2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

07 CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

FINANCIAL STATEMENTS<br />

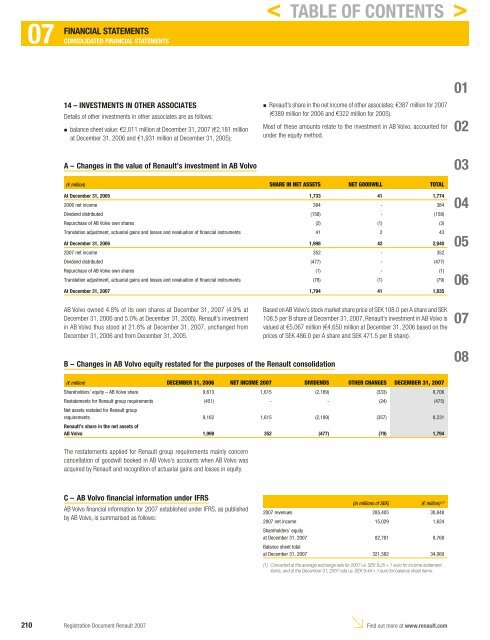

14 – INVESTMENTS IN OTHER ASSOCIATES<br />

Details of other investments in other associates are as follows:<br />

n balance sheet value: €2,011 million at December 31, <strong>2007</strong> (€2,181 million<br />

at December 31, 2006 and €1,931 million at December 31, 2005);<br />

A – Changes in the value of <strong>Renault</strong>’s investment in AB Volvo<br />

<strong>Renault</strong>’s share in the net income of other associates: €387 million for <strong>2007</strong><br />

(€389 million for 2006 and €322 million for 2005).<br />

Most of these amounts relate to the investment in AB Volvo, accounted for<br />

under the equity method.<br />

(€ million) SHARE IN NET ASSETS NET GOODWILL TOTAL<br />

At December 31, 2005 1,733 41 1,774<br />

2006 net income 384 - 384<br />

Dividend distributed (158) - (158)<br />

Repurchase of AB Volvo own shares (2) (1) (3)<br />

Translation adjustment, actuarial gains and losses and revaluation of financial instruments 41 2 43<br />

At December 31, 2006 1,998 42 2,040<br />

<strong>2007</strong> net income 352 - 352<br />

Dividend distributed (477) - (477)<br />

Repurchase of AB Volvo own shares (1) - (1)<br />

Translation adjustment, actuarial gains and losses and revaluation of financial instruments (78) (1) (79)<br />

At December 31, <strong>2007</strong> 1,794 41 1,835<br />

AB Volvo owned 4.8% of its own shares at December 31, <strong>2007</strong> (4.9% at<br />

December 31, 2006 and 5.0% at December 31, 2005). <strong>Renault</strong>’s investment<br />

in AB Volvo thus stood at 21.8% at December 31, <strong>2007</strong>, unchanged from<br />

December 31, 2006 and from December 31, 2005.<br />

B – Changes in AB Volvo equity restated for the purposes of the <strong>Renault</strong> consolidation<br />

210 <strong>Registration</strong> <strong>Document</strong> <strong>Renault</strong> <strong>2007</strong><br />

Find out more at www.renault.com<br />

n<br />

Based on AB Volvo’s stock market share price of SEK 108.0 per A share and SEK<br />

108.5 per B share at December 31, <strong>2007</strong>, <strong>Renault</strong>’s investment in AB Volvo is<br />

valued at €5,067 million (€4,650 million at December 31, 2006 based on the<br />

prices of SEK 486.0 per A share and SEK 471.5 per B share).<br />

(€ million) DECEMBER 31, 2006 NET INCOME <strong>2007</strong> DIVIDENDS OTHER CHANGES DECEMBER 31, <strong>2007</strong><br />

Shareholders’ equity – AB Volvo share 9,613 1,615 (2,189) (333) 8,706<br />

Restatements for <strong>Renault</strong> group requirements<br />

Net assets restated for <strong>Renault</strong> group<br />

(451) - - (24) (475)<br />

requirements<br />

<strong>Renault</strong>’s share in the net assets of<br />

9,162 1,615 (2,189) (357) 8,231<br />

AB Volvo 1,998 352 (477) (79) 1,794<br />

The restatements applied for <strong>Renault</strong> group requirements mainly concern<br />

cancellation of goodwill booked in AB Volvo’s accounts when AB Volvo was<br />

acquired by <strong>Renault</strong> and recognition of actuarial gains and losses in equity.<br />

C – AB Volvo financial information under IFRS<br />

AB Volvo fi nancial information for <strong>2007</strong> established under IFRS, as published<br />

by AB Volvo, is summarised as follows:<br />

< TABLE OF CONTENTS ><br />

(in millions of SEK) (€ million) (1)<br />

<strong>2007</strong> revenues 285,405 30,848<br />

<strong>2007</strong> net income<br />

Shareholders’ equity<br />

15,029 1,624<br />

at December 31, <strong>2007</strong><br />

Balance sheet total<br />

82,781 8,768<br />

at December 31, <strong>2007</strong> 321,582 34,060<br />

(1) Converted at the average exchange rate for <strong>2007</strong> i.e. SEK 9.25 = 1 euro for income statement<br />

items, and at the December 31, <strong>2007</strong> rate i.e. SEK 9.44 = 1 euro for balance sheet items.<br />

01<br />

02<br />

03<br />

04<br />

05<br />

06<br />

07<br />

08