ONE ROOF

ONE ROOF

ONE ROOF

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

❘ Information for our Shareholders ❘ ❘ Management Report ❘ ❘ Financial Statements and Notes ❘<br />

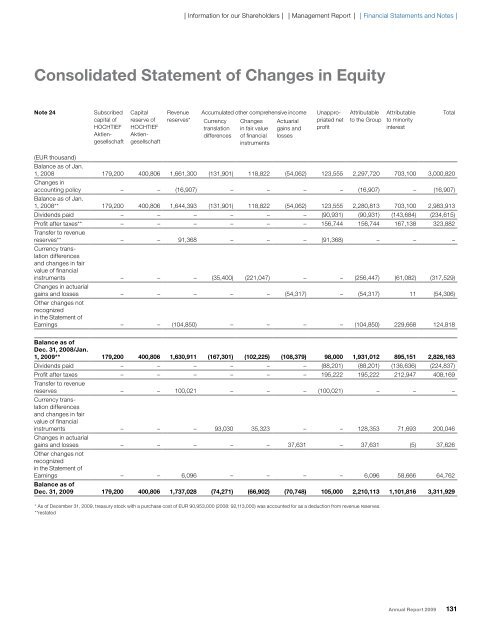

Consolidated Statement of Changes in Equity<br />

Note 24 Subscribed<br />

capital of<br />

HOCHTIEF<br />

Aktiengesellschaft<br />

Capital<br />

reserve of<br />

HOCHTIEF<br />

Aktiengesellschaft<br />

Revenue<br />

reserves*<br />

Accumulated other comprehensive income Unappro-<br />

Currency<br />

translation<br />

differences<br />

Changes<br />

in fair value<br />

of financial<br />

instruments<br />

Actuarial<br />

gains and<br />

losses<br />

priated net<br />

profit<br />

Attributable<br />

to the Group<br />

Attributable<br />

to minority<br />

interest<br />

(EUR thousand)<br />

Balance as of Jan.<br />

1, 2008<br />

Changes in<br />

179,200 400,806 1,661,300 (131,901) 118,822 (54,062) 123,555 2,297,720 703,100 3,000,820<br />

accounting policy<br />

Balance as of Jan.<br />

– – (16,907) – – – – (16,907) – (16,907)<br />

1, 2008** 179,200 400,806 1,644,393 (131,901) 118,822 (54,062) 123,555 2,280,813 703,100 2,983,913<br />

Dividends paid – – – – – – (90,931) (90,931) (143,684) (234,615)<br />

Profit after taxes**<br />

Transfer to revenue<br />

– – – – – – 156,744 156,744 167,138 323,882<br />

reserves**<br />

Currency translation<br />

differences<br />

and changes in fair<br />

value of financial<br />

– – 91,368 – – – (91,368) – – –<br />

instruments<br />

Changes in actuarial<br />

– – – (35,400) (221,047) – – (256,447) (61,082) (317,529)<br />

gains and losses<br />

Other changes not<br />

recognized<br />

in the Statement of<br />

– – – – – (54,317) – (54,317) 11 (54,306)<br />

Earnings – – (104,850) – – – – (104,850) 229,668 124,818<br />

Balance as of<br />

Dec. 31, 2008/Jan.<br />

1, 2009** 179,200 400,806 1,630,911 (167,301) (102,225) (108,379) 98,000 1,931,012 895,151 2,826,163<br />

Dividends paid – – – – – – (88,201) (88,201) (136,636) (224,837)<br />

Profit after taxes<br />

Transfer to revenue<br />

– – – – – – 195,222 195,222 212,947 408,169<br />

reserves<br />

Currency translation<br />

differences<br />

and changes in fair<br />

value of financial<br />

– – 100,021 – – – (100,021) – – –<br />

instruments – – – 93,030 35,323 – – 128,353 71,693 200,046<br />

Changes in actuarial<br />

gains and losses<br />

Other changes not<br />

recognized<br />

in the Statement of<br />

– – – – – 37,631 – 37,631 (5) 37,626<br />

Earnings<br />

Balance as of<br />

– – 6,096 – – – – 6,096 58,666 64,762<br />

Dec. 31, 2009 179,200 400,806 1,737,028 (74,271) (66,902) (70,748) 105,000 2,210,113 1,101,816 3,311,929<br />

* As of December 31, 2009, treasury stock with a purchase cost of EUR 90,953,000 (2008: 92,113,000) was accounted for as a deduction from revenue reserves.<br />

**restated<br />

Total<br />

Annual Report 2009 131