2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

07 CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

FINANCIAL STATEMENTS<br />

<strong>Renault</strong> Argentina<br />

<strong>Renault</strong> Argentina SA manages a savings plan called Plan Rombo SA, designed<br />

to enable savers’ groups to acquire vehicles. The savers make monthly<br />

contributions to the plan and a vehicle is delivered at the end of a given period.<br />

At December 31, <strong>2007</strong>, Plan Rombo SA had approximately 500 savers’ groups<br />

on its books. <strong>Renault</strong> Argentina SA and Plan Rombo SA are jointly responsible<br />

to subscribers for the correct operation of the plan. <strong>Renault</strong>’s corresponding<br />

off-balance sheet commitment amounts to 82 million Argentinean pesos at<br />

December 31, <strong>2007</strong> (€18 million).<br />

Other commitments<br />

Disposals of subsidiaries or businesses by the Group generally include<br />

representations and warranties in the buyer’s favour. At December 31, <strong>2007</strong>,<br />

<strong>Renault</strong> had not identified any significant risks in connection with these<br />

operations.<br />

Following partial sales of subsidiaries during previous years, <strong>Renault</strong> retains<br />

options to sell all or a portion of its residual investment. Exercising these<br />

options would not have any signifi cant impact on the consolidated fi nancial<br />

statements.<br />

Under the agreement signed in April 2003, when <strong>Renault</strong> sold a 51% stake<br />

in <strong>Renault</strong> Agriculture to Claas, after Claas exercised its option to acquire a<br />

further 29% in February 2006, <strong>Renault</strong> and Claas now hold a sale and purchase<br />

option respectively for the remaining 20%, which may be exercised from<br />

January 1, 2010.<br />

The agreement signed in March <strong>2007</strong> by <strong>Renault</strong> and the Japanese group<br />

NTN for the sale of 35% of SNR also provides for a fi rm future purchase by<br />

NTN of a further 16% in SNR on the fi rst anniversary of the sale. In addition,<br />

<strong>Renault</strong> and NTN respectively hold a sale and purchase option concerning 29%<br />

of SNR, which can be exercised during a 60-day period starting on the 3 rd and<br />

4 th anniversary dates of the original transaction. From the 5 th anniversary date,<br />

<strong>Renault</strong> has a unilateral option to sell its residual 20% investment in SNR, valid<br />

for fi ve years. If this option is not exercised by the end of the fi ve-year period,<br />

NTN will have a purchase option on the residual investment.<br />

Group companies are periodically subject to tax inspections in the countries<br />

in which they operate. Tax adjustments are recorded as provisions in the<br />

fi nancial statements. Contested tax adjustments are recognised on a caseby-case<br />

basis, taking into account the risk that the proceedings or appeal m ay<br />

be unsuccessful.<br />

< TABLE OF CONTENTS ><br />

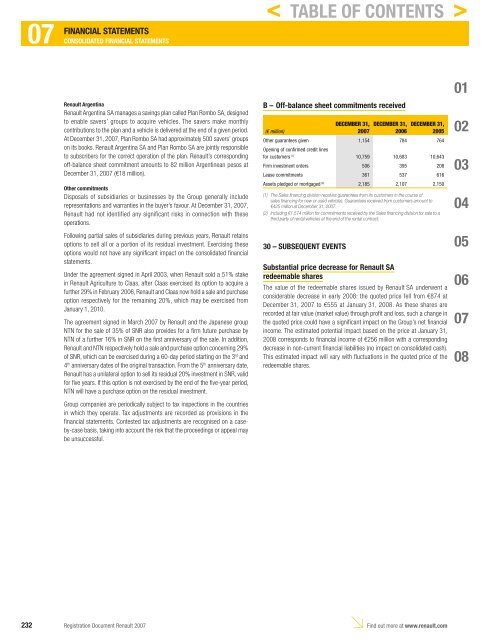

B – Off-balance sheet commitments received<br />

DECEMBER 31, DECEMBER 31, DECEMBER 31,<br />

(€ million)<br />

<strong>2007</strong> 2006 2005<br />

Other guarantees given<br />

Opening of confirmed credit lines<br />

1,154 784 764<br />

for customers (1) 10,759 10,683 10,643<br />

Firm investment orders 506 395 208<br />

Lease commitments 361 537 616<br />

Assets pledged or mortgaged (2) 2,185 2,107 2,150<br />

(1) The Sales financing division receives guarantees from its customers in the course of<br />

sales financing for new or used vehicles. Guarantees received from customers amount to<br />

€425 million at December 31, <strong>2007</strong>.<br />

(2) Including €1,574 million for commitments received by the Sales financing division for sale to a<br />

third party of rental vehicles at the end of the rental contract.<br />

30 – SUBSEQUENT EVENTS<br />

Substantial price decrease for <strong>Renault</strong> SA<br />

redeemable shares<br />

The value of the redeemable shares issued by <strong>Renault</strong> SA underwent a<br />

considerable decrease in early 2008: the quoted price fell from €874 at<br />

December 31, <strong>2007</strong> to €555 at January 31, 2008. As these shares are<br />

recorded at fair value (market value) through profi t and loss, such a change in<br />

the quoted price could have a signifi cant impact on the Group’s net fi nancial<br />

income. The estimated potential impact based on the price at January 31,<br />

2008 corresponds to fi nancial income of €256 million with a corresponding<br />

decrease in non-current fi nancial liabilities (no impact on consolidated cash).<br />

This estimated impact will vary with fl uctuations in the quoted price of the<br />

redeemable shares.<br />

232 <strong>Registration</strong> <strong>Document</strong> <strong>Renault</strong> <strong>2007</strong><br />

Find out more at www.renault.com<br />

01<br />

02<br />

03<br />

04<br />

05<br />

06<br />

07<br />

08