2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

07 RENAULT<br />

FINANCIAL STATEMENTS<br />

SA PARENT COMPANY FINANCIAL STATEMENTS<br />

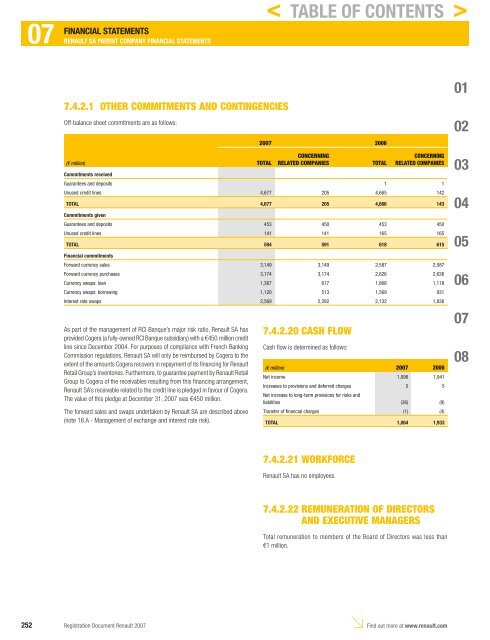

7.4.2.1 OTHER COMMITMENTS AND CONTINGENCIES<br />

Off-balance sheet commitments are as follows:<br />

(€ million) TOTAL<br />

<strong>2007</strong> 2006<br />

CONCERNING<br />

RELATED COMPANIES TOTAL<br />

CONCERNING<br />

RELATED COMPANIES<br />

Commitments received<br />

Guarantees and deposits 1 1<br />

Unused credit lines 4,677 205 4,665 142<br />

TOTAL 4,677 205 4,666 143<br />

Commitments given<br />

Guarantees and deposits 453 450 453 450<br />

Unused credit lines 141 141 165 165<br />

TOTAL 594 591 618 615<br />

Financial commitments<br />

Forward currency sales 3,149 3,149 2,587 2,587<br />

Forward currency purchases 3,174 3,174 2,626 2,626<br />

Currency swaps: loan 1,367 617 1,868 1,118<br />

Currency swaps: borrowing 1,120 513 1,569 931<br />

Interest rate swaps 2,569 2,282 2,132 1,836<br />

As part of the management of RCI Banque’s major risk ratio, <strong>Renault</strong> SA has<br />

provided Cogera (a fully-owned RCI Banque subsidiary) with a €450 million credit<br />

line since December 2004. For purposes of compliance with French Banking<br />

Commission regulations, <strong>Renault</strong> SA will only be reimbursed by Cogera to the<br />

extent of the amounts Cogera recovers in repayment of its fi nancing for <strong>Renault</strong><br />

Retail Group’s inventories. Furthermore, to guarantee payment by <strong>Renault</strong> Retail<br />

Group to Cogera of the receivables resulting from this fi nancing arrangement,<br />

<strong>Renault</strong> SA’s receivable related to the credit line is pledged in favour of Cogera.<br />

The value of this pledge at December 31, <strong>2007</strong> was €450 million.<br />

The forward sales and swaps undertaken by <strong>Renault</strong> SA are described above<br />

(note 18.A - Management of exchange and interest rate risk).<br />

< TABLE OF CONTENTS ><br />

7.4.2.20 CASH FLOW<br />

Cash fl ow is determined as follows:<br />

(€ million) <strong>2007</strong> 2006<br />

Net income 1,096 1,941<br />

Increases to provisions and deferred charges<br />

Net increase to long-term provisions for risks and<br />

5 5<br />

liabilities (36) (9)<br />

Transfer of financial charges (1) (4)<br />

TOTAL 1,064 1,933<br />

7.4.2.21 WORKFORCE<br />

<strong>Renault</strong> SA has no employees.<br />

7.4.2.22 REMUNERATION OF DIRECTORS<br />

AND EXECUTIVE MANAGERS<br />

Total remuneration to members of the Board of Directors was less than<br />

€1 million.<br />

252 <strong>Registration</strong> <strong>Document</strong> <strong>Renault</strong> <strong>2007</strong><br />

Find out more at www.renault.com<br />

01<br />

02<br />

03<br />

04<br />

05<br />

06<br />

07<br />

08