2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

02 RISK<br />

MANAGEMENT REPORT<br />

MANAGEMENT<br />

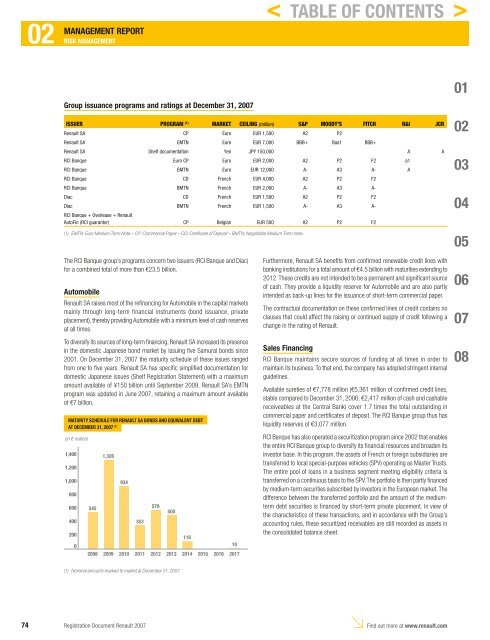

Group issuance programs and ratings at December 31, <strong>2007</strong><br />

ISSUER PROGRAM (1) MARKET CEILING (million) S&P MOODY’S FITCH R&I JCR<br />

<strong>Renault</strong> SA CP Euro EUR 1,500 A2 P2<br />

<strong>Renault</strong> SA EMTN Euro EUR 7,000 BBB+ Baa1 BBB+<br />

<strong>Renault</strong> SA Shelf documentation Yen JPY 150,000 A A<br />

RCI Banque Euro CP Euro EUR 2,000 A2 P2 F2 a1<br />

RCI Banque EMTN Euro EUR 12,000 A- A3 A- A<br />

RCI Banque CD French EUR 4,000 A2 P2 F2<br />

RCI Banque BMTN French EUR 2,000 A- A3 A-<br />

Diac CD French EUR 1,500 A2 P2 F2<br />

Diac<br />

RCI Banque + Overlease + <strong>Renault</strong><br />

BMTN French EUR 1,500 A- A3 A-<br />

AutoFin (RCI guarantor ) CP Belgian EUR 500 A2 P2 F2<br />

(1) EMTN: Euro Medium Term Note – CP: Commercial Paper – CD: Certificate of Deposit – BMTN: Negotiable Medium Term Note.<br />

The RCI Banque group’s programs concern two issuers (RCI Banque and Diac)<br />

for a combined total of more than €23.5 billion.<br />

Automobile<br />

<strong>Renault</strong> SA raises most of the refi nancing for Automobile in the capital markets<br />

mainly through long-term financial instruments (bond issuance, private<br />

placement), thereby providing Automobile with a minimum level of cash reserves<br />

at all times.<br />

To diversify its sources of long-term fi nancing, <strong>Renault</strong> SA increased its presence<br />

in the domestic Japanese bond market by issuing fi ve Samurai bonds since<br />

2001. On December 31, <strong>2007</strong> the maturity schedule of these issues ranged<br />

from one to fi ve years. <strong>Renault</strong> SA has specifi c simplifi ed documentation for<br />

domestic Japanese issues (Shelf <strong>Registration</strong> Statement) with a maximum<br />

amount available of ¥150 billion until September 2009. <strong>Renault</strong> SA’s EMTN<br />

program was updated in June <strong>2007</strong>, retaining a maximum amount available<br />

of €7 billion.<br />

MATURITY SCHEDULE FOR RENAULT SA BONDS AND EQUIVALENT DEBT<br />

AT DECEMBER 31, <strong>2007</strong> (1)<br />

1,400<br />

1,200<br />

1,000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

(1) Nominal amounts marked to market at December 31, <strong>2007</strong>.<br />

< TABLE OF CONTENTS ><br />

Furthermore, <strong>Renault</strong> SA benefi ts from confi rmed renewable credit lines with<br />

banking institutions for a total amount of €4.5 billion with maturities extending to<br />

2012. These credits are not intended to be a permanent and signifi cant source<br />

of cash. They provide a liquidity reserve for Automobile and are also partly<br />

intended as back-up lines for the issuance of short-term commercial paper.<br />

The contractual documentation on these confi rmed lines of credit contains no<br />

clauses that could affect the raising or continued supply of credit following a<br />

change in the rating of <strong>Renault</strong>.<br />

Sales Financing<br />

RCI Banque maintains secure sources of funding at all times in order to<br />

maintain its business. To that end, the company has adopted stringent internal<br />

guidelines.<br />

Available sureties of €7,778 million (€5,361 million of confi rmed credit lines,<br />

stable compared to December 31, 2006; €2,417 million of cash and cashable<br />

receiveables at the Central Bank) cover 1.7 times the total outstanding in<br />

commercial paper and certifi cates of deposit. The RCI Banque group thus has<br />

liquidity reserves of €3,077 million.<br />

RCI Banque has also operated a securitization program since 2002 that enables<br />

the entire RCI Banque group to diversify its fi nancial resources and broaden its<br />

investor base. In this program, the assets of French or foreign subsidiaries are<br />

transferred to local special-purpose vehicles (SPV) operating as Master Trusts.<br />

The entire pool of loans in a business segment meeting eligibility criteria is<br />

transferred on a continuous basis to the SPV. The portfolio is then partly fi nanced<br />

by medium-term securities subscribed by investors in the European market. The<br />

difference between the transferred portfolio and the amount of the mediumterm<br />

debt securities is fi nanced by short-term private placement. In view of<br />

the characteristics of these transactions, and in accordance with the Group’s<br />

accounting rules, these securitized receivables are still recorded as assets in<br />

the consolidated balance sheet.<br />

74 <strong>Registration</strong> <strong>Document</strong> <strong>Renault</strong> <strong>2007</strong><br />

Find out more at www.renault.com<br />

01<br />

02<br />

03<br />

04<br />

05<br />

06<br />

07<br />

08