- Page 3 and 4:

The Military Balance 2010 Editor’

- Page 5 and 6:

The Military Balance 2010 Preface T

- Page 7 and 8:

Units and formation strength Compan

- Page 9 and 10:

Principal Aviation Equipment De�n

- Page 11 and 12:

Construction, Research and Developm

- Page 13 and 14:

Chapter One North America THE UNITE

- Page 15 and 16:

tion execution procedures’. There

- Page 17 and 18:

and network kits for the HMMWV. Whi

- Page 19 and 20:

tion brigade roughly quintuples the

- Page 21 and 22:

light of the forthcoming demographi

- Page 23 and 24:

FY2010 National Defence Process In

- Page 25 and 26:

North America Table 7 US National D

- Page 27 and 28:

Cbt Engr 1 regt MP 4 coy Log 10 bn

- Page 29 and 30:

SUDAN UN • UNMIS (Operation Safar

- Page 31 and 32:

Engr 4 bde Sig 1 bde Spt 8 spt bde,

- Page 33 and 34:

Naval reserve Forces 109,222 (total

- Page 35 and 36:

AAV 1,311 AAV-7A1 (all roles) ARTY

- Page 37 and 38:

FORCES BY ROLE HQ (AF) 1 HQ located

- Page 39 and 40:

FORCES BY ROLE Combined Service 1 H

- Page 41 and 42:

IRAQ NATO • NTM-I 12 UN • UNAMI

- Page 43 and 44:

Table 8 US Air Capability 2010 Airc

- Page 45 and 46:

Table 8 US Air Capability 2010 Airc

- Page 47 and 48:

Table 8 US Air Capability 2010 Airc

- Page 49 and 50:

Table 9 Selected US Arms Orders Fy2

- Page 51 and 52:

Chapter Two Latin America and the C

- Page 53 and 54:

II RM Mexicali, Baja California Reg

- Page 55 and 56:

elationship will be affected follow

- Page 57 and 58:

In March 2009, the 12 defence minis

- Page 59 and 60:

systems, including 100,000 Kalashni

- Page 61 and 62:

previous editions of The Military B

- Page 63 and 64:

MRL 105mm 4 SLAM Pampero MOR 883: 8

- Page 65 and 66:

WESTERN SAHARA UN • MINURSO 3 obs

- Page 67 and 68:

LOGISTICS AND SUPPORT 19: AH 2 TPT

- Page 69 and 70:

ABU 6: 1 Almirante Graca Aranah (li

- Page 71 and 72:

TOWED 138: 105mm 90 M-101 155mm 48

- Page 73 and 74:

Capabilities ACTIVE 285,220 (Army 2

- Page 75 and 76:

RECCE 11: 6 Schweizer SA-2-37; 2 B-

- Page 77 and 78:

TPT 12: 3 Yak-40; 3 An-24; 2 Il-76;

- Page 79 and 80:

PRINCIPAL SURFACE COMBATANTS 8 FRIG

- Page 81 and 82:

AIRCRAFT • RECCE 1 O-2A Skymaster

- Page 83 and 84:

EQUIPMENT By TyPE AIRCRAFT TPT 1 Y-

- Page 85 and 86:

SAR/Tpt 2 flt with 4 AS-355N Ecureu

- Page 87 and 88:

FTR 10: 8 F-5E Tiger II; 2 F-5F Tig

- Page 89 and 90:

Capabilities ACTIVE 10,650 (Army 7,

- Page 91 and 92:

AD SAM • MANPAD 298+: 70 SA-14 Gr

- Page 93 and 94:

EQUIPMENT By TyPE AIRCRAFT 4 combat

- Page 95 and 96:

DEPLOyMENT AFgHANISTAN UN • UNAMA

- Page 97 and 98:

FORCES By ROLE Ftr/FGA 2 gp with Su

- Page 99 and 100:

Latin America and the Caribbean Tab

- Page 101 and 102:

Chapter Three Europe NATO Towards a

- Page 103 and 104:

Table 13 EU Battlegroups year Semes

- Page 105 and 106:

in Atalanta can arrest, detain and

- Page 107 and 108:

NATO EUROPE - DEfENCE ECONOMICs Eco

- Page 109 and 110:

underestimation of programme costs

- Page 111 and 112:

Grand Coalition government incremen

- Page 113 and 114:

ordered, and there is currently no

- Page 115 and 116:

underfunded. In 2008, defence chief

- Page 117 and 118:

Albania ALB albanian lek 2008 2009

- Page 119 and 120:

fORCEs By ROLE AD/FGA/ Recce 2 (Tac

- Page 121 and 122:

UTL: 6 Bell 206 JetRanger UAV Yastr

- Page 123 and 124:

LIBERIA UN • UNMIL 3 sERBIA NATO

- Page 125 and 126:

MRL 227mm 12 MLRS (in store awaitin

- Page 127 and 128:

BOsNIA-HERzEgOVINA EU • EUFOR •

- Page 129 and 130:

FF 9 D’Estienne d’Orves each wi

- Page 131 and 132:

AfgHANIsTAN NATO • ISAF 3,095 (Op

- Page 133 and 134:

APC 2,307 APC (T) 1,161: 200 Bv-206

- Page 135 and 136:

fOREIgN fORCEs Canada NATO 287 Fran

- Page 137 and 138:

Air force 31,500 (incl 11,000 consc

- Page 139 and 140:

DEPLOyMENT Legal provisions for for

- Page 141 and 142:

2 Luigi Durand de la Penne (ex-Anim

- Page 143 and 144:

ALBANIA NATO 1 (HQ Tirana) Delegazi

- Page 145 and 146:

SP 10 M1025A2 HMMWV with Javelin MA

- Page 147 and 148:

MOR 43: 81mm 27 L16/M1 TOWED 120mm

- Page 149 and 150:

of 19 to 21, and then up to 4-5 ref

- Page 151 and 152:

Poland POL Polish Zloty z 2008 2009

- Page 153 and 154:

DEMOCRATIC REPUBLIC Of CONgO UN •

- Page 155 and 156:

sÃO TOME AND PRINCIPÉ Navy 1 Air

- Page 157 and 158:

capabilities ACTIVE 16,531 (army 7,

- Page 159 and 160:

capabilities ACTIVE 128,013 (army 7

- Page 161 and 162:

APC (W) 18 Piranha AAV 19: 16 AAV-7

- Page 163 and 164:

ORgANIsATIONs By sERVICE Army ε77,

- Page 165 and 166:

TPT 77: 13 C-130B Hercules/C-130E H

- Page 167 and 168:

Inf 13 bn SF 2 regt (SAS) AB 1 bn O

- Page 169 and 170:

LC 24 RRC HELICOPTERS ATK/SPT 43: 6

- Page 171 and 172:

NEPAL Army 280 (Gurkha trg org) NET

- Page 173 and 174:

OSCE • Kosovo 1 FOrEIgn FOrCEs De

- Page 175 and 176:

MSL • SSM ε4 SS-21 Scarab (Tochk

- Page 177 and 178:

DEPLOyMEnT bOsnIA-hErzEgOInVA OSCE

- Page 179 and 180:

AD • SAM 48 SP 6 SA-15 Gauntlet;

- Page 181 and 182:

navy 2,000; 1,850 conscript (total

- Page 183 and 184:

coast Guard PATROL AND COASTAL COMB

- Page 185 and 186:

MOR 39: 120mm 39 AT • MSL • MAN

- Page 187 and 188: Finland OSCE 1 France OSCE 1 German

- Page 189 and 190: Decision on deployment of troops ab

- Page 191 and 192: ut can also be used as HQ ship); 2

- Page 193 and 194: TPT 20: 15 PC-6 Turbo-Porter; 1 Fal

- Page 195 and 196: naval Infantry 3,000 Naval inf 1 bd

- Page 197 and 198: Table 17 selected arms procurements

- Page 199 and 200: Table 17 selected arms procurements

- Page 201 and 202: Table 17 selected arms procurements

- Page 203 and 204: Table 17 selected arms procurements

- Page 205 and 206: Table 17 selected arms procurements

- Page 207 and 208: Table 18 selected arms procurements

- Page 209 and 210: Chapter Four Russia New defence ref

- Page 211 and 212: 23 motor-rifle and tank divisions,

- Page 213 and 214: government will be able to keep mee

- Page 215 and 216: While the programme contained a lau

- Page 217 and 218: he was therefore open-minded about

- Page 219 and 220: ties of Russian military equipment.

- Page 221 and 222: Tk 4 bde (each: 3 tk bn, 1 MR (BMP-

- Page 223 and 224: SSM 1 regt with 8 SS-C-1B Sepal AD

- Page 225 and 226: Tpt sqns with An-12 Cub/An-24 Coke/

- Page 227 and 228: Arty 1 bde, SSM 1 bde with 12-18 SS

- Page 229 and 230: Paramilitary 449,000 Federal Border

- Page 231 and 232: Table 22 selected arms procurements

- Page 233 and 234: Chapter Five Middle East and North

- Page 235 and 236: Map 2 iraq BAGHDAD 3 2 1 6 9 XX IA

- Page 237: governments before Iran was effecti

- Page 241 and 242: system specifically targeted to cou

- Page 243 and 244: Algeria ALG Algerian Dinar D 2008 2

- Page 245 and 246: ORGAnIsAtIOns by seRvICe Army 6,000

- Page 247 and 248: navy ε8,500 (incl 2,000 Coast Guar

- Page 249 and 250: WesteRn sAhARA UN • MINURSO 21 ob

- Page 251 and 252: Air Force 30,000 (incl 12,000 Air D

- Page 253 and 254: Israel ISR New israeli Shekel NS 20

- Page 255 and 256: MSL ASM AGM-114 Hellfire; AGM-45 Sh

- Page 257 and 258: demOCRAtIC RepUblIC OF COnGO UN •

- Page 259 and 260: ARTY 516 TOWED 160: 105mm 21: 13 M-

- Page 261 and 262: AMPHIBIOUS 4 LS 1 LST 1 Ibn Harissa

- Page 263 and 264: Mech Inf 3 bde Inf 35 indep bn Mot

- Page 265 and 266: APC 206 APC (T) 16: 6 FV 103 Sparta

- Page 267 and 268: ARTY 89 SP 155mm 28 (AMX) Mk F3 TOW

- Page 269 and 270: Hel 2 sqn with AS-532 Cougar (CSAR)

- Page 271 and 272: AMPHIBIOUS • LS • LSM 3 Polnoch

- Page 273 and 274: deplOyment CentRAl AFRICAn RepUblIC

- Page 275 and 276: capabilities ACtIve 66,700 (Army 60

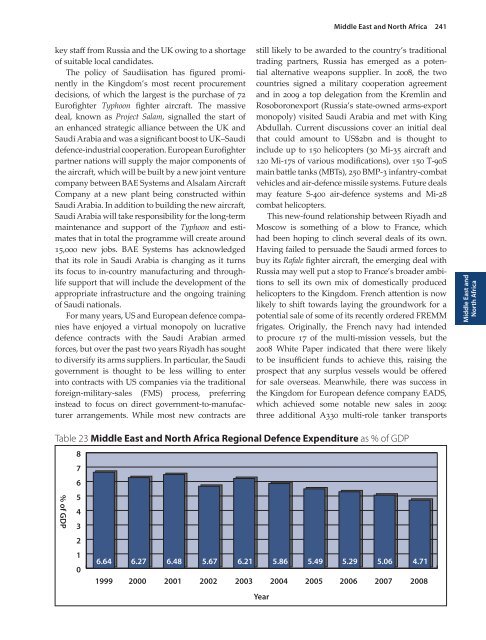

- Page 277 and 278: Middle East and North Africa Table

- Page 279 and 280: Middle East and North Africa Table

- Page 281 and 282: Chapter Six Sub-Saharan Africa The

- Page 283 and 284: { Regions: Deployment of mission HQ

- Page 285 and 286: December 2005) and the democratic e

- Page 287 and 288: training, technical and financial s

- Page 289 and 290:

Table 26 South african defence budg

- Page 291 and 292:

aircraft and SAM batteries to prote

- Page 293 and 294:

paramilitary 10,000 rapid-reaction

- Page 295 and 296:

eQuipmenT by Type AIRCRAFT TPT 8: 1

- Page 297 and 298:

deploymenT cenTral african republic

- Page 299 and 300:

eQuipmenT by Type AIRCRAFT 6 combat

- Page 301 and 302:

paramilitary 10,450 Presidential Gu

- Page 303 and 304:

djibouti DJB Djiboutian Franc fr 20

- Page 305 and 306:

MOR 120mm/160mm 100+ AT MSL • MAN

- Page 307 and 308:

eQuipmenT by Type AIRCRAFT 14 comba

- Page 309 and 310:

Ranger 1 bn Cdo 1 bn Arty 1 bn Engr

- Page 311 and 312:

TRG up to 25: up to 5 Bulldog 103/B

- Page 313 and 314:

Liaison sqn with Cessna 310; Cessna

- Page 315 and 316:

eQuipmenT by Type RECCE BRDM-2; Fer

- Page 317 and 318:

niger NER cFA Franc BceAO fr 2008 2

- Page 319 and 320:

paramilitary ε82,000 coast Guard P

- Page 321 and 322:

cenTral african republic/chad UN

- Page 323 and 324:

puntland Armed Forces ε5-10,000; c

- Page 325 and 326:

organiSaTionS by Service army 85,00

- Page 327 and 328:

forceS by role Tk 1 bde Inf 5 bde A

- Page 329 and 330:

forceS by role Army 5 div (each: up

- Page 331 and 332:

GUNS • TOWED 116: 14.5mm 36 ZPU-1

- Page 333 and 334:

Chapter Seven South and Central Asi

- Page 335 and 336:

Pakistan Democratically elected Pre

- Page 337 and 338:

Fonseka resigned as CDS on 12 Novem

- Page 339 and 340:

S-300 air-defence batteries, beyond

- Page 341 and 342:

AFGHANISTAN International concern g

- Page 343 and 344:

Map 3 Afghanistan ISAF/OEF-A 1 RC-C

- Page 345 and 346:

Fatalities 500 400 300 200 100 0 US

- Page 347 and 348:

SOUTH ASIA - DEFENCE ECONOmICS Afte

- Page 349 and 350:

Table 31 Indian Defence Budget by F

- Page 351 and 352:

The biggest naval procurement agree

- Page 353 and 354:

their finances’ but wish to repla

- Page 355 and 356:

Australia 1,350; 1 inf BG with (1 m

- Page 357 and 358:

TRG 30: 8 L-39ZA Albatros*; 10 PT-6

- Page 359 and 360:

Navy 58,350 (incl 7,000 Naval Avn a

- Page 361 and 362:

Mirage/M-2000TH (M-2000ED) Mirage (

- Page 363 and 364:

GUN/MOR 120mm 25 2S9 Anona MRL 380:

- Page 365 and 366:

Police Force 47,000 SELECTED NON-ST

- Page 367 and 368:

Cadres School and PAF Academy are D

- Page 369 and 370:

Air Force 28,000 (incl SLAF Regt) F

- Page 371 and 372:

HELICOPTERS ATK 10 Mi-24 Hind SPT 8

- Page 373 and 374:

South and Central Asia Table 32 Sel

- Page 375 and 376:

Chapter Eight East Asia and Austral

- Page 377 and 378:

Map 4 China: military regions and m

- Page 379 and 380:

JAPAN Japan’s defence policy in

- Page 381 and 382:

training and deployments. Naval ele

- Page 383 and 384:

months, including that of a C-�

- Page 385 and 386:

Australia’s Force 2030: Key capab

- Page 387 and 388:

for the ��-year period of the W

- Page 389 and 390:

International Monetary Fund (IMF) r

- Page 391 and 392:

column C, data are converted into U

- Page 393 and 394:

Inf 6 bde HQ (4/5/8/9/11/13) each w

- Page 395 and 396:

Brunei BRN Brunei Dollar B$ 2008 20

- Page 397 and 398:

Capabilities ACTIVE 2,285,000 (Army

- Page 399 and 400:

Navy ε215,000; 40,000 conscript (t

- Page 401 and 402:

East Sea Fleet Coastal defence from

- Page 403 and 404:

Fiji FJI Fijian Dollar F$ 2008 2009

- Page 405 and 406:

TPT 23: 3 CN-235M; 2 DHC-5 Buffalo;

- Page 407 and 408:

Maritime Self- Defense Force 42,400

- Page 409 and 410:

PCC 60 PC-Type PCI 174: 170 CL-Type

- Page 411 and 412:

Tpt regts with An-2 Colt to infiltr

- Page 413 and 414:

UTL 5 F406 Caravan II HELICOPTERS A

- Page 415 and 416:

Capabilities ACTIVE 109,000 (Army 8

- Page 417 and 418:

Customs Service PATROL AND COASTAL

- Page 419 and 420:

FGA 22 A-5M (Q-5II) Fantan TPT 15:

- Page 421 and 422:

FOREIGN FORCES Australia Army 38; 1

- Page 423 and 424:

Capabilities ACTIVE 72,500 (Army 50

- Page 425 and 426:

TAIWAN (REPUBLIC OF CHINA) Army 3 t

- Page 427 and 428:

Fokker 50 • Makung Air Base Comma

- Page 429 and 430:

MINE WARFARE • MINE COUNTERMEASUR

- Page 431 and 432:

RESERVES 5,000,000 ORGANISATIONS BY

- Page 433 and 434:

East Asia and Australasia Table 35

- Page 435 and 436:

East Asia and Australasia Table 35

- Page 437 and 438:

East Asia and Australasia Table 35

- Page 439 and 440:

Chapter Nine Country comparisons -

- Page 441 and 442:

Table 36 UN Deployments 2009-2010 l

- Page 443 and 444:

Table 36 UN Deployments 2009-2010 l

- Page 445 and 446:

Table 36 UN Deployments 2009-2010 l

- Page 447 and 448:

Table 37 Non-UN Deployments 2009-20

- Page 449 and 450:

Table 37 Non-UN Deployments 2009-20

- Page 451 and 452:

index of contributing nations Alban

- Page 453 and 454:

Number deployed 110,000 90,000 70,0

- Page 455 and 456:

Table 38 Selected training activity

- Page 457 and 458:

Table 38 Selected training activity

- Page 459 and 460:

Table 38 Selected training activity

- Page 461 and 462:

Country comparisons Table 39 Intern

- Page 463 and 464:

Country comparisons Table 39 Intern

- Page 465 and 466:

Country comparisons Table 39 Intern

- Page 467 and 468:

Table 43 Global Arms Transfer Agree

- Page 469 and 470:

Table 47 Selected Operational Milit

- Page 471 and 472:

Chapter Ten Reforming India’s def

- Page 473 and 474:

develop a fifth-generation fighter

- Page 475 and 476:

Table 48: Major Current Domestic De

- Page 477 and 478:

Part two Reference table 49 Designa

- Page 479 and 480:

Reference Type Name/designation Cou

- Page 481 and 482:

Reference Type Name/designation Cou

- Page 483 and 484:

Reference Type Name/designation Cou

- Page 485 and 486:

table 50 List of Abbreviations for

- Page 487 and 488:

NCO non-commissioned officer NLACM

- Page 489 and 490:

Index of Country/Territory Abbrevia