2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

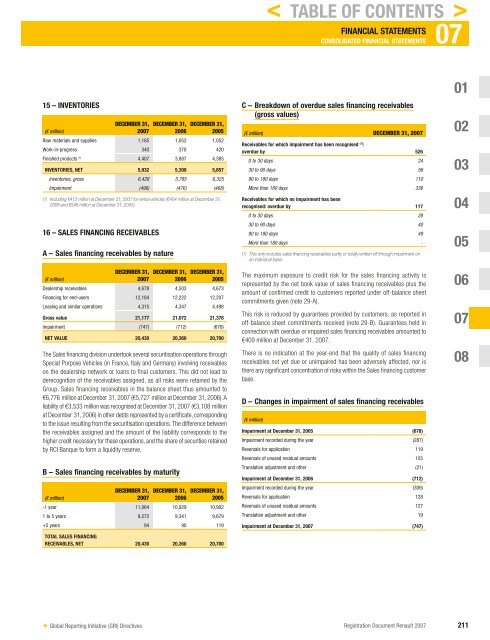

15 – INVENTORIES<br />

DECEMBER 31, DECEMBER 31, DECEMBER 31,<br />

(€ million)<br />

<strong>2007</strong> 2006 2005<br />

Raw materials and supplies 1,185 1,052 1,052<br />

Work-in-progress 340 370 420<br />

Finished products (1) 4,407 3,887 4,385<br />

INVENTORIES, NET 5,932 5,309 5,857<br />

Inventories, gross 6,428 5,785 6,325<br />

Impairment (496) (476) (468)<br />

(1) Including €413 million at December 31, <strong>2007</strong> for rental vehicles (€454 million at December 31,<br />

2006 and €546 million at December 31, 2005).<br />

16 – SALES FINANCING RECEIVABLES<br />

A – Sales financing receivables by nature<br />

DECEMBER 31, DECEMBER 31, DECEMBER 31,<br />

(€ million)<br />

<strong>2007</strong> 2006 2005<br />

Dealership receivables 4,678 4,503 4,673<br />

Financing for end-users 12,184 12,222 12,207<br />

Leasing and similar operations 4,315 4,347 4,498<br />

Gross value 21,177 21,072 21,378<br />

Impairment (747) (712) (678)<br />

NET VALUE 20,430 20,360 20,700<br />

The Sales fi nancing division undertook several securitisation operations through<br />

S pecial P urpose V ehicles (in France, Italy and Germany) involving receivables<br />

on the dealership network or loans to fi nal customers. This did not lead to<br />

derecognition of the receivables assigned, as all risks were retained by the<br />

Group. Sales fi nancing receivables in the balance sheet thus amounted to<br />

€6,776 million at December 31, <strong>2007</strong> (€5,727 million at December 31, 2006). A<br />

liability of €3,533 million was recognised at December 31, <strong>2007</strong> (€3,108 million<br />

at December 31, 2006) in other debts represented by a certifi cate, corresponding<br />

to the issue resulting from the securitisation operations. The difference between<br />

the receivables assigned and the amount of the liability corresponds to the<br />

higher credit necessary for these operations, and the share of securities retained<br />

by RCI Banque to form a liquidity reserve.<br />

B – Sales financing receivables by maturity<br />

DECEMBER 31, DECEMBER 31, DECEMBER 31,<br />

(€ million)<br />

<strong>2007</strong> 2006 2005<br />

-1 year 11,064 10,929 10,902<br />

1 to 5 years 9,272 9,341 9,679<br />

+5 years 94 90 119<br />

TOTAL SALES FINANCING<br />

RECEIVABLES, NET 20,430 20,360 20,700<br />

✦ Global Reporting Initiative (GRI) Directives<br />

FINANCIAL STATEMENTS 07<br />

CONSOLIDATED FINANCIAL STATEMENTS<br />

C – Breakdown of overdue sales financing receivables<br />

(gross values)<br />

(€ million) DECEMBER 31, <strong>2007</strong><br />

Receivables for which impairment has been recognised (1) :<br />

overdue by 526<br />

0 to 30 days 24<br />

30 to 90 days 56<br />

90 to 180 days 110<br />

More than 180 days 336<br />

Receivables for which no impairment has been<br />

recognised: overdue by 117<br />

0 to 30 days 28<br />

30 to 90 days 40<br />

90 to 180 days 49<br />

More than 180 days -<br />

(1) This only includes sales financing receivables partly or totally written off through impairment on<br />

an individual basis.<br />

The maximum exposure to credit risk for the sales financing activity is<br />

represented by the net book value of sales fi nancing receivables plus the<br />

amount of confi rmed credit to customers reported under off-balance sheet<br />

commitments given (note 29-A).<br />

This risk is reduced by guarantees provided by customers, as reported in<br />

off-balance sheet commitments received (note 29-B). Guarantees held in<br />

connection with overdue or impaired sales fi nancing receivables amounted to<br />

€409 million at December 31, <strong>2007</strong>.<br />

There is no indication at the year-end that the quality of sales fi nancing<br />

receivables not yet due or unimpaired has been adversely affected, nor is<br />

there any signifi cant concentration of risks within the Sales fi nancing customer<br />

base.<br />

D – Changes in impairment of sales financing receivables<br />

(€ million)<br />

< TABLE OF CONTENTS ><br />

Impairment at December 31, 2005 (678)<br />

Impairment recorded during the year (287)<br />

Reversals for application 119<br />

Reversals of unused residual amounts 155<br />

Translation adjustment and other (21)<br />

Impairment at December 31, 2006 (712)<br />

Impairment recorded during the year (309)<br />

Reversals for application 128<br />

Reversals of unused residual amounts 127<br />

Translation adjustment and other 19<br />

Impairment at December 31, <strong>2007</strong> (747)<br />

01<br />

02<br />

03<br />

04<br />

05<br />

06<br />

07<br />

08<br />

<strong>Registration</strong> <strong>Document</strong> <strong>Renault</strong> <strong>2007</strong> 211