2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

07 CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

FINANCIAL STATEMENTS<br />

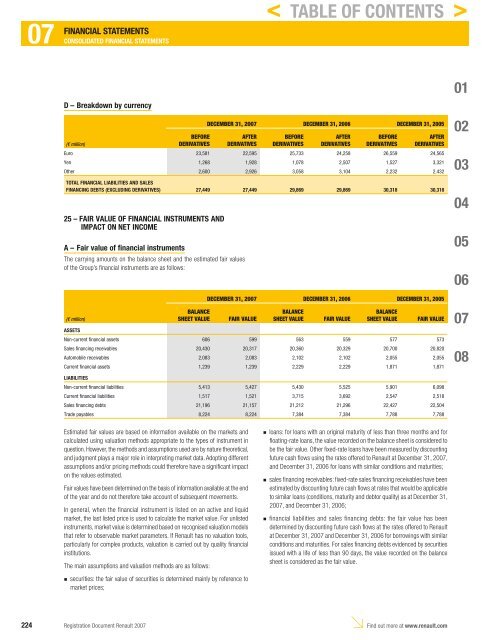

D – Breakdown by currency<br />

DECEMBER 31, <strong>2007</strong> DECEMBER 31, 2006 DECEMBER 31, 2005<br />

BEFORE<br />

AFTER BEFORE<br />

AFTER BEFORE<br />

AFTER<br />

(€ million)<br />

DERIVATIVES DERIVATIVES DERIVATIVES DERIVATIVES DERIVATIVES DERIVATIVES<br />

Euro 23,581 22,595 25,733 24,258 26,559 24,565<br />

Yen 1,268 1,928 1,078 2,507 1,527 3,321<br />

Other 2,600 2,926 3,058 3,104 2,232 2,432<br />

TOTAL FINANCIAL LIABILITIES AND SALES<br />

FINANCING DEBTS (EXCLUDING DERIVATIVES) 27,449 27,449 29,869 29,869 30,318 30,318<br />

25 – FAIR VALUE OF FINANCIAL INSTRUMENTS AND<br />

IMPACT ON NET INCOME<br />

A – Fair value of financial instruments<br />

The carrying amounts on the balance sheet and the estimated fair values<br />

of the Group’s fi nancial instruments are as follows:<br />

(€ million)<br />

Estimated fair values are based on information available on the markets and<br />

calculated using valuation methods appropriate to the types of instrument in<br />

question. However, the methods and assumptions used are by nature theoretical,<br />

and judgment plays a major role in interpreting market data. Adopting different<br />

assumptions and/or pricing methods could therefore have a signifi cant impact<br />

on the values estimated.<br />

Fair values have been determined on the basis of information available at the end<br />

of the year and do not therefore take account of subsequent movements.<br />

In general, when the fi nancial instrument is listed on an active and liquid<br />

market, the last listed price is used to calculate the market value. For unlisted<br />

instruments, market value is determined based on recognised valuation models<br />

that refer to observable market parameters. If <strong>Renault</strong> has no valuation tools,<br />

particularly for complex products, valuation is carried out by quality fi nancial<br />

institutions.<br />

The main assumptions and valuation methods are as follows:<br />

n securities : the fair value of securities is determined mainly by reference to<br />

market prices;<br />

DECEMBER 31, <strong>2007</strong> DECEMBER 31, 2006 DECEMBER 31, 2005<br />

BALANCE<br />

SHEET VALUE FAIR VALUE<br />

loans: for loans with an original maturity of less than three months and for<br />

fl oating-rate loans, the value recorded on the balance sheet is considered to<br />

be the fair value. Other fi xed-rate loans have been measured by discounting<br />

future cash fl ows using the rates offered to <strong>Renault</strong> at December 31, <strong>2007</strong>,<br />

and December 31, 2006 for loans with similar conditions and maturities;<br />

sales fi nancing receivables: fi xed-rate sales fi nancing receivables have been<br />

estimated by discounting future cash fl ows at rates that would be applicable<br />

to similar loans (conditions, maturity and debtor quality) as at December 31,<br />

<strong>2007</strong>, and December 31, 2006;<br />

financial liabilities and sales financing debts: the fair value has been<br />

determined by discounting future cash fl ows at the rates offered to <strong>Renault</strong><br />

at December 31, <strong>2007</strong> and December 31, 2006 for borrowings with similar<br />

conditions and maturities. For sales fi nancing debts evidenced by securities<br />

issued with a life of less than 90 days, the value recorded on the balance<br />

sheet is considered as the fair value.<br />

224 <strong>Registration</strong> <strong>Document</strong> <strong>Renault</strong> <strong>2007</strong><br />

Find out more at www.renault.com<br />

n<br />

n<br />

n<br />

< TABLE OF CONTENTS ><br />

BALANCE<br />

SHEET VALUE FAIR VALUE<br />

BALANCE<br />

SHEET VALUE FAIR VALUE<br />

ASSETS<br />

Non-current financial assets 606 599 563 559 577 573<br />

Sales financing receivables 20,430 20,317 20,360 20,329 20,700 20,820<br />

Automobile receivables 2,083 2,083 2,102 2,102 2,055 2,055<br />

Current financial assets 1,239 1,239 2,229 2,229 1,871 1,871<br />

LIABILITIES<br />

Non-current financial liabilities 5,413 5,427 5,430 5,525 5,901 6,098<br />

Current financial liabilities 1,517 1,521 3,715 3,692 2,547 2,518<br />

Sales financing debts 21,196 21,157 21,212 21,296 22,427 22,504<br />

Trade payables 8,224 8,224 7,384 7,384 7,788 7,788<br />

01<br />

02<br />

03<br />

04<br />

05<br />

06<br />

07<br />

08