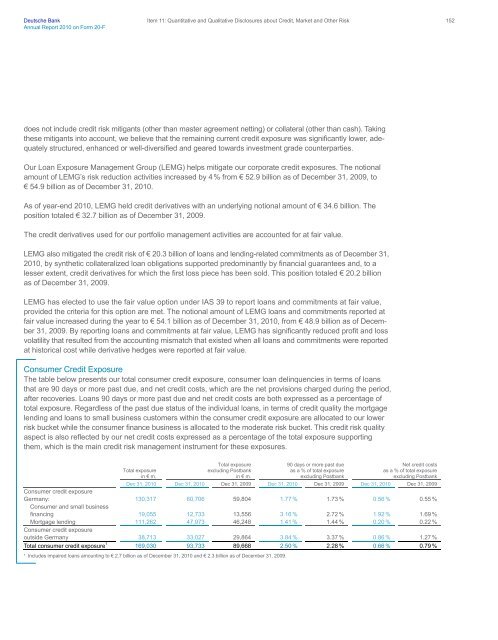

<strong>Deutsche</strong> <strong>Bank</strong> <strong>Annual</strong> <strong>Report</strong> <strong>20</strong>10 on <strong>Form</strong> <strong>20</strong>-F Item 11: Quantitative and Qualitative Disclosures about Credit, Market and Other Risk 152 does not include credit risk mitigants (other than master agreement netting) or collateral (other than cash). Taking these mitigants into account, we believe that the remaining current credit exposure was significantly lower, adequately structured, enhanced or well-diversified and geared towards investment grade counterparties. Our Loan Exposure Management Group (LEMG) helps mitigate our corporate credit exposures. The notional amount of LEMG’s risk reduction activities increased by 4 % from € 52.9 billion as of December 31, <strong>20</strong>09, to € 54.9 billion as of December 31, <strong>20</strong>10. As of year-end <strong>20</strong>10, LEMG held credit derivatives with an underlying notional amount of € 34.6 billion. The position totaled € 32.7 billion as of December 31, <strong>20</strong>09. The credit derivatives used for our portfolio management activities are accounted for at fair value. LEMG also mitigated the credit risk of € <strong>20</strong>.3 billion of loans and lending-related commitments as of December 31, <strong>20</strong>10, by synthetic collateralized loan obligations supported predominantly by financial guarantees and, to a lesser extent, credit derivatives for which the first loss piece has been sold. This position totaled € <strong>20</strong>.2 billion as of December 31, <strong>20</strong>09. LEMG has elected to use the fair value option under IAS 39 to report loans and commitments at fair value, provided the criteria for this option are met. The notional amount of LEMG loans and commitments reported at fair value increased during the year to € 54.1 billion as of December 31, <strong>20</strong>10, from € 48.9 billion as of December 31, <strong>20</strong>09. By reporting loans and commitments at fair value, LEMG has significantly reduced profit and loss volatility that resulted from the accounting mismatch that existed when all loans and commitments were reported at historical cost while derivative hedges were reported at fair value. Consumer Credit Exposure The table below presents our total consumer credit exposure, consumer loan delinquencies in terms of loans that are 90 days or more past due, and net credit costs, which are the net provisions charged during the period, after recoveries. Loans 90 days or more past due and net credit costs are both expressed as a percentage of total exposure. Regardless of the past due status of the individual loans, in terms of credit quality the mortgage lending and loans to small business customers within the consumer credit exposure are allocated to our lower risk bucket while the consumer finance business is allocated to the moderate risk bucket. This credit risk quality aspect is also reflected by our net credit costs expressed as a percentage of the total exposure supporting them, which is the main credit risk management instrument for these exposures. Total exposure in € m. Total exposure excluding Postbank in € m. 90 days or more past due as a % of total exposure excluding Postbank Net credit costs as a % of total exposure excluding Postbank Dec 31, <strong>20</strong>10 Dec 31, <strong>20</strong>10 Dec 31, <strong>20</strong>09 Dec 31, <strong>20</strong>10 Dec 31, <strong>20</strong>09 Dec 31, <strong>20</strong>10 Dec 31, <strong>20</strong>09 Consumer credit exposure Germany: Consumer and small business 130,317 60,706 59,804 1.77 % 1.73 % 0.56 % 0.55 % financing 19,055 12,733 13,556 3.16 % 2.72 % 1.92 % 1.69 % Mortgage lending Consumer credit exposure 111,262 47,973 46,248 1.41 % 1.44 % 0.<strong>20</strong> % 0.22 % outside Germany 38,713 33,027 29,864 3.84 % 3.37 % 0.86 % 1.27 % Total consumer credit exposure 1 169,030 93,733 89,668 2.50 % 2.28 % 0.66 % 0.79 % 1 Includes impaired loans amounting to € 2.7 billion as of December 31, <strong>20</strong>10 and € 2.3 billion as of December 31, <strong>20</strong>09.

<strong>Deutsche</strong> <strong>Bank</strong> <strong>Annual</strong> <strong>Report</strong> <strong>20</strong>10 on <strong>Form</strong> <strong>20</strong>-F Item 11: Quantitative and Qualitative Disclosures about Credit, Market and Other Risk 153 The volume of our consumer credit exposure increased due to the consolidation of Postbank by € 75.3 billion or 89 %, mainly in German mortgage lending. As loans were consolidated at their fair values representing our expected future cash flows, no consolidated loans were considered 90 days or more past due as of December 31, <strong>20</strong>10. The net credit cost incurred on Postbank consumer credit loans since consolidation date were insignificant compared to the consolidated loan volume. The volume of our consumer credit exposure excluding Postbank rose by € 4 billion, or 4.5 %, from year end <strong>20</strong>09 to December 31, <strong>20</strong>10, driven by volume growth in Germany (up € 902 million), Poland (up € 1,034 million), Italy (up € 949 million) and Portugal (up € 547 million), mainly within mortgage lending. Measures taken on portfolio and country level lead to significant reduction of net credit costs in Spain and India, partially offset by increases in our consumer finance business in Poland. Revised parameter and model assumptions in <strong>20</strong>09 led to a one-time release of loan loss allowance of € 60 million in the first quarter <strong>20</strong>09 as well as a lower level of provisions for credit losses of € 28 million for the first quarter <strong>20</strong>10. Credit Exposure from Derivatives The following table shows the notional amounts and gross market values of OTC and exchange-traded derivative contracts we held for trading and nontrading purposes as of December 31, <strong>20</strong>10. The table below includes Postbank OTC and exchange-traded derivative contracts which have a negligible impact on the overall totals. Dec 31, <strong>20</strong>10 Notional amount maturity distribution Positive in € m. Within 1 year > 1 and ≤ 5 years After 5 years Total Exchange-traded derivative transactions (e.g., futures and options) are regularly settled through a central counterparty (e.g., LCH. Clearnet Ltd. or Eurex Clearing AG), the rules and regulations of which provide for daily margining of all current and future credit risk positions emerging out of such transactions. To the extent possible, we also use central counterparty clearing services for OTC derivative transactions (“OTC clearing”); we thereby benefit from the credit risk mitigation achieved through the central counterparty’s settlement system. market value Negative market value Net market value Interest-rate-related transactions: OTC products 16,942,302 15,853,777 11,080,457 43,876,536 419,196 401,179 18,017 Exchange-traded products 1,1<strong>20</strong>,579 276,258 2,272 1,399,109 128 110 18 Sub-total 18,062,881 16,130,035 11,082,729 45,275,645 419,324 401,289 18,035 Currency-related transactions: OTC products 3,805,544 1,325,473 607,743 5,738,760 110,440 118,452 (8,012) Exchange-traded products 13,113 970 – 14,083 104 221 (117) Sub-total 3,818,657 1,326,443 607,743 5,752,843 110,544 118,673 (8,129) Equity/index-related transactions: OTC products 362,294 333,108 95,785 791,187 31,084 38,297 (7,213) Exchange-traded products 256,942 100,475 4,332 361,749 2,933 1,995 938 Sub-total 619,236 433,583 100,117 1,152,936 34,017 40,292 (6,275) Credit derivatives 308,387 2,545,673 537,759 3,391,819 81,095 73,036 8,059 Other transactions: OTC products 143,323 150,068 8,831 302,222 18,587 17,879 708 Exchange-traded products 72,437 41,874 839 115,150 2,742 2,621 121 Sub-total 215,760 191,942 9,670 417,372 21,329 <strong>20</strong>,500 829 Total OTC business 21,561,850 <strong>20</strong>,<strong>20</strong>8,099 12,330,575 54,100,524 660,402 648,843 11,559 Total exchange-traded business 1,463,071 419,577 7,443 1,890,091 5,907 4,947 960 Total 23,024,921 <strong>20</strong>,627,676 12,338,018 55,990,615 666,309 653,790 12,519 Positive market values including the effect of netting and cash collateral received 63,942

- Page 1:

Deutsche Bank Annual Report 2010 on

- Page 4 and 5:

Deutsche Bank Annual Report 2010 on

- Page 6 and 7:

Deutsche Bank Annual Report 2010 on

- Page 8 and 9:

Deutsche Bank Annual Report 2010 on

- Page 11 and 12:

Deutsche Bank Item 3: Key Informati

- Page 13 and 14:

Deutsche Bank Item 3: Key Informati

- Page 15 and 16:

Deutsche Bank Item 3: Key Informati

- Page 17 and 18:

Deutsche Bank Item 3: Key Informati

- Page 19 and 20:

Deutsche Bank Item 3: Key Informati

- Page 21 and 22:

Deutsche Bank Item 3: Key Informati

- Page 23 and 24:

Deutsche Bank Item 3: Key Informati

- Page 25 and 26:

Deutsche Bank Item 3: Key Informati

- Page 27 and 28:

Deutsche Bank Item 3: Key Informati

- Page 29 and 30:

Deutsche Bank Annual Report 2010 on

- Page 31 and 32:

Deutsche Bank Annual Report 2010 on

- Page 33 and 34:

Deutsche Bank Annual Report 2010 on

- Page 35 and 36:

Deutsche Bank Annual Report 2010 on

- Page 37 and 38:

Deutsche Bank Annual Report 2010 on

- Page 39 and 40:

Deutsche Bank Annual Report 2010 on

- Page 41 and 42:

Deutsche Bank Annual Report 2010 on

- Page 43 and 44:

Deutsche Bank Annual Report 2010 on

- Page 45 and 46:

Deutsche Bank Annual Report 2010 on

- Page 47 and 48:

Deutsche Bank Annual Report 2010 on

- Page 49 and 50:

Deutsche Bank Annual Report 2010 on

- Page 51 and 52:

Deutsche Bank Annual Report 2010 on

- Page 53 and 54:

Deutsche Bank Annual Report 2010 on

- Page 55 and 56:

Deutsche Bank Annual Report 2010 on

- Page 57 and 58:

Deutsche Bank Annual Report 2010 on

- Page 59 and 60:

Deutsche Bank Annual Report 2010 on

- Page 61 and 62:

Deutsche Bank Annual Report 2010 on

- Page 63 and 64:

Deutsche Bank Annual Report 2010 on

- Page 65 and 66:

Deutsche Bank Annual Report 2010 on

- Page 67 and 68:

Deutsche Bank Annual Report 2010 on

- Page 69 and 70:

Deutsche Bank Annual Report 2010 on

- Page 71 and 72:

Deutsche Bank Annual Report 2010 on

- Page 73 and 74:

Deutsche Bank Annual Report 2010 on

- Page 75 and 76:

Deutsche Bank Annual Report 2010 on

- Page 77 and 78:

Deutsche Bank Annual Report 2010 on

- Page 79 and 80:

Deutsche Bank Annual Report 2010 on

- Page 81 and 82:

Deutsche Bank Annual Report 2010 on

- Page 83 and 84:

Deutsche Bank Annual Report 2010 on

- Page 85 and 86:

Deutsche Bank Annual Report 2010 on

- Page 87 and 88:

Deutsche Bank Annual Report 2010 on

- Page 89 and 90:

Deutsche Bank Annual Report 2010 on

- Page 91 and 92:

Deutsche Bank Annual Report 2010 on

- Page 93 and 94:

Deutsche Bank Annual Report 2010 on

- Page 95 and 96:

Deutsche Bank Annual Report 2010 on

- Page 97 and 98:

Deutsche Bank Annual Report 2010 on

- Page 99 and 100:

Deutsche Bank Annual Report 2010 on

- Page 101 and 102:

Deutsche Bank Annual Report 2010 on

- Page 103 and 104:

Deutsche Bank Annual Report 2010 on

- Page 105 and 106:

Deutsche Bank Annual Report 2010 on

- Page 107 and 108:

Deutsche Bank Annual Report 2010 on

- Page 109 and 110:

Deutsche Bank Annual Report 2010 on

- Page 111 and 112: Deutsche Bank Annual Report 2010 on

- Page 113 and 114: Deutsche Bank Annual Report 2010 on

- Page 115 and 116: Deutsche Bank Annual Report 2010 on

- Page 117 and 118: Deutsche Bank Annual Report 2010 on

- Page 119 and 120: Deutsche Bank Annual Report 2010 on

- Page 121 and 122: Deutsche Bank Annual Report 2010 on

- Page 123 and 124: Deutsche Bank Annual Report 2010 on

- Page 125 and 126: Deutsche Bank Annual Report 2010 on

- Page 127 and 128: Deutsche Bank Annual Report 2010 on

- Page 129 and 130: Deutsche Bank Annual Report 2010 on

- Page 131 and 132: Deutsche Bank Annual Report 2010 on

- Page 133 and 134: Deutsche Bank Annual Report 2010 on

- Page 135 and 136: Deutsche Bank Annual Report 2010 on

- Page 137 and 138: Deutsche Bank Annual Report 2010 on

- Page 139 and 140: Deutsche Bank Annual Report 2010 on

- Page 141 and 142: Deutsche Bank Annual Report 2010 on

- Page 143 and 144: Deutsche Bank Annual Report 2010 on

- Page 145 and 146: Deutsche Bank Annual Report 2010 on

- Page 147 and 148: Deutsche Bank Annual Report 2010 on

- Page 149 and 150: Deutsche Bank Annual Report 2010 on

- Page 151 and 152: Deutsche Bank Annual Report 2010 on

- Page 153 and 154: Deutsche Bank Annual Report 2010 on

- Page 155 and 156: Deutsche Bank Annual Report 2010 on

- Page 157 and 158: Deutsche Bank Annual Report 2010 on

- Page 159 and 160: Deutsche Bank Annual Report 2010 on

- Page 161: Deutsche Bank Annual Report 2010 on

- Page 165 and 166: Deutsche Bank Annual Report 2010 on

- Page 167 and 168: Deutsche Bank Annual Report 2010 on

- Page 169 and 170: Deutsche Bank Annual Report 2010 on

- Page 171 and 172: Deutsche Bank Annual Report 2010 on

- Page 173 and 174: Deutsche Bank Annual Report 2010 on

- Page 175 and 176: Deutsche Bank Annual Report 2010 on

- Page 177 and 178: Deutsche Bank Annual Report 2010 on

- Page 179 and 180: Deutsche Bank Annual Report 2010 on

- Page 181 and 182: Deutsche Bank Annual Report 2010 on

- Page 183 and 184: Deutsche Bank Annual Report 2010 on

- Page 185 and 186: Deutsche Bank Annual Report 2010 on

- Page 187 and 188: Deutsche Bank Annual Report 2010 on

- Page 189 and 190: Deutsche Bank Annual Report 2010 on

- Page 191 and 192: Deutsche Bank Annual Report 2010 on

- Page 193 and 194: Deutsche Bank Annual Report 2010 on

- Page 195 and 196: Deutsche Bank Annual Report 2010 on

- Page 197 and 198: Deutsche Bank Annual Report 2010 on

- Page 199 and 200: Deutsche Bank Annual Report 2010 on

- Page 201 and 202: Deutsche Bank Item 15: Controls and

- Page 203 and 204: Deutsche Bank Item 16A: Audit Commi

- Page 205 and 206: Deutsche Bank Item 16C: Principal A

- Page 207 and 208: Deutsche Bank Item 16E: Purchases o

- Page 209 and 210: Deutsche Bank Item 16G: Corporate G

- Page 211 and 212: Deutsche Bank Item 16G: Corporate G

- Page 213 and 214:

Deutsche Bank Item 19: Exhibits 203

- Page 215 and 216:

Deutsche Bank Aktiengesellschaft Co

- Page 217 and 218:

Deutsche Bank Deutsche Bank Aktieng

- Page 219 and 220:

Deutsche Bank Consolidated Financia

- Page 221 and 222:

Deutsche Bank Consolidated Financia

- Page 223 and 224:

Deutsche Bank Consolidated Financia

- Page 225 and 226:

Deutsche Bank Notes to the Consolid

- Page 227 and 228:

Deutsche Bank Notes to the Consolid

- Page 229 and 230:

Deutsche Bank Notes to the Consolid

- Page 231 and 232:

Deutsche Bank Notes to the Consolid

- Page 233 and 234:

Deutsche Bank Notes to the Consolid

- Page 235 and 236:

Deutsche Bank Notes to the Consolid

- Page 237 and 238:

Deutsche Bank Notes to the Consolid

- Page 239 and 240:

Deutsche Bank Notes to the Consolid

- Page 241 and 242:

Deutsche Bank Notes to the Consolid

- Page 243 and 244:

Deutsche Bank Notes to the Consolid

- Page 245 and 246:

Deutsche Bank Notes to the Consolid

- Page 247 and 248:

Deutsche Bank Notes to the Consolid

- Page 249 and 250:

Deutsche Bank Notes to the Consolid

- Page 251 and 252:

Deutsche Bank Notes to the Consolid

- Page 253 and 254:

Deutsche Bank Notes to the Consolid

- Page 255 and 256:

Deutsche Bank Notes to the Consolid

- Page 257 and 258:

Deutsche Bank Notes to the Consolid

- Page 259 and 260:

Deutsche Bank Notes to the Consolid

- Page 261 and 262:

Deutsche Bank Notes to the Consolid

- Page 263 and 264:

Deutsche Bank Notes to the Consolid

- Page 265 and 266:

Deutsche Bank Notes to the Consolid

- Page 267 and 268:

Deutsche Bank Notes to the Consolid

- Page 269 and 270:

Deutsche Bank Notes to the Consolid

- Page 271 and 272:

Deutsche Bank Notes to the Consolid

- Page 273 and 274:

Deutsche Bank Notes to the Consolid

- Page 275 and 276:

Deutsche Bank Notes to the Consolid

- Page 277 and 278:

Deutsche Bank Notes to the Consolid

- Page 279 and 280:

Deutsche Bank Notes to the Consolid

- Page 281 and 282:

Deutsche Bank Notes to the Consolid

- Page 283 and 284:

Deutsche Bank Notes to the Consolid

- Page 285 and 286:

Deutsche Bank Notes to the Consolid

- Page 287 and 288:

Deutsche Bank Notes to the Consolid

- Page 289 and 290:

Deutsche Bank Notes to the Consolid

- Page 291 and 292:

Deutsche Bank Notes to the Consolid

- Page 293 and 294:

Deutsche Bank Notes to the Consolid

- Page 295 and 296:

Deutsche Bank Notes to the Consolid

- Page 297 and 298:

Deutsche Bank Notes to the Consolid

- Page 299 and 300:

Deutsche Bank Notes to the Consolid

- Page 301 and 302:

Deutsche Bank Notes to the Consolid

- Page 303 and 304:

Deutsche Bank Notes to the Consolid

- Page 305 and 306:

Deutsche Bank Notes to the Consolid

- Page 307 and 308:

Deutsche Bank Notes to the Consolid

- Page 309 and 310:

Deutsche Bank Notes to the Consolid

- Page 311 and 312:

Deutsche Bank Notes to the Consolid

- Page 313 and 314:

Deutsche Bank Notes to the Consolid

- Page 315 and 316:

Deutsche Bank Notes to the Consolid

- Page 317 and 318:

Deutsche Bank Notes to the Consolid

- Page 319 and 320:

Deutsche Bank Notes to the Consolid

- Page 321 and 322:

Deutsche Bank Notes to the Consolid

- Page 323 and 324:

Deutsche Bank Notes to the Consolid

- Page 325 and 326:

Deutsche Bank Notes to the Consolid

- Page 327 and 328:

Deutsche Bank Notes to the Consolid

- Page 329 and 330:

Deutsche Bank Notes to the Consolid

- Page 331 and 332:

Deutsche Bank Notes to the Consolid

- Page 333 and 334:

Deutsche Bank Notes to the Consolid

- Page 335 and 336:

Deutsche Bank Notes to the Consolid

- Page 337 and 338:

Deutsche Bank Notes to the Consolid

- Page 339 and 340:

Deutsche Bank Notes to the Consolid

- Page 341 and 342:

Deutsche Bank Notes to the Consolid

- Page 343 and 344:

Deutsche Bank Notes to the Consolid

- Page 345 and 346:

Deutsche Bank Notes to the Consolid

- Page 347 and 348:

Deutsche Bank Notes to the Consolid

- Page 349 and 350:

Deutsche Bank Notes to the Consolid

- Page 351 and 352:

Deutsche Bank Additional Notes F-13

- Page 353 and 354:

Deutsche Bank Additional Notes F-13

- Page 355 and 356:

Deutsche Bank Additional Notes F-14

- Page 357 and 358:

Deutsche Bank Additional Notes F-14

- Page 359 and 360:

Deutsche Bank Additional Notes F-14

- Page 361 and 362:

Deutsche Bank Additional Notes F-14

- Page 363 and 364:

Deutsche Bank Additional Notes F-14

- Page 365 and 366:

Deutsche Bank Additional Notes F-15

- Page 367 and 368:

Deutsche Bank Additional Notes F-15

- Page 369 and 370:

Deutsche Bank Additional Notes F-15

- Page 371 and 372:

Deutsche Bank Additional Notes F-15

- Page 373 and 374:

Deutsche Bank Additional Notes F-15

- Page 375 and 376:

Deutsche Bank Additional Notes F-16

- Page 377 and 378:

Deutsche Bank Additional Notes F-16

- Page 379 and 380:

Deutsche Bank Additional Notes F-16

- Page 381 and 382:

Deutsche Bank Additional Notes F-16

- Page 383 and 384:

Deutsche Bank Additional Notes F-16

- Page 385 and 386:

Deutsche Bank Additional Notes F-17

- Page 387 and 388:

Deutsche Bank Additional Notes F-17

- Page 389 and 390:

Deutsche Bank Additional Notes F-17

- Page 391 and 392:

Deutsche Bank Additional Notes F-17

- Page 393 and 394:

Deutsche Bank Additional Notes F-17

- Page 395 and 396:

Deutsche Bank Supplemental Financia

- Page 397 and 398:

Deutsche Bank Supplemental Financia

- Page 399 and 400:

Deutsche Bank Supplemental Financia

- Page 401 and 402:

Deutsche Bank Supplemental Financia

- Page 403 and 404:

Deutsche Bank Supplemental Financia

- Page 405 and 406:

Deutsche Bank Supplemental Financia

- Page 407 and 408:

Deutsche Bank Supplemental Financia

- Page 409 and 410:

Deutsche Bank Supplemental Financia

- Page 411 and 412:

Deutsche Bank Supplemental Financia

- Page 413 and 414:

Deutsche Bank Supplemental Financia

- Page 416:

2011 April 28, 2011 Interim Report