2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

07 CONSOLIDATED<br />

FINANCIAL STATEMENTS<br />

FINANCIAL STATEMENTS<br />

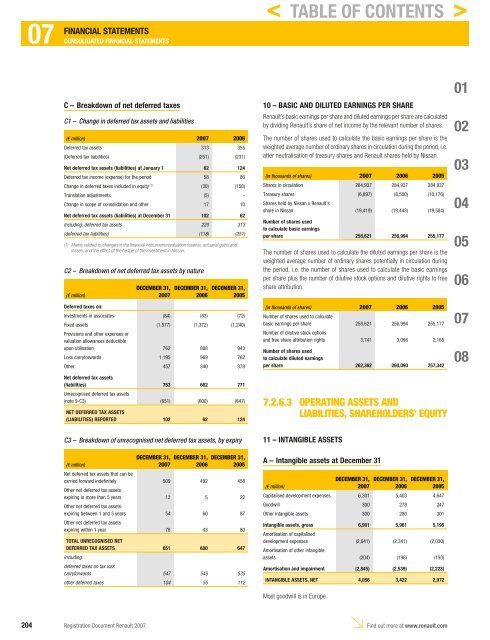

C – Breakdown of net deferred taxes<br />

C1 – Change in deferred tax assets and liabilities<br />

(€ million) <strong>2007</strong> 2006<br />

Deferred tax assets 313 355<br />

(Deferred tax liabilities) (251) (231)<br />

Net deferred tax assets (liabilities) at January 1 62 124<br />

Deferred tax income (expense) for the period 58 86<br />

Change in deferred taxes included in equity (1) (30) (158)<br />

Translation adjustments (5) -<br />

Change in scope of consolidation and other 17 10<br />

Net deferred tax assets (liabilities) at December 31 102 62<br />

Including: deferred tax assets 220 313<br />

(deferred tax liabilities) (118) (251)<br />

(1) Mainly related to changes in the financial instrument revaluation reserve, actuarial gains and<br />

losses, and the effect of the hedge of the investment in Nissan.<br />

C2 – Breakdown of net deferred tax assets by nature<br />

(€ million)<br />

DECEMBER 31,<br />

<strong>2007</strong><br />

DECEMBER 31,<br />

2006<br />

DECEMBER 31,<br />

2005<br />

Deferred taxes on:<br />

Investments in associates (84) (83) (72)<br />

Fixed assets<br />

Provisions and other expenses or<br />

valuation allowances deductible<br />

(1,577) (1,372) (1,240)<br />

upon utilisation 762 808 943<br />

Loss carryforwards 1,195 969 762<br />

Other 457 340 378<br />

Net deferred tax assets<br />

(liabilities)<br />

Unrecognised deferred tax assets<br />

753 662 771<br />

(note 9-C3) (651) (600) (647)<br />

NET DEFERRED TAX ASSETS<br />

(LIABILITIES) REPORTED 102 62 124<br />

C3 – Breakdown of unrecognised net deferred tax assets, by expiry<br />

DECEMBER 31, DECEMBER 31, DECEMBER 31,<br />

(€ million)<br />

Net deferred tax assets that can be<br />

<strong>2007</strong> 2006 2005<br />

carried forward indefinitely<br />

Other net deferred tax assets<br />

509 492 458<br />

expiring in more than 5 years<br />

Other net deferred tax assets<br />

12 5 22<br />

expiring between 1 and 5 years<br />

Other net deferred tax assets<br />

54 60 87<br />

expiring within 1 year 76 43 80<br />

TOTAL UNRECOGNISED NET<br />

DEFERRED TAX ASSETS<br />

Including:<br />

deferred taxes on tax loss<br />

651 600 647<br />

carryforwards 547 545 535<br />

other deferred taxes 104 55 112<br />

< TABLE OF CONTENTS ><br />

10 – BASIC AND DILUTED EARNINGS PER SHARE<br />

<strong>Renault</strong>’s basic earnings per share and diluted earnings per share are calculated<br />

by dividing <strong>Renault</strong>’s share of net income by the relevant number of shares.<br />

The number of shares used to calculate the basic earnings per share is the<br />

weighted average number of ordinary shares in circulation during the period, i.e.<br />

after neutralisation of treasury shares and <strong>Renault</strong> shares held by Nissan.<br />

(i n thousands of shares) <strong>2007</strong> 2006 2005<br />

Shares in circulation 284,937 284,937 284,937<br />

Treasury shares<br />

Shares held by Nissan x <strong>Renault</strong>’s<br />

(6,897) (8,500) (10,176)<br />

share in Nissan (19,419) (19,443) (19,584)<br />

Number of shares used<br />

to calculate basic earnings<br />

per share 258,621 256,994 255,177<br />

The number of shares used to calculate the diluted earnings per share is the<br />

weighted average number of ordinary shares potentially in circulation during<br />

the period, i.e. the number of shares used to calculate the basic earnings<br />

per share plus the number of dilutive stock options and dilutive rights to free<br />

share attribution.<br />

(i n thousands of shares)<br />

Number of shares used to calculate<br />

<strong>2007</strong> 2006 2005<br />

basic earnings per share<br />

Number of dilutive stock options<br />

258,621 256,994 255,177<br />

and free share attribution rights 3,741 3,096 2,165<br />

Number of shares used<br />

to calculate diluted earnings<br />

per share 262,362 260,090 257,342<br />

7.2.6.3 OPERATING ASSETS AND<br />

LIABILITIES, SHAREHOLDERS’ EQUITY<br />

11 – INTANGIBLE ASSETS<br />

A – Intangible assets at December 31<br />

DECEMBER 31, DECEMBER 31, DECEMBER 31,<br />

(€ million)<br />

<strong>2007</strong> 2006 2005<br />

Capitalised development expenses 6,301 5,403 4,647<br />

Goodwill 300 278 247<br />

Other intangible assets 300 280 301<br />

Intangible assets, gross<br />

Amortisation of capitalised<br />

6,901 5,961 5,195<br />

development expenses<br />

Amortisation of other intangible<br />

(2,641) (2,341) (2,030)<br />

assets (204) (198) (193)<br />

Amortisation and impairment (2,845) (2,539) (2,223)<br />

INTANGIBLE ASSETS, NET 4,056 3,422 2,972<br />

Most goodwill is in Europe.<br />

204 <strong>Registration</strong> <strong>Document</strong> <strong>Renault</strong> <strong>2007</strong><br />

Find out more at www.renault.com<br />

01<br />

02<br />

03<br />

04<br />

05<br />

06<br />

07<br />

08