2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

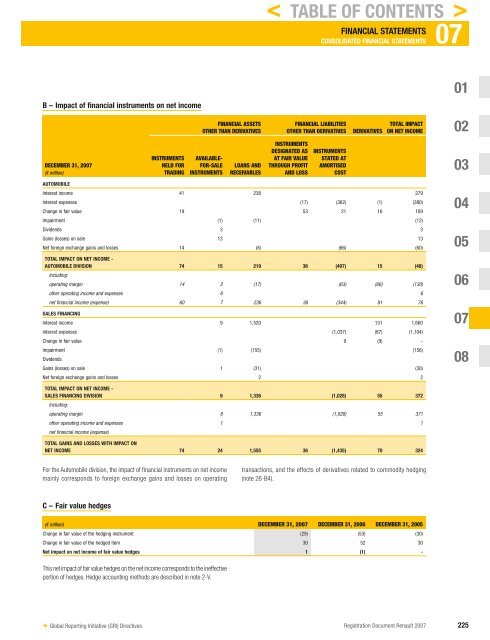

B – Impact of financial instruments on net income<br />

DECEMBER 31, <strong>2007</strong><br />

(€ million)<br />

✦ Global Reporting Initiative (GRI) Directives<br />

INSTRUMENTS<br />

HELD FOR<br />

TRADING<br />

FINANCIAL ASSETS<br />

OTHER THAN DERIVATIVES<br />

AVAILABLE-<br />

FOR-SALE<br />

INSTRUMENTS<br />

LOANS AND<br />

RECEIVABLES<br />

FINANCIAL STATEMENTS 07<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

FINANCIAL LIABILITIES<br />

OTHER THAN DERIVATIVES DERIVATIVES<br />

INSTRUMENTS<br />

DESIGNATED AS<br />

AT FAIR VALUE<br />

THROUGH PROFIT<br />

AND LOSS<br />

INSTRUMENTS<br />

STATED AT<br />

AMORTISED<br />

COST<br />

TOTAL IMPACT<br />

ON NET INCOME<br />

AUTOMOBILE<br />

Interest income 41 238 279<br />

Interest expenses (17) (362) (1) (380)<br />

Change in fair value 19 53 21 16 109<br />

Impairment (1) (11) (12)<br />

Dividends 3 3<br />

Gains (losses) on sale 13 13<br />

Net foreign exchange gains and losses 14 (8) (66) (60)<br />

TOTAL IMPACT ON NET INCOME -<br />

AUTOMOBILE DIVISION<br />

Including:<br />

74 15 219 36 (407) 15 (48)<br />

operating margin 14 2 (17) (63) (66) (130)<br />

other operating income and expenses 6 6<br />

net financial income (expense) 60 7 236 36 (344) 81 76<br />

SALES FINANCING<br />

Interest income 9 1,520 131 1,660<br />

Interest expenses (1,037) (67) (1,104)<br />

Change in fair value 9 (9) -<br />

Impairment<br />

Dividends<br />

(1) (155) (156)<br />

Gains (losses) on sale 1 (31) (30)<br />

Net foreign exchange gains and losses 2 2<br />

TOTAL IMPACT ON NET INCOME -<br />

SALES FINANCING DIVISION<br />

Including:<br />

9 1,336 (1,028) 55 372<br />

operating margin 8 1,336 (1,028) 55 371<br />

other operating income and expenses<br />

net financial income (expense)<br />

1 1<br />

TOTAL GAINS AND LOSSES WITH IMPACT ON<br />

NET INCOME 74 24 1,555 36 (1,435) 70 324<br />

For the Automobile division, the impact of fi nancial instruments on net income<br />

mainly corresponds to foreign exchange gains and losses on operating<br />

C – Fair value hedges<br />

transactions, and the effects of derivatives related to commodity hedging<br />

(note 26-B4).<br />

(€ million) DECEMBER 31, <strong>2007</strong> DECEMBER 31, 2006 DECEMBER 31, 2005<br />

Change in fair value of the hedging instrument (29) (53) (30)<br />

Change in fair value of the hedged item 30 52 30<br />

Net impact on net income of fair value hedges 1 (1) -<br />

This net impact of fair value hedges on the net income corresponds to the ineffective<br />

portion of hedges. Hedge accounting methods are described in note 2-V.<br />

< TABLE OF CONTENTS ><br />

01<br />

02<br />

03<br />

04<br />

05<br />

06<br />

07<br />

08<br />

<strong>Registration</strong> <strong>Document</strong> <strong>Renault</strong> <strong>2007</strong> 225