2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

13 – INVESTMENT IN NISSAN<br />

A – Nissan consolidation method<br />

<strong>Renault</strong> holds 44.3% ownership in Nissan. <strong>Renault</strong> and Nissan have chosen<br />

to develop a unique type of alliance between two distinct companies with<br />

common interests, uniting forces to achieve optimum performance. The Alliance<br />

is organised so as to preserve individual brand identities and respect each<br />

company’s corporate culture.<br />

Consequently:<br />

n<br />

n<br />

n<br />

n<br />

<strong>Renault</strong> does not hold the majority of Nissan voting rights;<br />

the terms of the <strong>Renault</strong>-Nissan agreements do not entitle <strong>Renault</strong> to appoint<br />

the majority of Nissan directors, nor to hold the majority of voting rights at<br />

meetings of Nissan’s Board of Directors; at December 31, <strong>2007</strong> as in 2006<br />

and 2005, <strong>Renault</strong> supplied 4 of the total 9 members of Nissan’s Board of<br />

Directors;<br />

<strong>Renault</strong>-Nissan b.v., owned 50% by <strong>Renault</strong> and 50% by Nissan, is the<br />

Alliance’s joint decision-making body for strategic issues concerning either<br />

group individually. Its decisions are applicable to both <strong>Renault</strong> and Nissan.<br />

This entity does not enable <strong>Renault</strong> to direct Nissan’s fi nancial and operating<br />

strategies, and cannot therefore be considered to represent contractual<br />

control by <strong>Renault</strong> over Nissan. The matters examined by <strong>Renault</strong>-Nissan b.v.<br />

since it was formed have remained strictly within this contractual framework,<br />

and are not an indication that <strong>Renault</strong> exercises control over Nissan;<br />

<strong>Renault</strong> can neither use nor infl uence the use of Nissan’s assets in the same<br />

way as its own assets;<br />

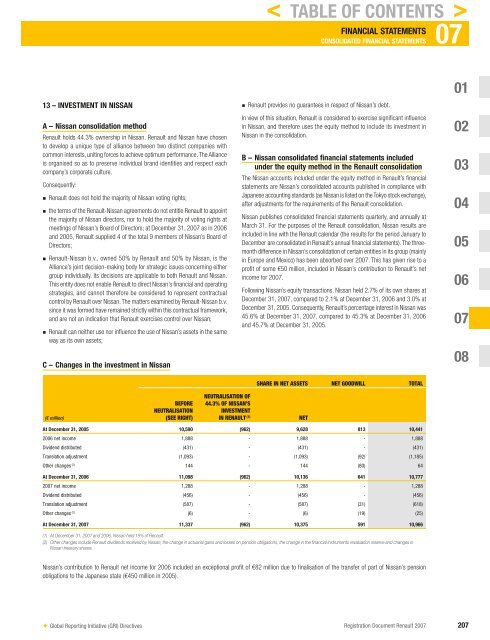

C – Changes in the investment in Nissan<br />

(€ million)<br />

✦ Global Reporting Initiative (GRI) Directives<br />

BEFORE<br />

NEUTRALISATION<br />

(SEE RIGHT)<br />

n<br />

FINANCIAL STATEMENTS 07<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

<strong>Renault</strong> provides no guarantees in respect of Nissan’s debt.<br />

In view of this situation, <strong>Renault</strong> is considered to exercise signifi cant infl uence<br />

in Nissan, and therefore uses the equity method to include its investment in<br />

Nissan in the consolidation.<br />

B – Nissan consolidated financial statements included<br />

under the equity method in the <strong>Renault</strong> consolidation<br />

The Nissan accounts included under the equity method in <strong>Renault</strong>’s fi nancial<br />

statements are Nissan’s consolidated accounts published in compliance with<br />

Japanese accounting standards (as Nissan is listed on the Tokyo stock exchange),<br />

after adjustments for the requirements of the <strong>Renault</strong> consolidation.<br />

Nissan publishes consolidated fi nancial statements quarterly, and annually at<br />

March 31. For the purposes of the <strong>Renault</strong> consolidation, Nissan results are<br />

included in line with the <strong>Renault</strong> calendar (the results for the period January to<br />

December are consolidated in <strong>Renault</strong>’s annual fi nancial statements). The threemonth<br />

difference in Nissan’s consolidation of certain entities in its group (mainly<br />

in Europe and Mexico) has been absorbed over <strong>2007</strong>. This has given rise to a<br />

profi t of some €50 million , included in Nissan’s contribution to <strong>Renault</strong>’s net<br />

income for <strong>2007</strong>.<br />

Following Nissan’s equity transactions, Nissan held 2.7% of its own shares at<br />

December 31, <strong>2007</strong>, compared to 2.1% at December 31, 2006 and 3.0% at<br />

December 31, 2005. Consequently, <strong>Renault</strong>’s percentage interest in Nissan was<br />

45.6% at December 31, <strong>2007</strong>, compared to 45.3% at December 31, 2006<br />

and 45.7% at December 31, 2005.<br />

NEUTRALISATION OF<br />

44.3% OF NISSAN’S<br />

INVESTMENT<br />

IN RENAULT (1) NET<br />

< TABLE OF CONTENTS ><br />

SHARE IN NET ASSETS NET GOODWILL TOTAL<br />

At December 31, 2005 10,590 (962) 9,628 813 10,441<br />

2006 net income 1,888 - 1,888 - 1,888<br />

Dividend distributed (431) - (431) - (431)<br />

Translation adjustment (1,093) - (1,093) (92) (1,185)<br />

Other changes (2) 144 - 144 (80) 64<br />

At December 31, 2006 11,098 (962) 10,136 641 10,777<br />

<strong>2007</strong> net income 1,288 - 1,288 - 1,288<br />

Dividend distributed (456) - (456) - (456)<br />

Translation adjustment (587) - (587) (31) (618)<br />

Other changes (2) (6) - (6) (19) (25)<br />

At December 31, <strong>2007</strong> 11,337 (962) 10,375 591 10,966<br />

(1) At December 31, <strong>2007</strong> and 2006, Nissan held 15% of <strong>Renault</strong>.<br />

(2) Other changes include <strong>Renault</strong> dividends received by Nissan, the change in actuarial gains and losses on pension obligations, the change in the financial instruments revaluation reserve and changes in<br />

Nissan treasury shares.<br />

Nissan’s contribution to <strong>Renault</strong> net income for 2006 included an exceptional profi t of €82 million due to fi nalisation of the transfer of part of Nissan’s pension<br />

obligations to the Japanese state (€450 million in 2005).<br />

01<br />

02<br />

03<br />

04<br />

05<br />

06<br />

07<br />

08<br />

<strong>Registration</strong> <strong>Document</strong> <strong>Renault</strong> <strong>2007</strong> 207