2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

5.2.4 UNISSUED AUTHORIZED CAPITAL<br />

5.2.4.1 OVERALL AUTHORIZATIONS<br />

The General Meeting of S hareholders of May 2, <strong>2007</strong> gave the Board of<br />

Directors an authorization for a maximum period of 26 months to proceed at<br />

its own discretion with miscellaneous fi nancial transactions to increase the<br />

company’s share capital, with or without preferential rights.<br />

At this writing, these authorizations have not been used.<br />

RENAULT AND ITS SHAREHOLDERS 05<br />

GENERAL INFORMATION ABOUT RENAULT’S SHARE CAPITAL<br />

5.2.4.2 EXTRAORDINARY GENERAL<br />

MEETING, MAY 2, <strong>2007</strong><br />

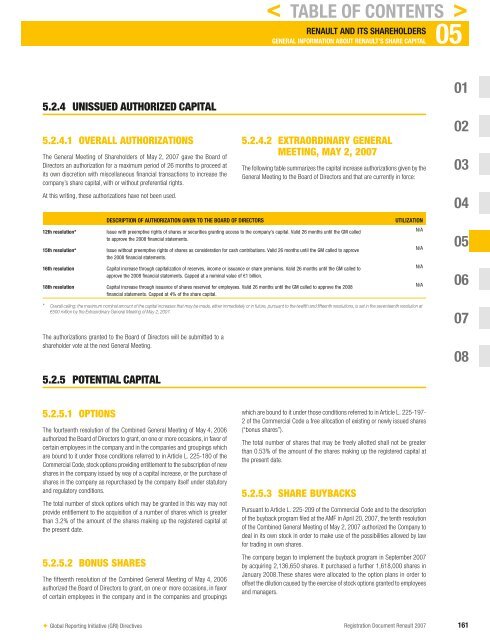

The following table summarizes the capital increase authorizations given by the<br />

General Meeting to the Board of Directors and that are currently in force:<br />

DESCRIPTION OF AUTHORIZATION GIVEN TO THE BOARD OF DIRECTORS UTILIZATION<br />

12th resolution* Issue with preemptive rights of shares or securities granting access to the company’s capital. Valid 26 months until the GM called<br />

to approve the 2008 financial statements.<br />

15th resolution* Issue without preemptive rights of shares as consideration for cash contributions. Valid 26 months until the GM called to approve<br />

the 2008 financial statements.<br />

16th resolution Capital increase through capitalization of reserves, income or issuance or share premiums. Valid 26 months until the GM called to<br />

approve the 2008 financial statements. Capped at a nominal value of €1 billion.<br />

18th resolution Capital increase through issuance of shares reserved for employees. Valid 26 months until the GM called to approve the 2008<br />

financial statements. Capped at 4% of the share capital.<br />

* Overall ceiling: the maximum nominal amount of the capital increases that may be made, either immediately or in future, pursuant to the twelfth and fifteenth resolutions, is set in the seventeenth resolution at<br />

€500 million by the Extraordinary General Meeting of May 2, <strong>2007</strong>.<br />

The authorizations granted to the Board of Directors will be submitted to a<br />

shareholder vote at the next General Meeting.<br />

5.2.5 POTENTIAL CAPITAL<br />

5.2.5.1 OPTIONS<br />

The fourteenth resolution of the Combined General Meeting of May 4, 2006<br />

authorized the Board of Directors to grant, on one or more occasions, in favor of<br />

certain employees in the company and in the companies and groupings which<br />

are bound to it under those conditions referred to in Article L. 225-180 of the<br />

Commercial Code, stock options providing entitlement to the subscription of new<br />

shares in the company issued by way of a capital increase, or the purchase of<br />

shares in the company as repurchased by the company itself under statutory<br />

and regulatory conditions.<br />

The total number of stock options which may be granted in this way may not<br />

provide entitlement to the acquisition of a number of shares which is greater<br />

than 3.2% of the amount of the shares making up the registered capital at<br />

the present date.<br />

5.2.5.2 BONUS SHARES<br />

The fi fteenth resolution of the Combined General Meeting of May 4, 2006<br />

authorized the Board of Directors to grant, on one or more occasions, in favor<br />

of certain employees in the company and in the companies and groupings<br />

< TABLE OF CONTENTS ><br />

which are bound to it under those conditions referred to in Article L. 225-197-<br />

2 of the Commercial Code a free allocation of existing or newly issued shares<br />

(“bonus shares”).<br />

The total number of shares that may be freely allotted shall not be greater<br />

than 0.53% of the amount of the shares making up the registered capital at<br />

the present date.<br />

5.2.5.3 SHARE BUYBACKS<br />

Pursuant to Article L. 225-209 of the Commercial Code and to the description<br />

of the buyback program fi led at the AMF in April 20, <strong>2007</strong>, the tenth resolution<br />

of the Combined General Meeting of May 2, <strong>2007</strong> authorized the Company to<br />

deal in its own stock in order to make use of the possibilities allowed by law<br />

for trading in own shares.<br />

The company began to implement the buyback program in September <strong>2007</strong><br />

by acquiring 2,136,650 shares. It purchased a further 1,618,000 shares in<br />

January 2008.These shares were allocated to the option plans in order to<br />

offset the dilution caused by the exercise of stock options granted to employees<br />

and managers.<br />

✦ Global Reporting Initiative (GRI) Directives <strong>Registration</strong> <strong>Document</strong> <strong>Renault</strong> <strong>2007</strong> 161<br />

N/A<br />

N/A<br />

N/A<br />

N/A<br />

01<br />

02<br />

03<br />

04<br />

05<br />

06<br />

07<br />

08