2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

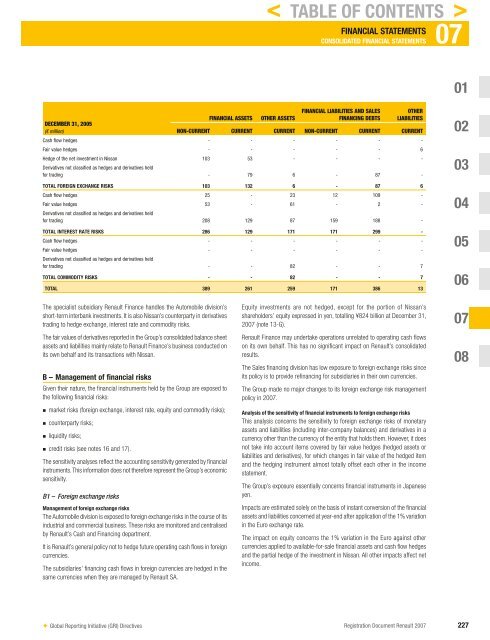

DECEMBER 31, 2005<br />

(€ million)<br />

✦ Global Reporting Initiative (GRI) Directives<br />

FINANCIAL ASSETS OTHER ASSETS<br />

FINANCIAL STATEMENTS 07<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

FINANCIAL LIABILITIES AND SALES<br />

FINANCING DEBTS<br />

OTHER<br />

LIABILITIES<br />

NON-CURRENT CURRENT CURRENT NON-CURRENT CURRENT CURRENT<br />

Cash flow hedges - - - - - -<br />

Fair value hedges - - - - - 6<br />

Hedge of the net investment in Nissan<br />

Derivatives not classified as hedges and derivatives held<br />

103 53 - - - -<br />

for trading - 79 6 - 87 -<br />

TOTAL FOREIGN EXCHANGE RISKS 103 132 6 - 87 6<br />

Cash flow hedges 25 - 23 12 109 -<br />

Fair value hedges<br />

Derivatives not classified as hedges and derivatives held<br />

53 - 61 - 2 -<br />

for trading 208 129 87 159 188 -<br />

TOTAL INTEREST RATE RISKS 286 129 171 171 299 -<br />

Cash flow hedges - - - - - -<br />

Fair value hedges<br />

Derivatives not classified as hedges and derivatives held<br />

- - - - - -<br />

for trading - - 82 - - 7<br />

TOTAL COMMODITY RISKS - - 82 - - 7<br />

TOTAL 389 261 259 171 386 13<br />

The specialist subsidiary <strong>Renault</strong> Finance handles the Automobile division’s<br />

short-term interbank investments. It is also Nissan’s counterparty in derivatives<br />

trading to hedge exchange, interest rate and commodity risks.<br />

The fair values of derivatives reported in the Group’s consolidated balance sheet<br />

assets and liabilities mainly relate to <strong>Renault</strong> Finance’s business conducted on<br />

its own behalf and its transactions with Nissan.<br />

B – Management of financial risks<br />

Given their nature, the fi nancial instruments held by the Group are exposed to<br />

the following fi nancial risks:<br />

n<br />

n<br />

n<br />

n<br />

market risks (foreign exchange, interest rate, equity and commodity risks);<br />

counterparty risks;<br />

liquidity risks;<br />

credit risks (see notes 16 and 17).<br />

The sensitivity analyses refl ect the accounting sensitivity generated by fi nancial<br />

instruments. This information does not therefore represent the Group’s economic<br />

sensitivity.<br />

B1 – Foreign exchange risks<br />

Management of foreign exchange risks<br />

The Automobile division is exposed to foreign exchange risks in the course of its<br />

industrial and commercial business. These risks are monitored and centralised<br />

by <strong>Renault</strong>’s Cash and Financing department.<br />

It is <strong>Renault</strong>’s general policy not to hedge future operating cash fl ows in foreign<br />

currencies.<br />

The s ubsidiaries’ fi nancing cash fl ows in foreign currencies are hedged in the<br />

same currencies when they are managed by <strong>Renault</strong> SA.<br />

< TABLE OF CONTENTS ><br />

Equity investments are not hedged, except for the portion of Nissan’s<br />

shareholders’ equity expressed in yen, totalling ¥824 billion at December 31,<br />

<strong>2007</strong> (note 13-G).<br />

<strong>Renault</strong> Finance m ay undertake operations unrelated to operating cash fl ows<br />

on its own behalf. This has no signifi cant impact on <strong>Renault</strong>’s consolidated<br />

results.<br />

The Sales fi nancing division has low exposure to foreign exchange risks since<br />

its policy is to provide refi nancing for subsidiaries in their own currencies.<br />

The Group made no major changes to its foreign exchange risk management<br />

policy in <strong>2007</strong>.<br />

Analysis of the sensitivity of financial instruments to foreign exchange risks<br />

This analysis concerns the sensitivity to foreign exchange risks of monetary<br />

assets and liabilities (including inter-company balances) and derivatives in a<br />

currency other than the currency of the entity that holds them. However, it does<br />

not take into account items covered by fair value hedges (hedged assets or<br />

liabilities and derivatives), for which changes in fair value of the hedged item<br />

and the hedging instrument almost totally offset each other in the income<br />

statement.<br />

The Group’s exposure essentially concerns fi nancial instruments in Japanese<br />

yen.<br />

Impacts are estimated solely on the basis of instant conversion of the fi nancial<br />

assets and liabilities concerned at year-end after application of the 1% variation<br />

in the Euro exchange rate.<br />

The impact on equity concerns the 1% variation in the Euro against other<br />

currencies applied to available-for-sale fi nancial assets and cash fl ow hedges<br />

and the partial hedge of the investment in Nissan. All other impacts affect net<br />

income.<br />

01<br />

02<br />

03<br />

04<br />

05<br />

06<br />

07<br />

08<br />

<strong>Registration</strong> <strong>Document</strong> <strong>Renault</strong> <strong>2007</strong> 227