2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

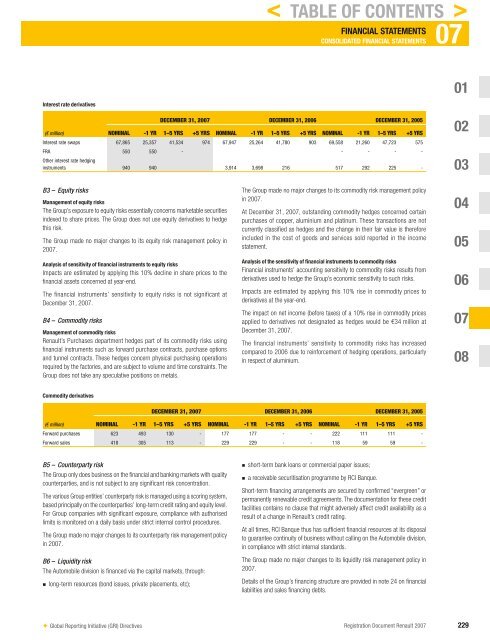

Interest rate derivatives<br />

B3 – Equity risks<br />

Management of equity risks<br />

The Group’s exposure to equity risks essentially concerns marketable securities<br />

indexed to share prices. The Group does not use equity derivatives to hedge<br />

this risk.<br />

The Group made no major changes to its equity risk management policy in<br />

<strong>2007</strong>.<br />

Analysis of sensitivity of financial instruments to equity risks<br />

Impacts are estimated by applying this 10% decline in share prices to the<br />

fi nancial assets concerned at year-end.<br />

The financial instruments’ sensitivity to equity risks is not significant at<br />

December 31, <strong>2007</strong>.<br />

B4 – Commodity risks<br />

Management of commodity risks<br />

<strong>Renault</strong>’s Purchases department hedges part of its commodity risks using<br />

fi nancial instruments such as forward purchase contracts, purchase options<br />

and tunnel contracts. These hedges concern physical purchasing operations<br />

required by the factories, and are subject to volume and time constraints. The<br />

Group does not take any speculative positions on metals.<br />

Commodity derivatives<br />

✦ Global Reporting Initiative (GRI) Directives<br />

FINANCIAL STATEMENTS 07<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

The Group made no major changes to its commodity risk management policy<br />

in <strong>2007</strong>.<br />

At December 31, <strong>2007</strong>, outstanding commodity hedges concerned certain<br />

purchases of copper, aluminium and platinum. These transactions are not<br />

currently classifi ed as hedges and the change in their fair value is therefore<br />

included in the cost of goods and services sold reported in the income<br />

statement.<br />

Analysis of the sensitivity of financial instruments to commodity risks<br />

Financial instruments’ accounting sensitivity to commodity risks results from<br />

derivatives used to hedge the Group’s economic sensitivity to such risks.<br />

Impacts are estimated by applying this 10% rise in commodity prices to<br />

derivatives at the year-end.<br />

The impact on net income (before taxes) of a 10% rise in commodity prices<br />

applied to derivatives not designated as hedges would be €34 million at<br />

December 31, <strong>2007</strong>.<br />

The financial instruments’ sensitivity to commodity risks has increased<br />

compared to 2006 due to reinforcement of hedging operations, particularly<br />

in respect of aluminium.<br />

DECEMBER 31, <strong>2007</strong> DECEMBER 31, 2006 DECEMBER 31, 2005<br />

(€ million)<br />

NOMINAL -1 YR 1–5 YRS +5 YRS NOMINAL -1 YR 1–5 YRS +5 YRS NOMINAL -1 YR 1–5 YRS +5 YRS<br />

Forward purchases 623 493 130 - 177 177 - - 222 111 111 -<br />

Forward sales 418 305 113 - 229 229 - - 118 59 59 -<br />

B5 – Counterparty risk<br />

The Group only does business on the fi nancial and banking markets with quality<br />

counterparties, and is not subject to any signifi cant risk concentration.<br />

The various Group entities’ counterparty risk is managed using a scoring system,<br />

based principally on the counterparties’ long-term credit rating and equity level.<br />

For Group companies with signifi cant exposure, compliance with authorised<br />

limits is monitored on a daily basis under strict internal control procedures.<br />

The Group made no major changes to its counterparty risk management policy<br />

in <strong>2007</strong>.<br />

B6 – Liquidity risk<br />

The Automobile division is fi nanced via the capital markets, through:<br />

n<br />

long-term resources (bond issues, private placements, etc);<br />

n<br />

n<br />

< TABLE OF CONTENTS ><br />

DECEMBER 31, <strong>2007</strong> DECEMBER 31, 2006 DECEMBER 31, 2005<br />

(€ million)<br />

NOMINAL -1 YR 1–5 YRS +5 YRS NOMINAL -1 YR 1–5 YRS +5 YRS NOMINAL -1 YR 1–5 YRS +5 YRS<br />

Interest rate swaps 67,865 25,357 41,534 974 67,947 25,264 41,780 903 69,558 21,260 47,723 575<br />

FRA<br />

Other interest rate hedging<br />

550 550 - - - - -<br />

instruments 940 940 3,914 3,698 216 517 292 225 -<br />

short-term bank loans or commercial paper issues;<br />

a receivable securitisation programme by RCI Banque.<br />

Short-term fi nancing arrangements are secured by confi rmed “evergreen” or<br />

permanently renewable credit agreements. The documentation for these credit<br />

facilities contains no clause that might adversely affect credit availability as a<br />

result of a change in <strong>Renault</strong>’s credit rating.<br />

At all times, RCI Banque thus has suffi cient fi nancial resources at its disposal<br />

to guarantee continuity of business without calling on the Automobile division,<br />

in compliance with strict internal standards.<br />

The Group made no major changes to its liquidity risk management policy in<br />

<strong>2007</strong>.<br />

Details of the Group’s fi nancing structure are provided in note 24 on fi nancial<br />

liabilities and sales fi nancing debts.<br />

01<br />

02<br />

03<br />

04<br />

05<br />

06<br />

07<br />

08<br />

<strong>Registration</strong> <strong>Document</strong> <strong>Renault</strong> <strong>2007</strong> 229