2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Renegotiations of the terms of borrowings and similar operations are recorded<br />

as an extinction of the former liability with recognition of a new liability only if<br />

there are substantial differences between the old and new terms. When this is<br />

the case, the costs borne for renegotiation are included in the fi nancial expenses<br />

for the period during which the negotiation takes place.<br />

V – Derivatives and hedge accounting<br />

Measurement and presentation<br />

Derivatives are initially recognised at fair value. This fair value is subsequently<br />

reviewed at each closing date.<br />

n<br />

n<br />

n<br />

The fair value of forward exchange contracts is based on market conditions.<br />

The fair value of currency swaps is determined by discounting future cash<br />

fl ows, using closing-date market rates (exchange and interest rates);<br />

The fair value of interest rate derivatives is the amount the Group would<br />

receive (or pay) to settle outstanding contracts at the closing date, taking into<br />

account any unrealised gains or losses based on current interest rates and<br />

the quality of the counterparty to each contract at the closing date.<br />

This fair value includes accrued interest;<br />

The fair value of commodity derivatives is based on market conditions.<br />

The Automobile division’s derivatives are reported in the balance sheet as<br />

current if they mature within 12 months and non-current otherwise. All Sales<br />

fi nancing division derivatives are reported in the balance sheet as current.<br />

Hedge accounting<br />

The treatment of derivatives designated as hedging instruments depends on<br />

the type of hedging relationship:<br />

n<br />

n<br />

n<br />

fair value hedge;<br />

cash fl ow hedge;<br />

hedge of a net investment in a foreign operation.<br />

The Group identifi es the hedging instrument and the hedged item as soon<br />

as the hedge is set up, and documents the hedging relationship, stating the<br />

hedging strategy, the risk hedged and the method used to assess the hedge’s<br />

effectiveness. This documentation is subsequently updated, such that the<br />

effectiveness of the designated hedge can be demonstrated.<br />

Hedge accounting uses specifi c measurement and recognition methods for<br />

each category of hedge.<br />

n<br />

n<br />

Fair value hedges: the hedged item is adjusted to fair value in view of the risk<br />

hedged and the hedging instrument is recorded at fair value. As changes in<br />

these items are recorded in the income statement simultaneously, only the<br />

ineffective portion of the hedge has an impact on net income. It is recorded in<br />

the same income statement item as changes in the fair value of the hedged<br />

item and the hedging instrument.<br />

Cash fl ow hedges: no adjustment is made to the value of the hedged<br />

item; only the hedging instrument is adjusted to fair value. Following this<br />

adjustment, the effective portion of the change in fair value attributable to the<br />

hedged risk is recorded, net of taxes, in equity, while the ineffective portion<br />

is included in the income statement. The cumulative amount included in<br />

✦ Global Reporting Initiative (GRI) Directives<br />

n<br />

FINANCIAL STATEMENTS 07<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

equity is transferred to the income statement when the hedged item has an<br />

impact on net income.<br />

Hedge of a net investment in a foreign operation: the hedging instrument is<br />

adjusted to fair value. Following this adjustment, the effective portion of the<br />

change in fair value attributable to the hedged exchange risk is recorded,<br />

net of taxes, in equity, while the ineffective portion is included in the income<br />

statement. The cumulative amount included in equity is transferred to<br />

the income statement at the date of liquidation or sale of the investment.<br />

The interest rate component of fi nancial instruments used to hedge the<br />

investment in Nissan (forward sales and fi xed/fi xed c ross c urrency s waps)<br />

is treated as an ineffective portion and consequently recorded directly in<br />

fi nancial income and expenses.<br />

Derivatives not designated as hedges<br />

Changes in the fair value of derivatives not designated as hedges are recognised<br />

directly in fi nancial income, except in the case of derivatives entered into<br />

exclusively for reasons closely related to business operations. In this case,<br />

changes in the fair value of derivatives are included in the operating margin.<br />

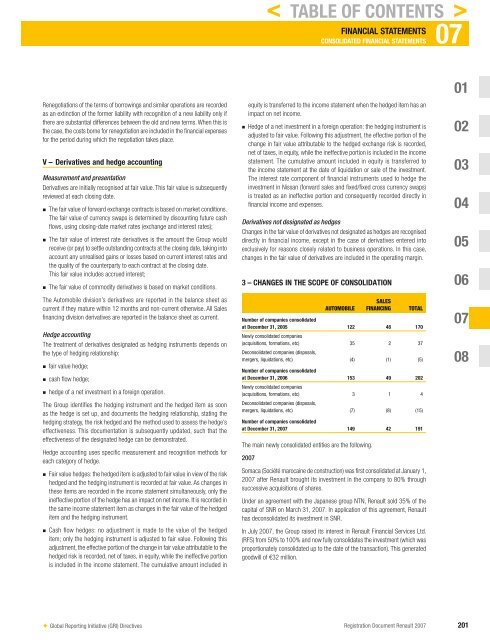

3 – CHANGES IN THE SCOPE OF CONSOLIDATION<br />

AUTOMOBILE<br />

SALES<br />

FINANCING TOTAL<br />

Number of companies consolidated<br />

at December 31, 2005<br />

Newly consolidated companies<br />

122 48 170<br />

(acquisitions, formations, etc)<br />

Deconsolidated companies (disposals,<br />

35 2 37<br />

mergers, liquidations, etc) (4) (1) (5)<br />

Number of companies consolidated<br />

at December 31, 2006<br />

Newly consolidated companies<br />

153 49 202<br />

(acquisitions, formations, etc)<br />

Deconsolidated companies (disposals,<br />

3 1 4<br />

mergers, liquidations, etc) (7) (8) (15)<br />

Number of companies consolidated<br />

at December 31, <strong>2007</strong> 149 42 191<br />

The main newly consolidated entities are the following.<br />

<strong>2007</strong><br />

< TABLE OF CONTENTS ><br />

Somaca (Société marocaine de construction) was fi rst consolidated at January 1,<br />

<strong>2007</strong> after <strong>Renault</strong> brought its investment in the company to 80% through<br />

successive acquisitions of shares.<br />

Under an agreement with the Japanese group NTN, <strong>Renault</strong> sold 35% of the<br />

capital of SNR on March 31, <strong>2007</strong>. In application of this agreement, <strong>Renault</strong><br />

has deconsolidated its investment in SNR.<br />

In July <strong>2007</strong>, the Group raised its interest in <strong>Renault</strong> Financial Services Ltd.<br />

(RFS) from 50% to 100% and now fully consolidates the investment (which was<br />

proportionately consolidated up to the date of the transaction). This generated<br />

goodwill of €32 million.<br />

01<br />

02<br />

03<br />

04<br />

05<br />

06<br />

07<br />

08<br />

<strong>Registration</strong> <strong>Document</strong> <strong>Renault</strong> <strong>2007</strong> 201