

exchange profits – – R40 million<br />

The period of when the cash flows are expected to occur and impact on profit and loss is the same as those set out for the derivatives in<br />

the maturity analysis.<br />

The interest rate characteristics of new and refinanced debt instruments are restructured according to expected movements in interest<br />

rates (refer note 24).