2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

2007 Interactive Registration Document - Renault

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

01 THE<br />

RENAULT AND THE GROUP<br />

RENAULT-NISSAN ALLIANCE<br />

1.3.2 OPERATIONAL STRUCTURE OF THE ALLIANCE ✦<br />

1.3.2.1 MAIN STAGES IN THE<br />

CONSTRUCTION OF THE ALLIANCE<br />

In accordance with the principles set out in the initial agreement signed in<br />

March 1999, the second stage of the <strong>Renault</strong>-Nissan Alliance was engaged in<br />

2002. This phase strengthened the community of interests between <strong>Renault</strong><br />

and Nissan, underpinned by stronger equity ties. It involved establishing an<br />

Alliance Board tasked with defi ning Alliance strategy and developing a joint<br />

long-term vision.<br />

On March 1, 2002, <strong>Renault</strong> increased its equity stake in Nissan from 36.8%<br />

to 44.3% by exercising the warrants it had held since 1999.<br />

At the same time, Nissan took a stake in <strong>Renault</strong>’s capital through its whollyowned<br />

subsidiary. Nissan Finance Co, Ltd, which acquired 15% of <strong>Renault</strong>’s<br />

capital through two reserved capital increases, on March 29 and May 28,<br />

2002.<br />

By acquiring a stake in <strong>Renault</strong>, Nissan gained a direct interest in its partner’s<br />

results, as was already the case for <strong>Renault</strong> in Nissan. Nissan also obtained a<br />

second seat on <strong>Renault</strong>’s Board of Directors.<br />

The purpose of the second phase of the Alliance in 2002 was to provide the<br />

Alliance with a common strategic vision, which resulted in the creation of<br />

<strong>Renault</strong>-Nissan b.v. and a specifi c corporate governance policy.<br />

1.3.2.2 GOVERNANCE AND OPERATIONAL<br />

STRUCTURE<br />

CREATION OF RENAULT-NISSAN B.V.<br />

Formed on March 28, 2002 <strong>Renault</strong>-Nissan b.v. is a joint company, incorporated<br />

under Dutch law and equally owned by <strong>Renault</strong> SA and Nissan Motor Co., Ltd.,<br />

responsible for the strategic management of the Alliance.<br />

This structure decides on medium - and long -term strategy, as described<br />

below under “Powers of <strong>Renault</strong>-Nissan b.v.”. It bolsters the management of<br />

the <strong>Renault</strong>-Nissan a lliance and coordinates joint activities at a global level,<br />

allowing for decisions to be made while respecting the autonomy of each<br />

partner and guaranteeing a consensual operating procedure.<br />

<strong>Renault</strong>-Nissan b.v. possesses clearly defi ned assets and powers over both<br />

<strong>Renault</strong> and Nissan Motor Co., Ltd.<br />

<strong>Renault</strong>-Nissan b.v. holds all the shares of existing and future joint subsidiaries<br />

of <strong>Renault</strong> and Nissan Motor Co., Ltd.<br />

Examples include <strong>Renault</strong>-Nissan Purchasing Organization (RNPO), which has<br />

been equally owned by <strong>Renault</strong> and Nissan since its creation in April 2001.<br />

These shares were transferred to <strong>Renault</strong>- Nissan b.v., which has owned 100%<br />

of RNPO since June 2003.<br />

<strong>Renault</strong>-Nissan Information Services (RNIS) is a common information systems<br />

company, created in July 2002 and wholly owned by <strong>Renault</strong>-Nissan b.v.<br />

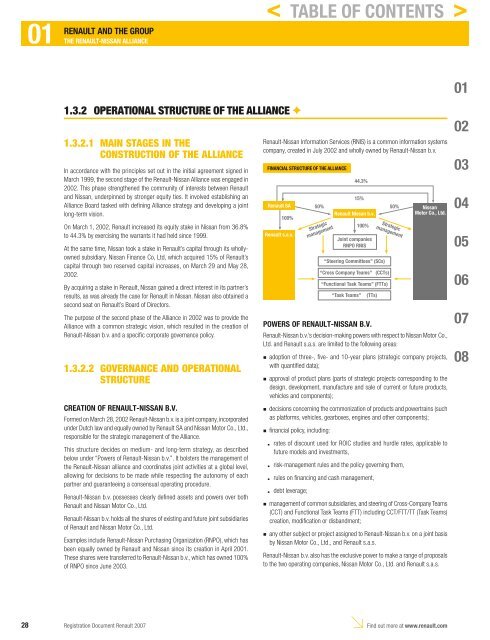

FINANCIAL STRUCTURE OF THE ALLIANCE<br />

POWERS OF RENAULT-NISSAN B.V.<br />

<strong>Renault</strong>-Nissan b.v.’s decision-making powers with respect to Nissan Motor Co.,<br />

Ltd. and <strong>Renault</strong> s.a.s. are limited to the following areas:<br />

adoption of three-, fi ve- and 10-year plans (strategic company projects,<br />

with quantifi ed data);<br />

approval of product plans (parts of strategic projects corresponding to the<br />

design, development, manufacture and sale of current or future products,<br />

vehicles and components);<br />

decisions concerning the commonization of products and powertrains (such<br />

as platforms, vehicles, gearboxes, engines and other components);<br />

fi nancial policy, including:<br />

. rates of discount used for ROIC studies and hurdle rates, applicable to<br />

future models and investments,<br />

. risk-management rules and the policy governing them,<br />

. rules on fi nancing and cash management,<br />

. debt leverage;<br />

management of common subsidiaries, and steering of Cross-Company Teams<br />

(CCT) and Functional Task Teams (FTT) including CCT/FTT/TT (Task Teams)<br />

creation, modifi cation or disbandment;<br />

any other subject or project assigned to <strong>Renault</strong>-Nissan b.v. on a joint basis<br />

by Nissan Motor Co., Ltd., and <strong>Renault</strong> s.a.s.<br />

<strong>Renault</strong>-Nissan b.v. also has the exclusive power to make a range of proposals<br />

to the two operating companies, Nissan Motor Co., Ltd. and <strong>Renault</strong> s.a.s.<br />

28 <strong>Registration</strong> <strong>Document</strong> <strong>Renault</strong> <strong>2007</strong><br />

Find out more at www.renault.com<br />

n<br />

n<br />

n<br />

n<br />

n<br />

n<br />

< TABLE OF CONTENTS ><br />

01<br />

02<br />

03<br />

04<br />

05<br />

06<br />

07<br />

08