2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

A dividend distribution of €3.80 per share, i.e. a total of €1,054 million, will be<br />

proposed at the General and Extraordinary Shareholders’ Meeting of April 29,<br />

2008.<br />

The <strong>Renault</strong> Commitment 2009 growth plan has set a target dividend of<br />

€4.50 per share for 2009.<br />

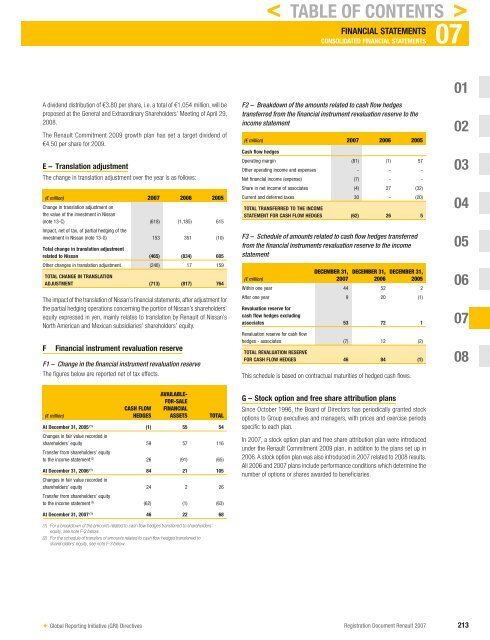

E – Translation adjustment<br />

The change in translation adjustment over the year is as follows:<br />

(€ million)<br />

Change in translation adjustment on<br />

the value of the investment in Nissan<br />

<strong>2007</strong> 2006 2005<br />

(note 13-C)<br />

Impact, net of tax, of partial hedging of the<br />

(618) (1,185) 615<br />

investment in Nissan (note 13-G) 153 351 (10)<br />

Total change in translation adjustment<br />

related to Nissan (465) (834) 605<br />

Other changes in translation adjustment (248) 17 159<br />

TOTAL CHANGE IN TRANSLATION<br />

ADJUSTMENT (713) (817) 764<br />

The impact of the translation of Nissan’s fi nancial statements, after adjustment for<br />

the partial hedging operations concerning the portion of Nissan’s shareholders’<br />

equity expressed in yen, mainly relates to translation by <strong>Renault</strong> of Nissan’s<br />

North American and Mexican subsidiaries’ shareholders’ equity.<br />

F Financial instrument revaluation reserve<br />

F1 – Change in the financial instrument revaluation reserve<br />

The fi gures below are reported net of tax effects.<br />

(€ million)<br />

CASH FLOW<br />

HEDGES<br />

✦ Global Reporting Initiative (GRI) Directives<br />

AVAILABLE-<br />

FOR-SALE<br />

FINANCIAL<br />

ASSETS TOTAL<br />

At December 31, 2005 (1 ) Changes in fair value recorded in<br />

(1) 55 54<br />

shareholders’ equity<br />

Transfer from shareholders’ equity<br />

59 57 116<br />

to the income statement (2 ) 26 (91) (65)<br />

At December 31, 2006 (1 ) Changes in fair value recorded in<br />

84 21 105<br />

shareholders’ equity<br />

Transfer from shareholders’ equity<br />

24 2 26<br />

to the income statement (2 ) (62) (1) (63)<br />

At December 31, <strong>2007</strong> (1 ) 46 22 68<br />

(1) For a breakdown of the amounts related to cash flow hedges transferred to shareholders’<br />

equity, see note F-2 below.<br />

(2) For the schedule of transfers of amounts related to cash flow hedges transferred to<br />

shareholders’ equity, see note F-3 below.<br />

< TABLE OF CONTENTS ><br />

FINANCIAL STATEMENTS 07<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

F2 – Breakdown of the amounts related to cash flow hedges<br />

transferred from the financial instrument revaluation reserve to the<br />

income statement<br />

(€ million) <strong>2007</strong> 2006 2005<br />

Cash flow hedges<br />

Operating margin (81) (1) 57<br />

Other operating income and expenses - - -<br />

Net financial income (expense) (7) - -<br />

Share in net income of associates (4) 27 (32)<br />

Current and deferred taxes 30 - (20)<br />

TOTAL TRANSFERRED TO THE INCOME<br />

STATEMENT FOR CASH FLOW HEDGES (62) 26 5<br />

F3 – Schedule of amounts related to cash flow hedges transferred<br />

from the financial instruments revaluation reserve to the income<br />

statement<br />

DECEMBER 31, DECEMBER 31, DECEMBER 31,<br />

(€ million)<br />

<strong>2007</strong> 2006 2005<br />

Within one year 44 52 2<br />

After one year 9 20 (1)<br />

Revaluation reserve for<br />

cash flow hedges excluding<br />

associates 53 72 1<br />

Revaluation reserve for cash flow<br />

hedges - associates (7) 12 (2)<br />

TOTAL REVALUATION RESERVE<br />

FOR CASH FLOW HEDGES 46 84 (1)<br />

This schedule is based on contractual maturities of hedged cash fl ows.<br />

G – Stock option and free share attribution plans<br />

Since October 1996, the Board of Directors has periodically granted stock<br />

options to Group executives and managers, with prices and exercise periods<br />

specifi c to each plan.<br />

In <strong>2007</strong>, a stock option plan and free share attribution plan were introduced<br />

under the <strong>Renault</strong> Commitment 2009 plan, in addition to the plans set up in<br />

2006. A stock option plan was also introduced in <strong>2007</strong> related to 2008 results.<br />

All 2006 and <strong>2007</strong> plans include performance conditions which determine the<br />

number of options or shares awarded to benefi ciaries.<br />

01<br />

02<br />

03<br />

04<br />

05<br />

06<br />

07<br />

08<br />

<strong>Registration</strong> <strong>Document</strong> <strong>Renault</strong> <strong>2007</strong> 213