2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

In April <strong>2007</strong>, in addition to an ordinary dividend of SEK 25 per share, a superdividend<br />

was paid out. Volvo made a six-for-one stock split with one share<br />

being automatically redeemed at SEK 25. <strong>Renault</strong> thus received €477 million<br />

in dividends in <strong>2007</strong>.<br />

RENAULT AND THE GROUP 01<br />

PRESENTATION OF RENAULT AND THE GROUP<br />

A dividend of SEK 5.5 per share for <strong>2007</strong> will be submitted for the approval of<br />

the next General Meeting.<br />

In <strong>2007</strong>, Volvo’s contribution to <strong>Renault</strong>’s net income was €352 million,<br />

compared with €384 million in 2006 (see c hapter 7, note 14 in the notes to<br />

the Consolidated Financial Statements).<br />

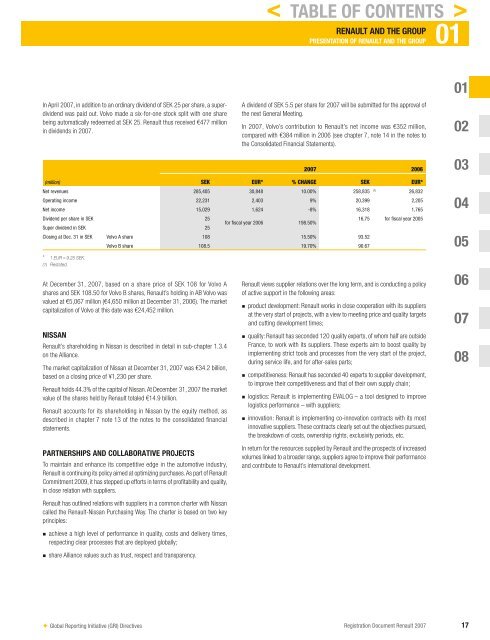

<strong>2007</strong> 2006<br />

(million) SEK EUR* % CHANGE SEK EUR*<br />

Net revenues 285,405 30,848 10.00% 258,835 (1) 26,832<br />

Operating income 22,231 2,403 9% 20,399 2,205<br />

Net income 15,029 1,624 -8% 16,318 1,765<br />

Dividend per share in SEK<br />

Super dividend in SEK<br />

25<br />

25<br />

for fiscal year 2006<br />

198.50%<br />

16,75 for fiscal year 2005<br />

Closing at Dec. 31 in SEK Volvo A share 108 15.50% 93.52<br />

Volvo B share 108.5 19.70% 90.67<br />

* 1 EUR = 9.25 SEK.<br />

(1) R estated.<br />

At December 31, <strong>2007</strong>, based on a share price of SEK 108 for Volvo A<br />

shares and SEK 108.50 for Volvo B shares, <strong>Renault</strong>’s holding in AB Volvo was<br />

valued at €5,067 million (€4,650 million at December 31, 2006). The market<br />

capitalization of Volvo at this date was €24,452 million.<br />

NISSAN<br />

<strong>Renault</strong>’s shareholding in Nissan is described in detail in sub-c hapter 1.3.4<br />

on the Alliance.<br />

The market capitalization of Nissan at December 31, <strong>2007</strong> was €34.2 billion,<br />

based on a closing price of ¥1,230 per share.<br />

<strong>Renault</strong> holds 44.3% of the capital of Nissan. At December 31, <strong>2007</strong> the market<br />

value of the shares held by <strong>Renault</strong> totaled €14.9 billion.<br />

<strong>Renault</strong> accounts for its shareholding in Nissan by the equity method, as<br />

described in c hapter 7 note 13 of the notes to the consolidated fi nancial<br />

statements.<br />

PARTNERSHIPS AND COLLABORATIVE PROJECTS<br />

To maintain and enhance its competitive edge in the automotive industry,<br />

<strong>Renault</strong> is continuing its policy aimed at optimizing purchases. As part of <strong>Renault</strong><br />

Commitment 2009, it has stepped up efforts in terms of profi tability and quality,<br />

in close relation with suppliers.<br />

<strong>Renault</strong> has outlined relations with suppliers in a common charter with Nissan<br />

called the <strong>Renault</strong>-Nissan Purchasing Way. The charter is based on two key<br />

principles:<br />

n<br />

n<br />

achieve a high level of performance in quality, costs and delivery times,<br />

respecting clear processes that are deployed globally;<br />

share Alliance values such as trust, respect and transparency.<br />

<strong>Renault</strong> views supplier relations over the long term, and is conducting a policy<br />

of active support in the following areas:<br />

n<br />

n<br />

n<br />

n<br />

n<br />

< TABLE OF CONTENTS ><br />

product development: <strong>Renault</strong> works in close cooperation with its suppliers<br />

at the very start of projects, with a view to meeting price and quality targets<br />

and cutting development times;<br />

quality: <strong>Renault</strong> has seconded 120 quality experts, of whom half are outside<br />

France, to work with its suppliers. These experts aim to boost quality by<br />

implementing strict tools and processes from the very start of the project,<br />

during service life, and for after-sales parts;<br />

competitiveness: <strong>Renault</strong> has seconded 40 experts to supplier development,<br />

to improve their competitiveness and that of their own supply chain;<br />

logistics: <strong>Renault</strong> is implementing EVALOG – a tool designed to improve<br />

logistics performance – with suppliers;<br />

innovation: <strong>Renault</strong> is implementing co-innovation contracts with its most<br />

innovative suppliers. These contracts clearly set out the objectives pursued,<br />

the breakdown of costs, ownership rights, exclusivity periods, etc.<br />

In return for the resources supplied by <strong>Renault</strong> and the prospects of increased<br />

volumes linked to a broader range, suppliers agree to improve their performance<br />

and contribute to <strong>Renault</strong>’s international development.<br />

✦ Global Reporting Initiative (GRI) Directives <strong>Registration</strong> <strong>Document</strong> <strong>Renault</strong> <strong>2007</strong> 17<br />

01<br />

02<br />

03<br />

04<br />

05<br />

06<br />

07<br />

08