ONE ROOF

ONE ROOF

ONE ROOF

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

24 Annual Report 2009<br />

Dow Jones Sustainability Indexes<br />

HOCHTIEF’s eligibility for inclusion in the respected<br />

Dow Jones Sustainability Indexes was reaffirmed for<br />

2009. We are the only German construction services<br />

company to be incorporated in these indices. This rewards<br />

our commitment to sustainability in the interests<br />

of economy, ecology and social responsibility. In this<br />

way, HOCHTIEF stock continues to appeal to investors<br />

who structure their portfolios in compliance with strict<br />

sustainability criteria. In addition, our Australian subsidiary<br />

Leighton has been listed in the new Dow Jones<br />

Sustainability Asia Pacific Index since March 2009.<br />

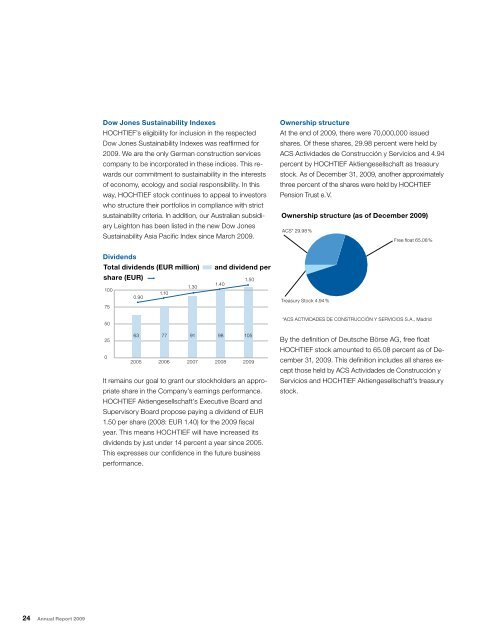

Dividends<br />

Total dividends (EUR million) and dividend per<br />

share (EUR)<br />

100<br />

75<br />

50<br />

25<br />

0<br />

0.90<br />

1.10<br />

1.30<br />

1.40<br />

1.50<br />

63 77 91 98 105<br />

2005 2006 2007 2008 2009<br />

It remains our goal to grant our stockholders an appro-<br />

priate share in the Company’s earnings performance.<br />

HOCHTIEF Aktiengesellschaft’s Executive Board and<br />

Supervisory Board propose paying a dividend of EUR<br />

1.50 per share (2008: EUR 1.40) for the 2009 fiscal<br />

year. This means HOCHTIEF will have increased its<br />

dividends by just under 14 percent a year since 2005.<br />

This expresses our confidence in the future business<br />

performance.<br />

Ownership structure<br />

At the end of 2009, there were 70,000,000 issued<br />

shares. Of these shares, 29.98 percent were held by<br />

ACS Actividades de Construcción y Servicios and 4.94<br />

percent by HOCHTIEF Aktiengesellschaft as treasury<br />

stock. As of December 31, 2009, another approximately<br />

three percent of the shares were held by HOCHTIEF<br />

Pension Trust e. V.<br />

Ownership structure (as of December 2009)<br />

ACS* 29.98 %<br />

Treasury Stock 4.94 %<br />

Free float 65.08 %<br />

*ACS ACTIVIDADES DE CONSTRUCCIÓN Y SERVICIOS S.A., Madrid<br />

By the definition of Deutsche Börse AG, free float<br />

HOCHTIEF stock amounted to 65.08 percent as of December<br />

31, 2009. This definition includes all shares except<br />

those held by ACS Actividades de Construcción y<br />

Servicios and HOCHTIEF Aktiengesellschaft’s treasury<br />

stock.