2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

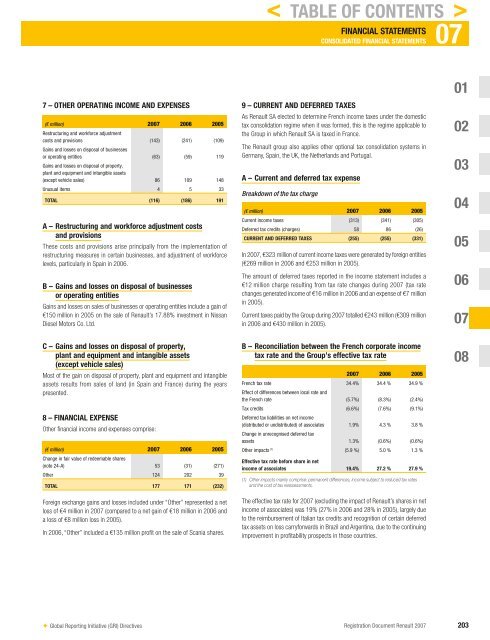

7 – OTHER OPERATING INCOME AND EXPENSES<br />

(€ million) <strong>2007</strong> 2006 2005<br />

Restructuring and workforce adjustment<br />

costs and provisions<br />

Gains and losses on disposal of businesses<br />

(143) (241) (109)<br />

or operating entities<br />

Gains and losses on disposal of property,<br />

plant and equipment and intangible assets<br />

(63) (59) 119<br />

(except vehicle sales) 86 109 148<br />

Unusual items 4 5 33<br />

TOTAL (116) (186) 191<br />

A – Restructuring and workforce adjustment costs<br />

and provisions<br />

These costs and provisions arise principally from the implementation of<br />

restructuring measures in certain businesses, and adjustment of workforce<br />

levels, particularly in Spain in 2006.<br />

B – Gains and losses on disposal of businesses<br />

or operating entities<br />

Gains and losses on sales of businesses or operating entities include a gain of<br />

€150 million in 2005 on the sale of <strong>Renault</strong>’s 17.88% investment in Nissan<br />

Diesel Motors Co. Ltd.<br />

C – Gains and losses on disposal of property,<br />

plant and equipment and intangible assets<br />

(except vehicle sales)<br />

Most of the gain on disposal of property, plant and equipment and intangible<br />

assets results from sales of land (in Spain and France) during the years<br />

presented.<br />

8 – FINANCIAL EXPENSE<br />

Other fi nancial income and expenses comprise:<br />

(€ million)<br />

Change in fair value of redeemable shares<br />

<strong>2007</strong> 2006 2005<br />

(note 24-A) 53 (31) (271)<br />

Other 124 202 39<br />

TOTAL 177 171 (232)<br />

Foreign exchange gains and losses included under “Other” represented a net<br />

loss of €4 million in <strong>2007</strong> (compared to a net gain of €18 million in 2006 and<br />

a loss of €8 million loss in 2005).<br />

In 2006, “Other” included a €135 million profi t on the sale of Scania shares.<br />

✦ Global Reporting Initiative (GRI) Directives<br />

< TABLE OF CONTENTS ><br />

FINANCIAL STATEMENTS 07<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

9 – CURRENT AND DEFERRED TAXES<br />

As <strong>Renault</strong> SA elected to determine French income taxes under the domestic<br />

tax consolidation regime when it was formed, this is the regime applicable to<br />

the Group in which <strong>Renault</strong> SA is taxed in France.<br />

The <strong>Renault</strong> group also applies other optional tax consolidation systems in<br />

Germany, Spain, the UK, the Netherlands and Portugal.<br />

A – Current and deferred tax expense<br />

Breakdown of the tax charge<br />

(€ million) <strong>2007</strong> 2006 2005<br />

Current income taxes (313) (341) (305)<br />

Deferred tax credits (charges) 58 86 (26)<br />

CURRENT AND DEFERRED TAXES (255) (255) (331)<br />

In <strong>2007</strong>, €323 million of current income taxes were generated by foreign entities<br />

(€269 million in 2006 and €253 million in 2005).<br />

The amount of deferred taxes reported in the income statement includes a<br />

€12 million charge resulting from tax rate changes during <strong>2007</strong> (tax rate<br />

changes generated income of €16 million in 2006 and an expense of €7 million<br />

in 2005).<br />

Current taxes paid by the Group during <strong>2007</strong> totalled €243 million (€309 million<br />

in 2006 and €430 million in 2005).<br />

B – Reconciliation between the French corporate income<br />

tax rate and the Group’s effective tax rate<br />

<strong>2007</strong> 2006 2005<br />

French tax rate<br />

Effect of differences between local rate and<br />

34.4% 34.4 % 34.9 %<br />

the French rate (5.7%) (8.3%) (2.4%)<br />

Tax credits<br />

Deferred tax liabilities on net income<br />

(6.6%) (7.6%) (9.1%)<br />

(distributed or undistributed) of associates<br />

Change in unrecognised deferred tax<br />

1.9% 4.3 % 3.8 %<br />

assets 1.3% (0.6%) (0.6%)<br />

Other impacts (1) (5.9 %) 5.0 % 1.3 %<br />

Effective tax rate before share in net<br />

income of associates 19.4% 27.2 % 27.9 %<br />

(1) Other impacts mainly comprise : permanent differences, income subject to reduced tax rates<br />

and the cost of tax reassessments.<br />

The effective tax rate for <strong>2007</strong> (excluding the impact of <strong>Renault</strong>’s shares in net<br />

income of associates) was 19% (27% in 2006 and 28% in 2005), largely due<br />

to the reimbursement of Italian tax credits and recognition of certain deferred<br />

tax assets on loss carryforwards in Brazil and Argentina, due to the continuing<br />

improvement in profi tability prospects in those countries.<br />

01<br />

02<br />

03<br />

04<br />

05<br />

06<br />

07<br />

08<br />

<strong>Registration</strong> <strong>Document</strong> <strong>Renault</strong> <strong>2007</strong> 203