2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

07 CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

FINANCIAL STATEMENTS<br />

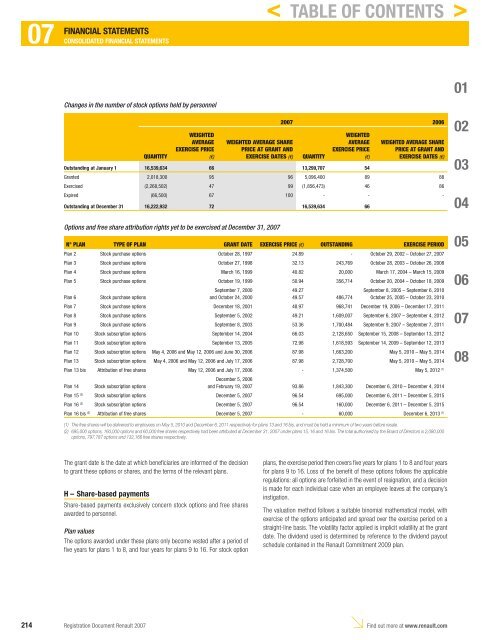

Changes in the number of stock options held by personnel<br />

QUANTITY<br />

WEIGHTED<br />

AVERAGE<br />

EXERCISE PRICE<br />

(€)<br />

WEIGHTED AVERAGE SHARE<br />

PRICE AT GRANT AND<br />

EXERCISE DATES (€) QUANTITY<br />

<strong>2007</strong> 2006<br />

WEIGHTED<br />

AVERAGE<br />

EXERCISE PRICE<br />

(€)<br />

WEIGHTED AVERAGE SHARE<br />

PRICE AT GRANT AND<br />

EXERCISE DATES (€)<br />

Outstanding at January 1 16,539,634 66 13,299,707 54<br />

Granted 2,018,300 95 96 5,096,400 89 88<br />

Exercised (2,268,502) 47 99 (1,856,473) 46 86<br />

Expired (66,500) 67 100 - - -<br />

Outstanding at December 31 16,222,932 72 16,539,634 66<br />

Options and free share attribution rights yet to be exercised at December 31, <strong>2007</strong><br />

N° PLAN TYPE OF PLAN GRANT DATE EXERCISE PRICE (€) OUTSTANDING EXERCISE PERIOD<br />

Plan 2 Stock purchase options October 28, 1997 24. 89 - October 29, 2002 – October 27, <strong>2007</strong><br />

Plan 3 Stock purchase options October 27, 1998 32. 13 243,769 October 28, 2003 – October 26, 2008<br />

Plan 4 Stock purchase options March 16, 1999 40. 82 20,000 March 17, 2004 – March 15, 2009<br />

Plan 5 Stock purchase options October 19, 1999 50. 94 356,714 October 20, 2004 – October 18, 2009<br />

September 7, 2000<br />

49. 27<br />

September 8, 2005 – September 6, 2010<br />

Plan 6 Stock purchase options<br />

and October 24, 2000<br />

49. 57 486,774 October 25, 2005 – October 23, 2010<br />

Plan 7 Stock purchase options December 18, 2001 48. 97 968,741 December 19, 2006 – December 17, 2011<br />

Plan 8 Stock purchase options September 5, 2002 49. 21 1,609,007 September 6, <strong>2007</strong> – September 4, 2012<br />

Plan 9 Stock purchase options September 8, 2003 53. 36 1,700,484 September 9, <strong>2007</strong> – September 7, 2011<br />

Plan 10 Stock subscription options September 14, 2004 66. 03 2,128,650 September 15, 2008 – September 13, 2012<br />

Plan 11 Stock subscription options September 13, 2005 72. 98 1,618,593 September 14, 2009 – September 12, 2013<br />

Plan 12 Stock subscription options May 4, 2006 and May 12, 2006 and June 30, 2006 87. 98 1,663,200 May 5, 2010 – May 5, 2014<br />

Plan 13 Stock subscription options May 4, 2006 and May 12, 2006 and July 17, 2006 87. 98 2,728,700 May 5, 2010 – May 5, 2014<br />

Plan 13 bis Attribution of free shares May 12, 2006 and July 17, 2006 - 1,374 ,5 00 May 5, 2012 (1)<br />

December 5, 2006<br />

Plan 14 Stock subscription options<br />

and February 19, <strong>2007</strong> 93. 86 1,843,300 December 6, 2010 – December 4, 2014<br />

Plan 15 (2) Stock subscription options December 5, <strong>2007</strong> 96. 54 695,000 December 6, 2011 – December 5, 2015<br />

Plan 16 (2) Stock subscription options December 5, <strong>2007</strong> 96. 54 160,000 December 6, 2011 – December 5, 2015<br />

Plan 16 bis (2) Attribution of free shares December 5, <strong>2007</strong> - 60,000 December 6, 2013 (1)<br />

(1) The free shares will be delivered to employees on May 5, 2010 and December 6, 2011 respectively for plans 13 and 16 bis, and must be held a minimum of two years before resale.<br />

(2) 695,000 options, 160,000 options and 60,000 free shares respectively had been attributed at December 31, <strong>2007</strong> under plans 15, 16 and 16 bis. The total authorised by the Board of Directors is 2,080,000<br />

options, 797,787 options and 132,166 free shares respectively.<br />

The grant date is the date at which benefi ciaries are informed of the decision<br />

to grant these options or shares, and the terms of the relevant plans.<br />

H – Share-based payments<br />

Share-based payments exclusively concern stock options and free shares<br />

awarded to personnel.<br />

Plan values<br />

The options awarded under these plans only become vested after a period of<br />

fi ve years for plans 1 to 8, and four years for plans 9 to 16. For stock option<br />

< TABLE OF CONTENTS ><br />

plans, the exercise period then covers fi ve years for plans 1 to 8 and four years<br />

for plans 9 to 16. Loss of the benefi t of these options follows the applicable<br />

regulations: all options are forfeited in the event of resignation, and a decision<br />

is made for each individual case when an employee leaves at the company’s<br />

instigation.<br />

The valuation method follows a suitable binomial mathematical model, with<br />

exercise of the options anticipated and spread over the exercise period on a<br />

straight-line basis. The volatility factor applied is implicit volatility at the grant<br />

date. The dividend used is determined by reference to the dividend payout<br />

schedule contained in the <strong>Renault</strong> Commitment 2009 plan.<br />

214 <strong>Registration</strong> <strong>Document</strong> <strong>Renault</strong> <strong>2007</strong><br />

Find out more at www.renault.com<br />

01<br />

02<br />

03<br />

04<br />

05<br />

06<br />

07<br />

08