ONE ROOF

ONE ROOF

ONE ROOF

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Consolidated Financial Statements<br />

178 Annual Report 2009<br />

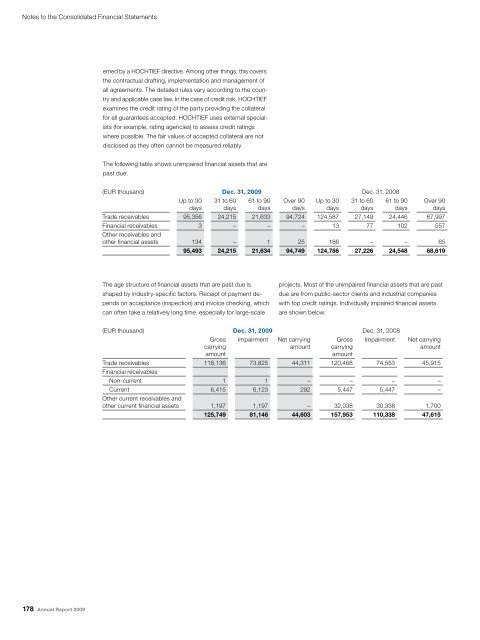

erned by a HOCHTIEF directive. Among other things, this covers<br />

the contractual drafting, implementation and management of<br />

all agreements. The detailed rules vary according to the country<br />

and applicable case law. In the case of credit risk, HOCHTIEF<br />

examines the credit rating of the party providing the collateral<br />

for all guarantees accepted. HOCHTIEF uses external specialists<br />

(for example, rating agencies) to assess credit ratings<br />

where possible. The fair values of accepted collateral are not<br />

disclosed as they often cannot be measured reliably.<br />

The following table shows unimpaired financial assets that are<br />

past due:<br />

(EUR thousand) Dec. 31, 2009 Dec. 31, 2008<br />

Up to 30<br />

days<br />

31 to 60<br />

days<br />

61 to 90<br />

days<br />

The age structure of financial assets that are past due is<br />

shaped by industry-specific factors. Receipt of payment depends<br />

on acceptance (inspection) and invoice checking, which<br />

can often take a relatively long time, especially for large-scale<br />

Over 90<br />

days<br />

Up to 30<br />

days<br />

31 to 60<br />

days<br />

61 to 90<br />

days<br />

Over 90<br />

days<br />

Trade receivables 95,356 24,215 21,633 94,724 124,587 27,149 24,446 67,997<br />

Financial receivables 3 – – – 13 77 102 557<br />

Other receivables and<br />

other financial assets 134 – 1 25 186 – – 65<br />

95,493 24,215 21,634 94,749 124,786 27,226 24,548 68,619<br />

projects. Most of the unimpaired financial assets that are past<br />

due are from public-sector clients and industrial companies<br />

with top credit ratings. Individually impaired financial assets<br />

are shown below:<br />

(EUR thousand) Dec. 31, 2009 Dec. 31, 2008<br />

Gross<br />

carrying<br />

amount<br />

Impairment Net carrying<br />

amount<br />

Gross<br />

carrying<br />

amount<br />

Impairment Net carrying<br />

amount<br />

Trade receivables 118,136 73,825 44,311 120,468 74,553 45,915<br />

Financial receivables<br />

Non-current 1 1 – – – –<br />

Current<br />

Other current receivables and<br />

6,415 6,123 292 5,447 5,447 –<br />

other current financial assets 1,197 1,197 – 32,038 30,338 1,700<br />

125,749 81,146 44,603 157,953 110,338 47,615