2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

07 CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

FINANCIAL STATEMENTS<br />

For the Automobile division, the impact on shareholders’ equity (before taxes)<br />

of a 1% rise in the Euro against the main currencies, applied to fi nancial<br />

instruments exposed to foreign exchange risks, would be €48 million at<br />

December 31, <strong>2007</strong>. The impact on shareholders’ equity results mainly from<br />

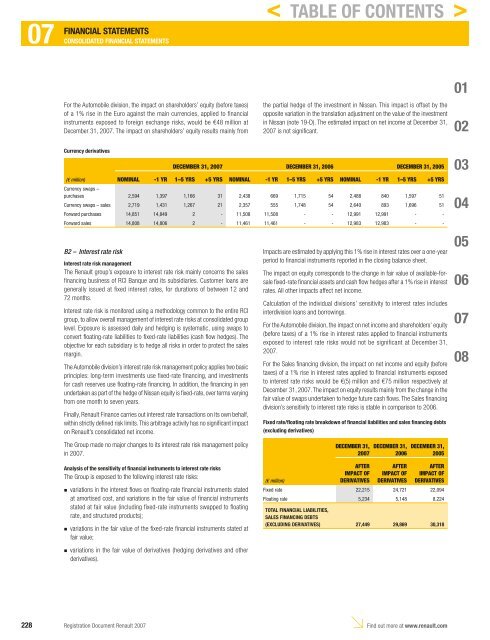

Currency derivatives<br />

(€ million)<br />

DECEMBER 31, <strong>2007</strong> DECEMBER 31, 2006 DECEMBER 31, 2005<br />

NOMINAL -1 YR 1–5 YRS +5 YRS NOMINAL -1 YR 1–5 YRS +5 YRS NOMINAL -1 YR 1–5 YRS +5 YRS<br />

Currency swaps –<br />

purchases 2,594 1,397 1,166 31 2,438 669 1,715 54 2,488 840 1,597 51<br />

Currency swaps – sales 2,719 1,431 1,267 21 2,357 555 1,748 54 2,640 893 1,696 51<br />

Forward purchases 14,851 14,849 2 - 11,508 11,508 - - 12,991 12,991 - -<br />

Forward sales 14,808 14,806 2 - 11,461 11,461 - - 12,983 12,983 - -<br />

B2 – Interest rate risk<br />

Interest rate risk management<br />

The <strong>Renault</strong> group’s exposure to interest rate risk mainly concerns the sales<br />

fi nancing business of RCI Banque and its subsidiaries. Customer loans are<br />

generally issued at fi xed interest rates, for durations of between 12 and<br />

72 months.<br />

Interest rate risk is monitored using a methodology common to the entire RCI<br />

group, to allow overall management of interest rate risks at consolidated group<br />

level. Exposure is assessed daily and hedging is systematic, using swaps to<br />

convert fl oating-rate liabilities to fi xed-rate liabilities (cash fl ow hedges). The<br />

objective for each subsidiary is to hedge all risks in order to protect the sales<br />

margin.<br />

The Automobile division’s interest rate risk management policy applies two basic<br />

principles: long-term investments use fi xed-rate fi nancing, and investments<br />

for cash reserves use fl oating-rate fi nancing. In addition, the fi nancing in yen<br />

undertaken as part of the hedge of Nissan equity is fi xed-rate, over terms varying<br />

from one month to seven years.<br />

Finally, <strong>Renault</strong> Finance carries out interest rate transactions on its own behalf,<br />

within strictly defi ned risk limits. This arbitrage activity has no signifi cant impact<br />

on <strong>Renault</strong>’s consolidated net income.<br />

The Group made no major changes to its interest rate risk management policy<br />

in <strong>2007</strong>.<br />

Analysis of the sensitivity of financial instruments to interest rate risks<br />

The Group is exposed to the following interest rate risks:<br />

n<br />

n<br />

n<br />

variations in the interest fl ows on fl oating-rate fi nancial instruments stated<br />

at amortised cost, and variations in the fair value of fi nancial instruments<br />

stated at fair value (including fi xed-rate instruments swapped to fl oating<br />

rate, and structured products);<br />

variations in the fair value of the fi xed-rate fi nancial instruments stated at<br />

fair value;<br />

variations in the fair value of derivatives (hedging derivatives and other<br />

derivatives).<br />

< TABLE OF CONTENTS ><br />

the partial hedge of the investment in Nissan. This impact is offset by the<br />

opposite variation in the translation adjustment on the value of the investment<br />

in Nissan (note 19-D). The estimated impact on net income at December 31,<br />

<strong>2007</strong> is not signifi cant.<br />

Impacts are estimated by applying this 1% rise in interest rates over a one-year<br />

period to fi nancial instruments reported in the closing balance sheet.<br />

The impact on equity corresponds to the change in fair value of available-forsale<br />

fi xed-rate fi nancial assets and cash fl ow hedges after a 1% rise in interest<br />

rates. All other impacts affect net income.<br />

Calculation of the individual divisions’ sensitivity to interest rates includes<br />

interdivision loans and borrowings.<br />

For the Automobile division, the impact on net income and shareholders’ equity<br />

(before taxes) of a 1% rise in interest rates applied to fi nancial instruments<br />

exposed to interest rate risks would not be significant at December 31,<br />

<strong>2007</strong>.<br />

For the Sales fi nancing division, the impact on net income and equity (before<br />

taxes) of a 1% rise in interest rates applied to fi nancial instruments exposed<br />

to interest rate risks would be €(5) million and €75 million respectively at<br />

December 31, <strong>2007</strong>. The impact on equity results mainly from the change in the<br />

fair value of swaps undertaken to hedge future cash fl ows. The Sales fi nancing<br />

division’s sensitivity to interest rate risks is stable in comparison to 2006.<br />

Fixed rate/floating rate breakdown of financial liabilities and sales financing debts<br />

(excluding derivatives)<br />

DECEMBER 31,<br />

<strong>2007</strong><br />

DECEMBER 31,<br />

2006<br />

DECEMBER 31,<br />

2005<br />

AFTER AFTER AFTER<br />

IMPACT OF IMPACT OF IMPACT OF<br />

(€ million)<br />

DERIVATIVES DERIVATIVES DERIVATIVES<br />

Fixed rate 22,215 24,721 22,094<br />

Floating rate 5,234 5,148 8,224<br />

TOTAL FINANCIAL LIABILITIES,<br />

SALES FINANCING DEBTS<br />

(EXCLUDING DERIVATIVES) 27,449 29,869 30,318<br />

228 <strong>Registration</strong> <strong>Document</strong> <strong>Renault</strong> <strong>2007</strong><br />

Find out more at www.renault.com<br />

01<br />

02<br />

03<br />

04<br />

05<br />

06<br />

07<br />

08