ONE ROOF

ONE ROOF

ONE ROOF

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

unified and optimized. The associated costs pushed<br />

the result down compared with the prior year.<br />

The HOCHTIEF Real Estate division’s key figures<br />

New orders in the HOCHTIEF Real Estate division remained<br />

on a par with the prior year level. At HOCHTIEF<br />

Projektentwicklung, new orders even increased by around<br />

seven percent. Significant new orders were recorded,<br />

for example, in the projects of maxCologne in Cologne,<br />

the Siemens center at Düsseldorf Airport City, and the<br />

Marco Polo Tower in Hamburg, as well as in care homes.<br />

At HOCHTIEF Property Management, new orders<br />

dropped sharply as expected, by approximately EUR<br />

50 million, owing to extraordinary items in 2008 from<br />

two major contracts that were concluded with Deka<br />

and aurelis.<br />

Work done in the division fell by 14.5 percent year on<br />

year. There was a clear decline in property development<br />

due to selective order taking. At HOCHTIEF Property<br />

Management, work done grew by some 15 percent,<br />

primarily due to new orders secured in 2008.<br />

The order backlog decreased by EUR 102.1 million,<br />

with HOCHTIEF Projektentwicklung accounting for<br />

around EUR 86 million of this decline, and HOCHTIEF<br />

Property Management for around EUR 16 million.<br />

At EUR 53.2 million, operating earnings were down<br />

by EUR 6 million or ten percent year on year. This decrease<br />

is partly due to the new rule for financial reporting<br />

(IFRIC 15) relating to project developments. Higher<br />

IT and labor costs weighed on HOCHTIEF Property<br />

Management’s result for 2009. Profit before taxes<br />

was just EUR 4.6 million down on the prior-year figure<br />

at EUR 27 million, thanks to a EUR 1.4 million overall<br />

improvement in net investment and interest income.<br />

Capital expenditure amounted to EUR 18.6 million in<br />

2009 and consisted mostly of payments into equity for<br />

joint ventures.<br />

The average number of employees rose by 160. This<br />

increase is mainly due to staff taken on for specific proj-<br />

ects and new employees at HOCHTIEF Property Man-<br />

agement.<br />

❘ Information for our Shareholders ❘ ❘ Management Report ❘ ❘ Financial Statements and Notes ❘<br />

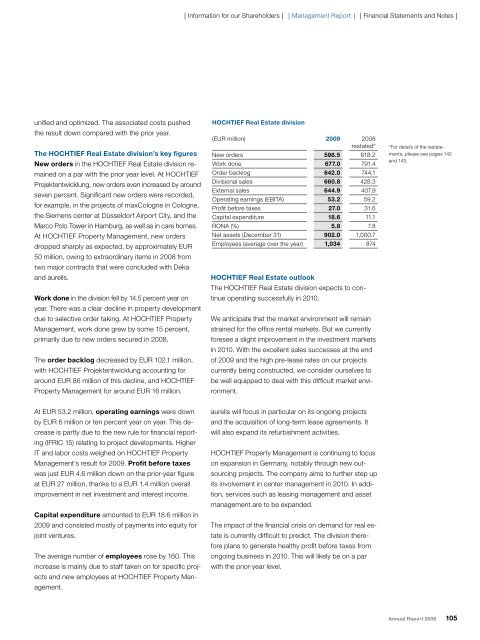

HOCHTIEF Real Estate division<br />

(EUR million) 2009 2008<br />

restated*<br />

New orders 598.5 618.2<br />

Work done 677.0 791.4<br />

Order backlog 642.0 744.1<br />

Divisional sales 660.8 428.3<br />

External sales 644.9 407.9<br />

Operating earnings (EBITA) 53.2 59.2<br />

Profit before taxes 27.0 31.6<br />

Capital expenditure 18.6 11.1<br />

RONA (%) 5.8 7.8<br />

Net assets (December 31) 902.0 1,000.7<br />

Employees (average over the year) 1,034 874<br />

HOCHTIEF Real Estate outlook<br />

The HOCHTIEF Real Estate division expects to continue<br />

operating successfully in 2010.<br />

We anticipate that the market environment will remain<br />

strained for the office rental markets. But we currently<br />

foresee a slight improvement in the investment markets<br />

in 2010. With the excellent sales successes at the end<br />

of 2009 and the high pre-lease rates on our projects<br />

currently being constructed, we consider ourselves to<br />

be well equipped to deal with this difficult market environment.<br />

aurelis will focus in particular on its ongoing projects<br />

and the acquisition of long-term lease agreements. It<br />

will also expand its refurbishment activities.<br />

HOCHTIEF Property Management is continuing to focus<br />

on expansion in Germany, notably through new outsourcing<br />

projects. The company aims to further step up<br />

its involvement in center management in 2010. In addition,<br />

services such as leasing management and asset<br />

management are to be expanded.<br />

The impact of the financial crisis on demand for real es-<br />

tate is currently difficult to predict. The division there-<br />

fore plans to generate healthy profit before taxes from<br />

ongoing business in 2010. This will likely be on a par<br />

with the prior-year level.<br />

*For details of the restatements,<br />

please see pages 142<br />

and 143.<br />

Annual Report 2009 105