2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Renault</strong> Finance also trades for its own account in interest-rate instruments<br />

within strictly defi ned risk limits. These positions are monitored and marked<br />

to market in real time. This activity carries very little risk and has no material<br />

impact on the Group’s results.<br />

Sales Financing<br />

The <strong>Renault</strong> group’s exposure to interest rate risk is concentrated mainly in the<br />

Sales Financing business of RCI Banque and its subsidiaries.<br />

Interest rate risk is monitored on a daily basis by measuring sensitivity for each<br />

currency, management entity and asset portfolio. The entire RCI Banque group<br />

uses a single set of methods to ensure that interest rate risk is measured in a<br />

standard manner across the entire scope of consolidation.<br />

The portfolio of commercial assets is monitored daily on the basis of sensitivity<br />

and is hedged systematically. Each subsidiary aims to hedge its entire interest<br />

rate risk in order to protect its trading margin. However, a slight degree of latitude<br />

is permitted in risk hedging, refl ecting the diffi culty of adjusting the borrowing<br />

structure to exactly match the structure of customer loans.<br />

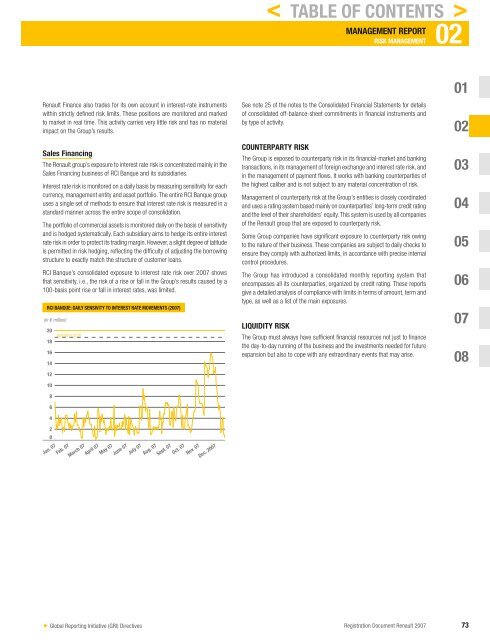

RCI Banque’s consolidated exposure to interest rate risk over <strong>2007</strong> shows<br />

that sensitivity, i.e., the risk of a rise or fall in the Group’s results caused by a<br />

100-basis point rise or fall in interest rates, was limited.<br />

RCI BANQUE: DAILY SENSIVITY TO INTEREST RATE MOVEMENTS (<strong>2007</strong>)<br />

20<br />

18<br />

16<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

✦ Global Reporting Initiative (GRI) Directives<br />

< TABLE OF CONTENTS ><br />

MANAGEMENT REPORT 02<br />

RISK MANAGEMENT<br />

See note 25 of the notes to the C onsolidated F inancial S tatements for details<br />

of consolidated off-balance-sheet commitments in fi nancial instruments and<br />

by type of activity.<br />

COUNTERPARTY RISK<br />

The Group is exposed to counterparty risk in its fi nancial-market and banking<br />

transactions, in its management of foreign exchange and interest rate risk, and<br />

in the management of payment fl ows. It works with banking counterparties of<br />

the highest caliber and is not subject to any material concentration of risk.<br />

Management of counterparty risk at the Group’s entities is closely coordinated<br />

and uses a rating system based mainly on counterparties’ long-term credit rating<br />

and the level of their shareholders’ equity. This system is used by all companies<br />

of the <strong>Renault</strong> group that are exposed to counterparty risk.<br />

Some Group companies have signifi cant exposure to counterparty risk owing<br />

to the nature of their business. These companies are subject to daily checks to<br />

ensure they comply with authorized limits, in accordance with precise internal<br />

control procedures.<br />

The Group has introduced a consolidated monthly reporting system that<br />

encompasses all its counterparties, organized by credit rating. These reports<br />

give a detailed analysis of compliance with limits in terms of amount, term and<br />

type, as well as a list of the main exposures.<br />

LIQUIDITY RISK<br />

The Group must always have suffi cient fi nancial resources not just to fi nance<br />

the day-to-day running of the business and the investments needed for future<br />

expansion but also to cope with any extraordinary events that may arise.<br />

01<br />

02<br />

03<br />

04<br />

05<br />

06<br />

07<br />

08<br />

<strong>Registration</strong> <strong>Document</strong> <strong>Renault</strong> <strong>2007</strong> 73