2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

07 CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

FINANCIAL STATEMENTS<br />

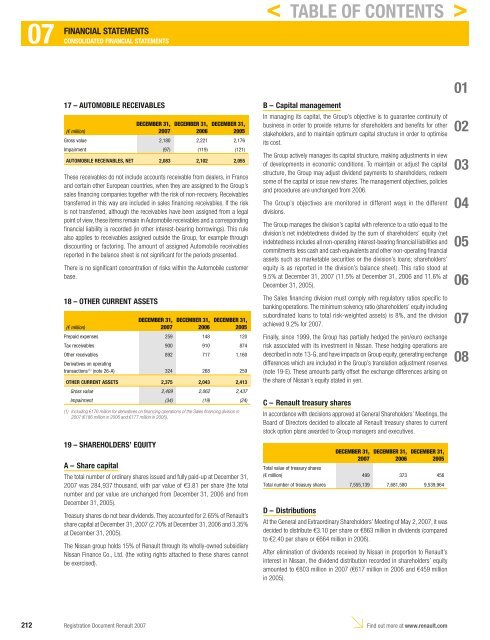

17 – AUTOMOBILE RECEIVABLES<br />

DECEMBER 31, DECEMBER 31, DECEMBER 31,<br />

(€ million)<br />

<strong>2007</strong> 2006 2005<br />

Gross value 2,180 2,221 2,176<br />

Impairment (97) (119) (121)<br />

AUTOMOBILE RECEIVABLES, NET 2,083 2,102 2,055<br />

These receivables do not include accounts receivable from dealers, in France<br />

and certain other European countries, when they are assigned to the Group’s<br />

sales fi nancing companies together with the risk of non-recovery. Receivables<br />

transferred in this way are included in sales fi nancing receivables. If the risk<br />

is not transferred, although the receivables have been assigned from a legal<br />

point of view, these items remain in Automobile receivables and a corresponding<br />

fi nancial liability is recorded (in other interest-bearing borrowings). This rule<br />

also applies to receivables assigned outside the Group, for example through<br />

discounting or factoring. The amount of assigned Automobile receivables<br />

reported in the balance sheet is not signifi cant for the periods presented.<br />

There is no signifi cant concentration of risks within the Automobile customer<br />

base.<br />

18 – OTHER CURRENT ASSETS<br />

DECEMBER 31, DECEMBER 31, DECEMBER 31,<br />

(€ million)<br />

<strong>2007</strong> 2006 2005<br />

Prepaid expenses 259 148 120<br />

Tax receivables 900 910 874<br />

Other receivables<br />

Derivatives on operating<br />

892 717 1,160<br />

transactions (1) (note 26-A) 324 268 259<br />

OTHER CURRENT ASSETS 2,375 2,043 2,413<br />

Gross value 2,409 2,062 2,437<br />

Impairment (34) (19) (24)<br />

(1) Including €176 million for derivatives on financing operations of the Sales financing division in<br />

<strong>2007</strong> (€186 million in 2006 and €177 million in 2005).<br />

19 – SHAREHOLDERS’ E QUITY<br />

A – Share capital<br />

The total number of ordinary shares issued and fully paid-up at December 31,<br />

<strong>2007</strong> was 284,937 thousand, with par value of €3.81 per share (the total<br />

number and par value are unchanged from December 31, 2006 and from<br />

December 31, 2005).<br />

Treasury shares do not bear dividends. They accounted for 2.65% of <strong>Renault</strong>’s<br />

share capital at December 31, <strong>2007</strong> (2.70% at December 31, 2006 and 3.35%<br />

at December 31, 2005).<br />

The Nissan group holds 15% of <strong>Renault</strong> through its wholly-owned subsidiary<br />

Nissan Finance Co., Ltd. (the voting rights attached to these shares cannot<br />

be exercised).<br />

< TABLE OF CONTENTS ><br />

B – Capital management<br />

In managing its capital, the Group’s objective is to guarantee continuity of<br />

business in order to provide returns for shareholders and benefi ts for other<br />

stakeholders, and to maintain optimum capital structure in order to optimise<br />

its cost.<br />

The Group actively manages its capital structure, making adjustments in view<br />

of developments in economic conditions. To maintain or adjust the capital<br />

structure, the Group may adjust dividend payments to shareholders, redeem<br />

some of the capital or issue new shares. The management objectives, policies<br />

and procedures are unchanged from 2006.<br />

The Group’s objectives are monitored in different ways in the different<br />

divisions.<br />

The Group manages the division’s capital with reference to a ratio equal to the<br />

division’s net indebtedness divided by the sum of shareholders’ equity (net<br />

indebtedness includes all non-operating interest-bearing fi nancial liabilities and<br />

commitments less cash and cash equivalents and other non-operating fi nancial<br />

assets such as marketable securities or the division’s loans; shareholders’<br />

equity is as reported in the division’s balance sheet). This ratio stood at<br />

9.5% at December 31, <strong>2007</strong> (11.5% at December 31, 2006 and 11.6% at<br />

December 31, 2005).<br />

The Sales fi nancing division must comply with regulatory ratios specifi c to<br />

banking operations. The minimum solvency ratio (shareholders’ equity including<br />

subordinated loans to total risk-weighted assets) is 8%, and the division<br />

achieved 9.2% for <strong>2007</strong>.<br />

Finally, since 1999, the Group has partially hedged the yen/euro exchange<br />

risk associated with its investment in Nissan. These hedging operations are<br />

described in note 13-G, and have impacts on Group equity, generating exchange<br />

differences which are included in the Group’s translation adjustment reserves<br />

(note 19-E). These amounts partly offset the exchange differences arising on<br />

the share of Nissan’s equity stated in yen.<br />

C – <strong>Renault</strong> treasury shares<br />

In accordance with decisions approved at General Shareholders’ Meetings, the<br />

Board of Directors decided to allocate all <strong>Renault</strong> treasury shares to current<br />

stock option plans awarded to Group managers and executives.<br />

DECEMBER 31,<br />

<strong>2007</strong><br />

DECEMBER 31,<br />

2006<br />

DECEMBER 31,<br />

2005<br />

Total value of treasury shares<br />

(€ million) 499 373 456<br />

Total number of treasury shares 7,555,139 7,681,580 9,539,964<br />

D – Distributions<br />

At the General and Extraordinary Shareholders’ Meeting of May 2, <strong>2007</strong>, it was<br />

decided to distribute €3.10 per share or €863 million in dividends (compared<br />

to €2.40 per share or €664 million in 2006).<br />

After elimination of dividends received by Nissan in proportion to <strong>Renault</strong>’s<br />

interest in Nissan, the dividend distribution recorded in shareholders’ equity<br />

amounted to €803 million in <strong>2007</strong> (€617 million in 2006 and €459 million<br />

in 2005).<br />

212 <strong>Registration</strong> <strong>Document</strong> <strong>Renault</strong> <strong>2007</strong><br />

Find out more at www.renault.com<br />

01<br />

02<br />

03<br />

04<br />

05<br />

06<br />

07<br />

08